Ethereum drops below $3,900, reaching a two-month low, raising concerns among crypto traders.

Nearly $1 billion in crypto liquidations hit the market, Ethereum taking the hardest blow.

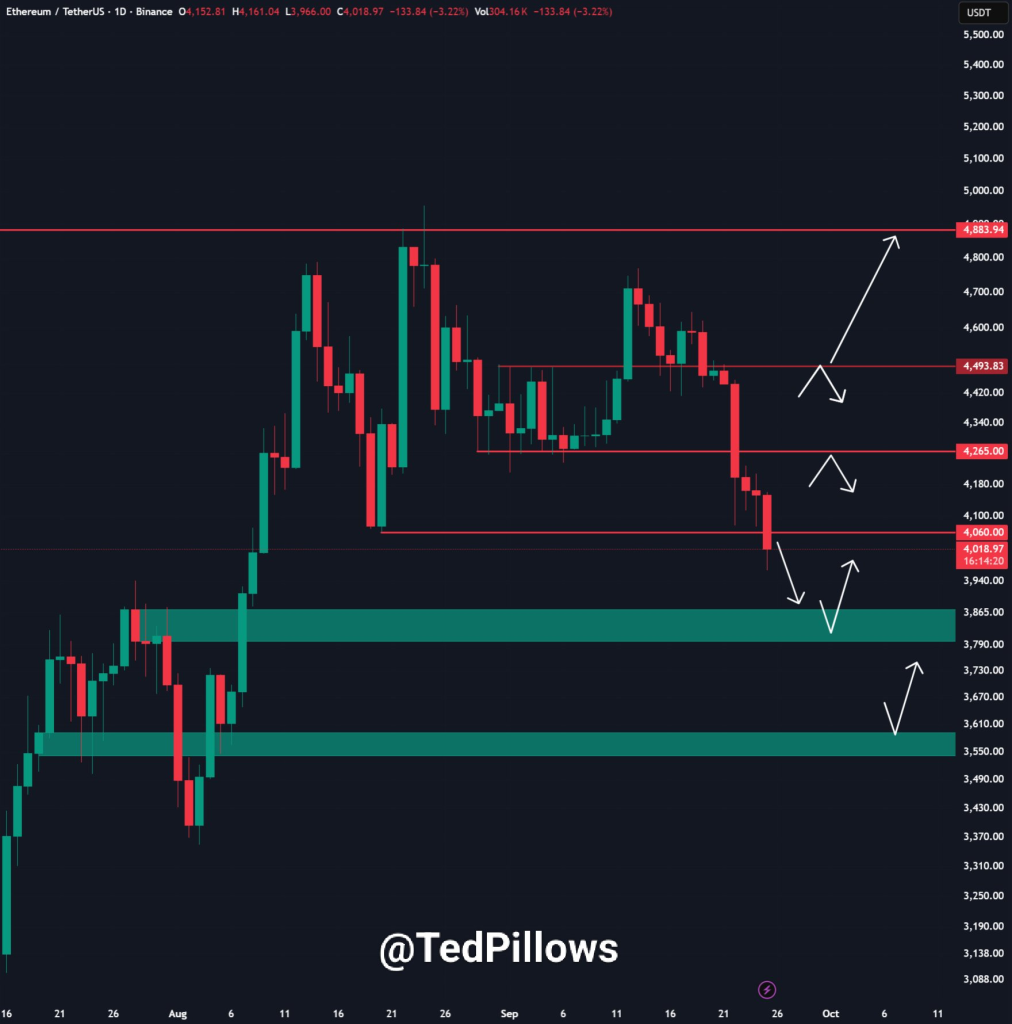

Analyst Ted Pillows warns ETH could fall to $3,500 before potentially starting a recovery.

A huge crypto selloff has shaken the market again, pushing Ethereum, the second-largest cryptocurrency, down to a two-month low, trading below $3,900. This has sparked concern among traders and investors alike, as Veteran crypto analyst Ted Pillows says ETH could drop even further, possibly reaching around $3,500 before it starts to recover.

Ethereum Leads the Liquidation

The latest selloff has been brutal. Nearly $1 billion in crypto liquidations have hit the market this week, with Ethereum taking the hardest blow. According to Coinglass data, Ethereum saw around $312 million wiped out, and most of it from long positions.

Adding to the pressure, reports reveal that BlackRock sold $25.6 million worth of ETH, sparking fears of further institutional exits. Even the Options market data also reflects bearish sentiment, with increased demand for put options indicating expectations of further downside.

According to Ted Pillows, Ethereum’s recent price action mirrors Bitcoin’s 2020 cycle, where a 25%–30% drop followed a breakout above $20,000. He suggests that ETH could decline another 10%–15%.

Ethereum Price Levels to Watch

Currently, Ethereum is approaching a key support zone around $3,800, which will be crucial in determining its short-term direction.

- If the $3,800 level holds, Ethereum could find stability and prepare for a fresh rally.

- If it fails, the price might slide further toward the $3,500 region before finding stronger ground.

Pillows’ chart highlights this battle zone clearly, showing how Ethereum’s next leg depends on whether bulls can defend the key support area.

ETH Long-Term Goal Eyeing $6998

Despite the recent turbulence, Ethereum’s fundamentals are still strong. Big institutions are still interested, and the network continues to grow, showing long-term strength.

Crypto analyst The House Of Crypto notes a Descending Broadening Wedge forming on Ethereum’s weekly chart, which could push ETH up to around $6,998 if it breaks out.

For now, however, traders are keeping a close watch on the $3,800 support level.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Ethereum is facing a major sell-off, leading to nearly $312 million in long position liquidations. Institutional selling and bearish options market sentiment are adding to the downward pressure.

Analysis suggests if the key $3,800 support level breaks, Ethereum could decline another 10-15%, potentially reaching a bottom around the $3,500 zone before recovering.

Despite short-term volatility, the long-term outlook remains strong. A breakout from its current chart pattern could potentially push Ethereum toward the $7,000 range.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.