Hacker exploited a Balancer vulnerability, draining over $116.6 million across multiple blockchains.

The exploit targeted Balancer’s Ether-based boosted pools through a faulty access control flaw.

Beets on Sonic network was also impacted, showing shared vulnerability in Balancer’s codebase.

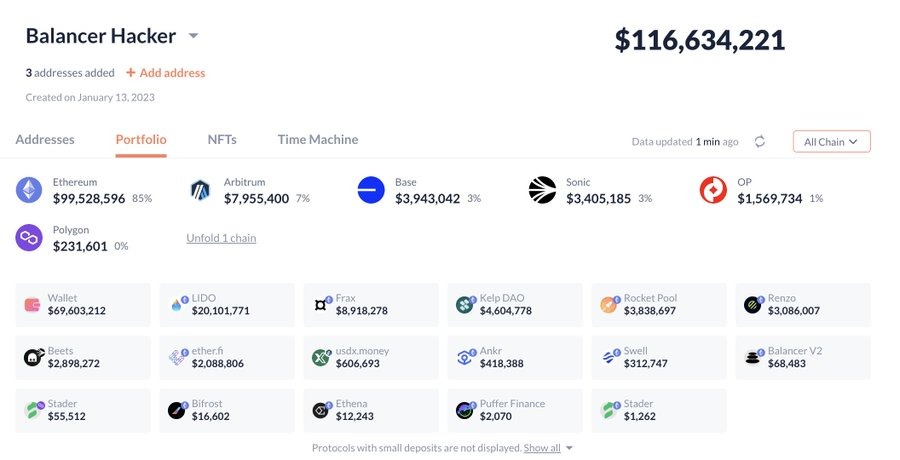

The DeFi world woke up to another major blow on November 3, 2025, after Balancer, a popular decentralized finance protocol, was hit by a major exploit draining over $116.6 million worth of assets across multiple blockchains.

The hack drained large amounts of osETH, WETH, and wstETH, raising fresh concerns about DeFi protocol security.

Here’s how the attached happened?

How the Balancer Hack Happened?

According to data shared by on-chain analytics firm Lookonchain, the exploit began with a massive outflow of funds from Balancer Vaults. Analysts believe the hacker took advantage of a faulty access control vulnerability within Balancer’s boosted pools that use Ether-based derivatives.

The attacker drained around $116.6 million from the Ethereum mainnet alone, followed by similar incidents across Base, Polygon, Arbitrum, Optimism, and Sonic networks.

The transfers included major crypto assets such as 6,587 WETH (worth $24.46 million), 6,851 osETH ($26.86 million), and 4,259 wstETH ($19.27 million).

Impact Extends Beyond Balancer

Interestingly, the attack didn’t just stop with Balancer. Its forked version, Beets on the Sonic network, also reported losses. This suggests the exploit targeted a shared vulnerability in the codebase that connects to the same liquidity infrastructure.

Meanwhile, transaction data shows that the stolen funds were transferred through Balancer’s vault contracts to a single wallet address 0x506D19…AE03207, which then interacted with another contract to execute multiple token swaps.

Community and Security Response

Blockchain security firm PeckShield quickly confirmed the breach, urging users to revoke all Balancer-related approvals and monitor wallet activity. Lookonchain also released transaction details showing the attacker’s movement of stolen funds between multiple vault addresses, typical of laundering attempts through decentralized exchanges.

As of now, Balancer has not issued an official statement, but its Discord moderators have warned users against interacting with suspicious contracts or new liquidity pools until further notice.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The Balancer hack was a major DeFi exploit on November 3, 2025, where an attacker drained over $116 million from Balancer’s liquidity pools due to a vulnerability in its boosted pools.

The hacker exploited a faulty access control vulnerability in Balancer’s boosted pools, allowing them to illegitimately withdraw large amounts of assets like osETH and WETH directly from the protocol’s vaults.

Revoke any token approvals you have granted to Balancer contracts immediately. Monitor your wallet activity and avoid interacting with new or suspicious Balancer pools until an official all-clear is given.

The attacker stole major crypto assets, including over $24 million in WETH, nearly $27 million in osETH, and over $19 million in wstETH from the pools on the Ethereum network.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.