Bitcoin's strong price surge this month, reaching near $107,000, is exciting crypto investors.

El Salvador's Bitcoin investment strategy has yielded over $357 million in unrealized profit.

Despite IMF negotiations and mixed reactions, El Salvador remains committed to its Bitcoin adoption.

Bitcoin is having a strong month, gaining nearly 8.7% so far. Earlier today, it even came close to hitting $107,000, sparking fresh excitement across the crypto market.

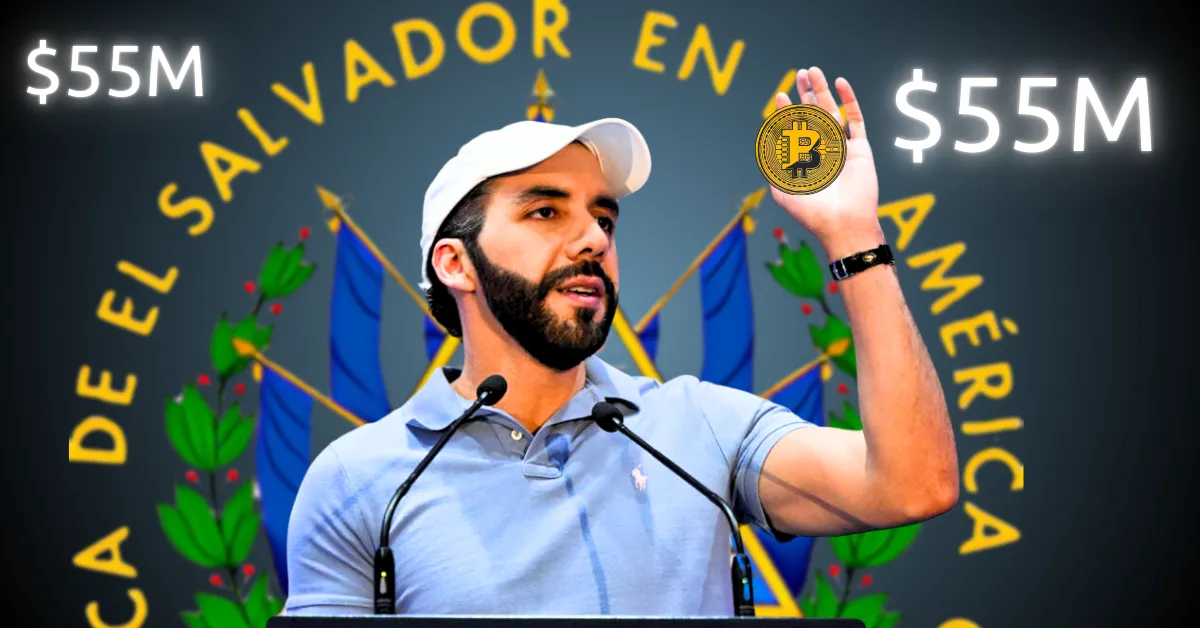

One unexpected factor behind this momentum? El Salvador. The country’s bold Bitcoin investment is now paying off in a big way. President Nayib Bukele recently revealed that their Bitcoin holdings have generated over $357 million in unrealized profit.

Here’s a closer look at what’s happening – and why this story is turning heads.

El Salvador’s Bitcoin Investment Strategy: Key Facts

El Salvador made headlines in 2021 when it became the first country to adopt Bitcoin as legal tender. Since then, it has stayed committed to a pro-Bitcoin path, despite global pushback.

According to El Salvador’s Bitcoin Office, the country currently holds 6,181 BTC. At current prices, that stash is worth around $639 million.

President Bukele recently posted on X:

With the BTC price around $102K per token, the total value of El Salvador’s holdings stands at roughly $644 million. The country’s initial investment was approximately $287.1 million, meaning their Bitcoin assets have grown by an incredible 124.4%.

Challenges on the Road

Despite the gains, El Salvador faces hurdles:

- The country is negotiating a financial package with the International Monetary Fund (IMF), which requires limiting Bitcoin activities.

- A law was passed making Bitcoin usage voluntary for the private sector, not mandatory.

- Many global critics and some Bitcoin supporters have distanced themselves from El Salvador’s approach.

However, President Bukele remains firm in his commitment:

“If it didn’t stop when the world ostracised us and most ‘bitcoiners’ abandoned us, it won’t stop now, and it won’t stop in the future.”

Why This Story Matters

El Salvador’s Bitcoin success signals a shift in how crypto is being viewed globally. The returns show that Bitcoin can be a long-term store of value, not just a speculative asset.

With BTC pushing past $100,000 and market confidence rising, El Salvador’s example could influence how other countries approach crypto adoption. Whether other governments follow remains to be seen.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

El Salvador holds 6,181 BTC, acquired since it adopted Bitcoin as legal tender in 2021.

IMF demands to curb BTC use, private‐sector voluntary adoption, and global skepticism.