Ethereum price falls near $1,948 as whale wallets reduce overall ETH supply control share.

Santiment data shows large ETH holders dropped below 75% supply ownership after months dominance.

Over 220,000 ETH withdrawn from exchanges, reducing short-term selling pressure across crypto markets.

Ethereum price today is trading around $1,948, down 3.5% and nearly 14% over the past week, showing strong selling pressure. At the same time, major shifts are happening behind the scenes.

Meanwhile, big whale wallets are losing control over supply, and millions of ETH are leaving exchanges. These changes suggest that while the ETH price remains under pressure.

Ethereum Big Holders Reduce ETH Supply Control

According to Santiment, wallets holding at least 1,000 ETH now control less than 75% of Ethereum’s total supply, the first time in seven months this level has dropped so low.

However, since December, these large holders have sold or redistributed about 1.5% of the supply, suggesting profit-taking and reduced exposure during market uncertainty.

Meanwhile, mid-sized wallets holding between 1 and 1,000 ETH have increased their share to over 23%, showing quiet accumulation.

Smaller wallets are also growing, with addresses holding less than 1 ETH now owning a record 2.3% of supply. Santiment believes this growth among small holders is likely linked to staking activity.

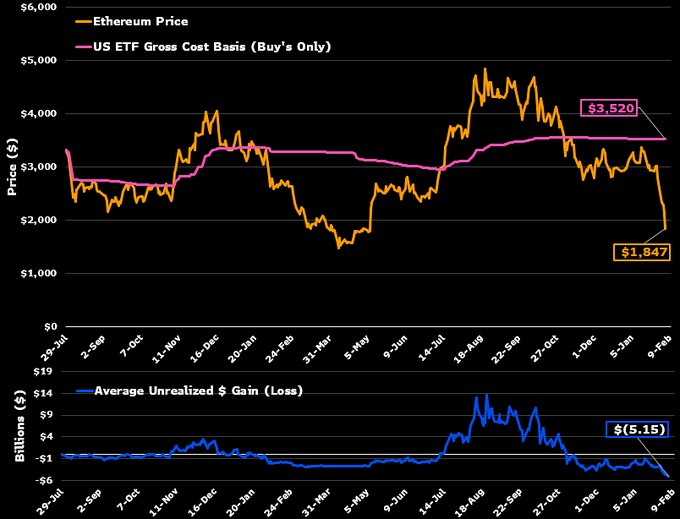

ETH Is Now Below Whale Cost Basis

Ethereum is now trading below the average price at which large holders bought their ETH, meaning many whales are currently in a loss. This could be easily visible among Ethereum ETF investors, who are in a tougher position than Bitcoin ETF holders.

With ETH trading near $1945, it remains far below the estimated average ETF entry price of around $3,500. For many investors, this is a painful situation.

However, despite these losses, ETF holders continue to accumulate more ETH.

In fact, Ethereum spot ETFs have also seen fresh inflows, with $57 million on February 9 and $13.8 million on February 10, signaling continued institutional interest.

220K ETH Leaves Exchanges

While the Ethereum price has been struggling recently, on-chain data shows strong signs of accumulation. CryptoQuant data shows that more than 220,000 ETH have been withdrawn from exchanges in recent days, marking the largest net outflow since October.

On February 5, Binance alone saw about 158,000 ETH in withdrawals, the highest since last August.

Large exchange withdrawals usually reduce selling pressure, as coins moved to private wallets are less likely to be sold quickly.

Ethereum Price Outlook

As of now, ETH is trading inside a well-defined descending channel, confirming continuous selling pressure. Price recently broke below the key $2,000 support level, which has now turned into resistance. ETH is currently trading near $1,945, close to a critical demand zone around $1,800.

For recovery, ETH must first reclaim $2,440, followed by $2,800. If price fails to hold above the $1,750 support, further downside toward $1,600 is likely.

However, the RSI is near 28, indicating oversold conditions, which suggests a short-term bounce is possible.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Ethereum could trade between key support near $2,500 and a potential high around $6,000 in 2026 if adoption grows and bullish momentum holds.

Based on current projections, 1 ETH could trade between $23,000 and $71,000 by 2030, depending on adoption, market cycles, and macro trends.

Over the next decade, Ethereum’s price could rise substantially if it remains a leading smart contract platform, though long-term forecasts remain speculative.

Macro conditions, regulatory changes, competition from other blockchains, and market volatility could slow or disrupt Ethereum’s price growth.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is the Crypto Market Going up Today [Live] Updates on March 3, 2026](https://image.coinpedia.org/wp-content/uploads/2026/03/03170220/Why-Is-the-Crypto-Market-Going-up-Today-Live-Updates-on-March-3-2026-2-390x220.webp)