Crypto Liquidations Today Trigger $1.7 billion Market Bloodbath: Bitcoin and Ethereum Lead the Sell-Off

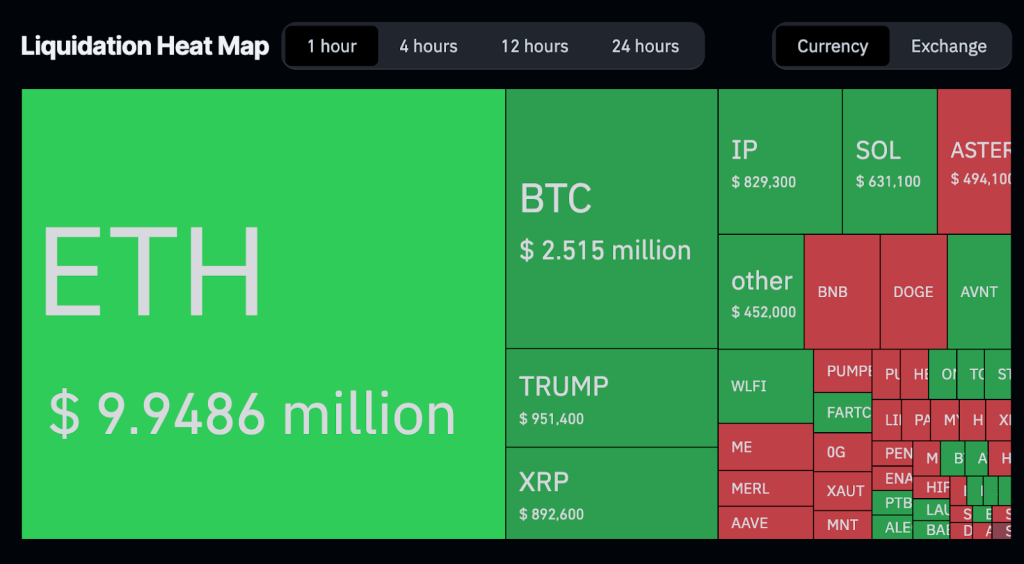

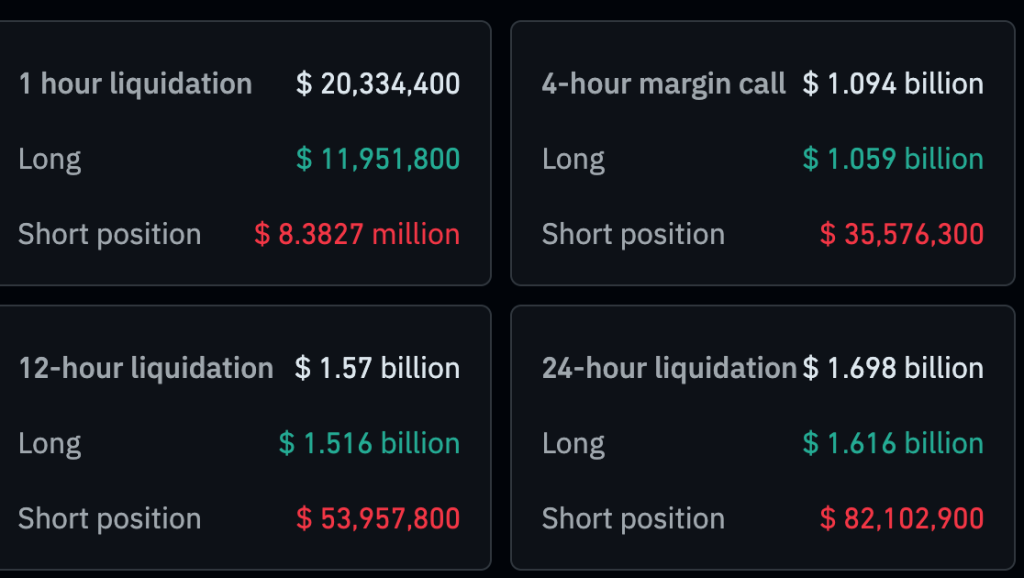

Over $1.7B in crypto liquidations in 24 hours; $1.615B longs vs $85.88M shorts

ETH saw $483M and BTC $276M in liquidations within 12 hours.

Weak liquidity, heavy leverage, and global stock sell-offs fueled the downturn.

The crypto market faced one of its sharpest downturns in months, with over $1.7 billion in crypto liquidations within 24 hours. Ethereum, Ripple (XRP), and Solana each plunged around 8%, while Bitcoin briefly fell into double-digit losses.

Data shows that futures traders using high leverage were forced into rapid liquidations, sparking a chain reaction across the market. Within just 10 minutes, liquidations surged past $1 billion, underscoring how quickly sentiment shifted.

According to Coinglass, $1.7 billion was liquidated in the past 24 hours, with $1.615 billion in longs and $85.88 million in shorts. In just 12 hours, Ethereum saw $483 million wiped out, while Bitcoin faced $276 million in liquidations. The scale highlights how overleveraged bullish bets were hit hardest during the crash.

Why Crypto Liquidations Spiked So Fast

Several factors combined to trigger this sudden sell-off:

- Recession fears and weak macroeconomic data pressured global risk assets.

- Low liquidity left the market vulnerable to volatility spikes.

- Large leveraged long positions were liquidated, intensifying the crash.

- A parallel global stock sell-off echoed through crypto markets.

The crash came just moments after rumors of a major crypto announcement this week, leading some traders to believe it was no coincidence

On-Chain Data Signals Weakening Market Activity

On-chain activity has been thinning for weeks, confirming a trend of weakening momentum. Analysts had already warned in recent reports that leverage levels were unsustainable and liquidity remained fragile.

Each rally in recent weeks has been short-lived, quickly giving way to consolidation phases. The post-FOMC period was flagged as a high-risk zone, and today’s events confirm that outlook.

Implications for Bitcoin, Ethereum, and Altcoins

The latest crypto liquidation wave has significant implications for the market:

- Systemic Risk Rising: Investors may shift toward Bitcoin or stablecoins as safer bets.

- Oversold Conditions Possible: A relief bounce could emerge if macro conditions stabilize.

- Policy and Regulatory Moves Critical: Decisions by the Fed and central banks will heavily influence the next crypto cycle.

What Comes Next for Crypto Investors?

While the market shock was severe, volatility is not unusual in the crypto space. Traders should be cautious of high leverage trading, especially in thin liquidity environments. With seasonal holiday slowdowns ahead, another 1–2 weeks of consolidation is likely before the next major move.

For now, the focus will be on whether the rumored crypto announcement shifts sentiment—or if more liquidations loom.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The market crashed due to a perfect storm of recession fears, low liquidity, and a massive $1.7 billion liquidation event that forced the selling of overleveraged long positions in a chain reaction.

Over $1.7 billion was liquidated in 24 hours, with the vast majority ($1.6B) being long bets. Ethereum led with $483 million liquidated, followed by Bitcoin at $276 million.

Liquidations occur when traders using high leverage get automatically sold off to cover losses as prices fall rapidly. This creates a selling cascade that intensifies the market downturn.

Caution is advised. While prices are lower, the underlying low liquidity and high systemic risk mean volatility remains extreme. Avoid high leverage and prioritize safer assets like Bitcoin if uncertain.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.