The cryptocurrency market has seen a massive influx of new tokens, with over 12,000 launched in the past year.

Concerns are rising regarding price manipulation, with allegations of project teams and market makers colluding.

This alleged manipulation contributes to the proliferation of low-quality assets and market volatility.

The cryptocurrency world has seen an explosion of new tokens. According to Coinranking, at least 12,799 new coins were listed in the past year. And the growth isn’t slowing down – nine new cryptocurrencies launched just today, including MBX, ModalAI, MCC, and NILA.

Many view this rapid expansion as a sign of a healthy, growing market. And to some extent, that’s true—it does reflect the innovative, fast-paced nature of the crypto space.

But look a little closer, and some cracks start to show. Are all these tokens as legitimate as they seem? And more importantly, who’s really deciding what they’re worth?

Some in the industry are raising red flags, pointing to behind-the-scenes deals and shady price tactics. It’s a side of crypto you don’t always hear about—but one worth paying attention to.

Let’s break it down.

Are New Tokens Being Manipulated?

Arthur Cheong, founder of DeFinance Capital, has raised serious concerns about how new tokens are entering the market. In a post on X, Cheong alleged that some project teams are secretly working with market makers to artificially manipulate token prices.

This kind of manipulation makes it difficult to understand what’s really driving the market. According to Cheong, this lack of transparency hurts traders and investors who rely on accurate data to make smart decisions.

To make a sensible market decision, a trader or investor should possess a clear idea about the factors affecting that market.

Centralized Exchanges Under Fire

Cheong also pointed a finger at centralized exchanges, accusing them of ignoring the problem. By failing to take action, he believes they’re allowing, or even enabling, bad practices to continue unchecked.

He claims this has opened the doors for low-quality, unreliable assets to flood into the altcoin market, making it harder for serious investors to find trustworthy projects.

Altcoin Market Takes a Hit

The impact is already visible. Since the beginning of this year, the total market capitalization of altcoins (excluding the top 10 cryptocurrencies) has dropped by 38.33%. It fell from $1.34 trillion to $961.7 billion—a massive decline in just a few months.

New Cryptos Listed

Despite the issues, the crypto market continues to grow at full speed. In the last 30 days alone, 778 new tokens were added. Today’s new entries include MAGABY, ModalAI, MeshChain AI, and NILAM Resources – Mind Wave.

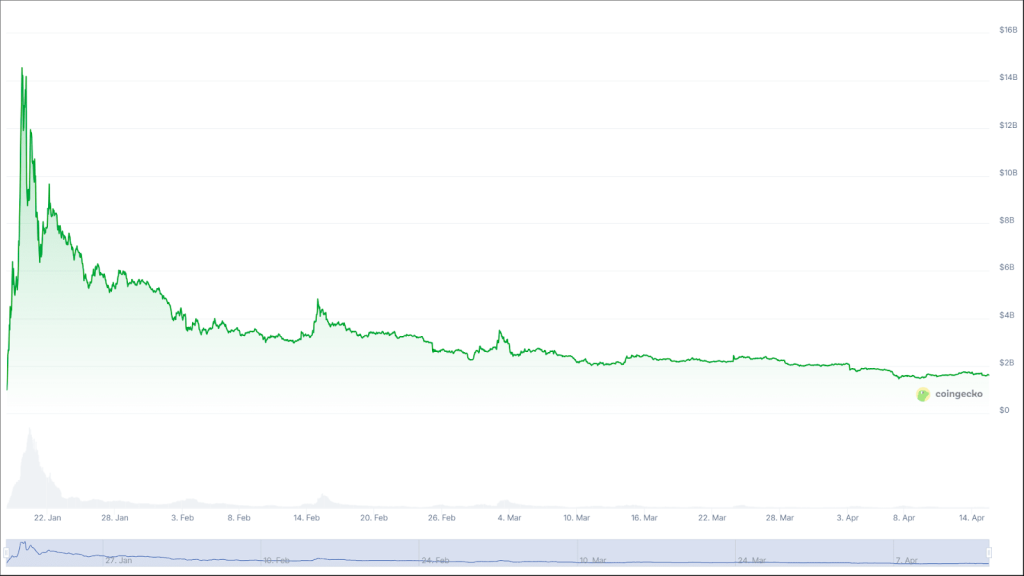

One of the year’s most attention-grabbing launches was the Official Trump token, which debuted in late January. It started at $6.54, surged to $72.62 within hours, and now trades at around $8.05.

In the past 30 days, the token has dropped by 33%, and in just the last 24 hours, it has fallen by over 3.9%.

The crypto space remains one of the most exciting and fast-moving areas in finance—but concerns like these highlight the risks that come with rapid growth and limited oversight.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Examples include fake buy/sell walls, insider pricing deals, pump-and-dump schemes, and collusion with market makers.

No one controls crypto fully, but developers, market makers, and centralized exchanges can heavily influence token behavior.