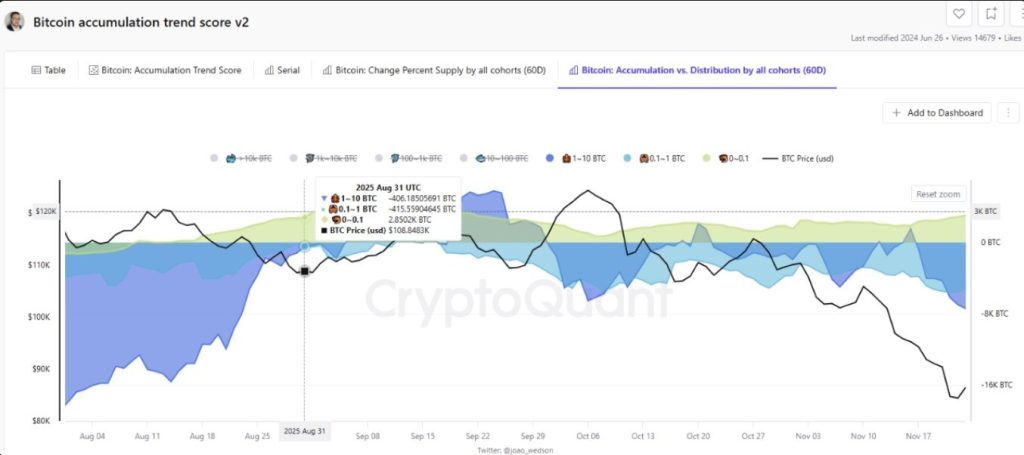

Whales holding between 1,000–10,000 BTC sold heavily, creating strong pressure during Bitcoin’s decline.

Only holders with 10–100 BTC and 100–1,000 BTC consistently accumulated throughout the correction.

Bitcoin recovered from 81,000 to 87,000 dollars, but whales must stop selling first.

Bitcoin’s sudden 20% drop in November shocked the entire crypto market, wiping out over $1 trillion in value. After reaching record highs above $125,000 in October, the price fell sharply to around $81,000 before recovering slightly to $87,236.

Now many traders are asking, “Has Bitcoin finally found its bottom?.” Here’s what leading on-chain data provider CryptoQuant thinks so.

Big Whales Took Profits, Let Bitcoin Crash

According to CryptoQuant analysis, the recent bitcoin crash wasn’t just panic selling, it was a complex mix of whale behavior, retail pressure, and heavy futures liquidations.

For weeks before the crash, wallets holding 1,000–10,000 BTC slowly reduced their positions. These large players, including institutions and big funds, were selling into strength, locking in profits from Bitcoin’s record highs.

Surprisingly, retail investors didn’t step in. Small wallets holding under 10 BTC and even up to 1,000 BTC were also selling during the correction.

Therefore, when both whales and retail chose safety, taking profits, and reducing risk after October’s rally, Bitcoin had no solid buying support left.

The Only Buyers Were Mid-Sized Holders

In the middle of all the selling Mid-sized holders, especially those with 10–100 and 100–1,000 BTC, are the only groups showing steady buying through the correction.

Their buying added some support and slowed down the fall, but it wasn’t strong enough to counter the heavy whale distribution. Their weight in the market is simply smaller compared to big whales.

Futures Liquidations Made the Drop Even Worse

CryptoQuant also points out that the real damage came from the futures market. Over a 13-day stretch, long positions were cleared out at a massive scale.

This pushed Bitcoin down from $106,000 to $81,000, turning a normal correction into a sharp and violent crash.

As long traders got liquidated one after another, forced selling created a chain reaction.

So, Is This the Bottom? Completely Not!

After touching $81K, Bitcoin finally showed life, jumping back to $87K within two days. This rebound is the first real sign that the market might be forming a local bottom.

However, a true reversal can only happen when the 1,000–10,000 BTC group stops selling. Until then, the recovery looks hopeful but still fragile.

Bitcoin may be close to a bottom, but the next move depends on how whales act in the coming days.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.