FET price could soar by 22% to reach the $2 level.

FET's long/short ratio currently stands at 1.041, indicating bullish market sentiment among traders.

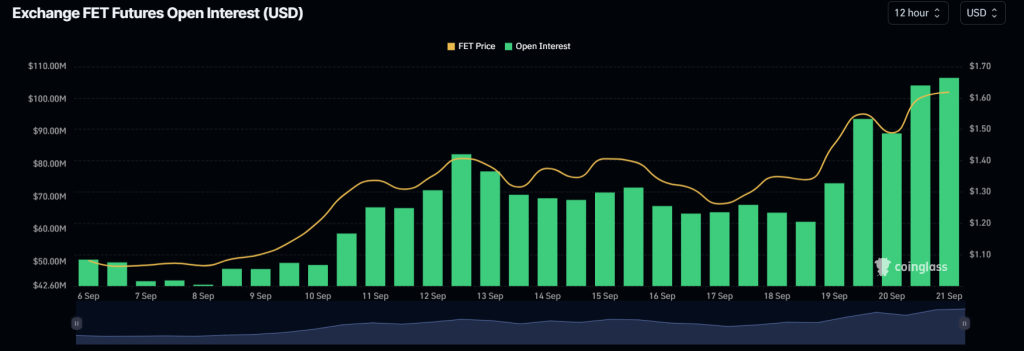

FET's future open interest has increased by 20% in the last 24 hours.

The Artificial Superintelligence Alliance (FET) is making a wave in the cryptocurrency landscape following its impressive price performance over the past few days. With its remarkable price surge, FET has confirmed its bullish breakout from an inverted head and shoulder price action pattern.

FET Technical Analysis and Upcoming Levels

According to expert technical analysis, FET appears bullish and is heading toward the next resistance level of $2. It is currently trading above the 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend. The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an uptrend or downtrend.

With the recent breakout of the neckline of the inverted head and should price action pattern, there is a strong possibility FET price could soar by 22% to reach the $2 level in the coming days and potentially higher.

However, before it reaches $2, a small price correction or retest of the breakout level may occur in the coming days, which is crucial for the upcoming upside rally.

Bullish On-chain Metrics

This bullish outlook is further supported by on-chain metrics. Coinglass’s FET long/short ratio currently stands at 1.041, indicating bullish market sentiment among traders. Additionally, its future open interest has increased by 20% in the last 24 hours and has been steadily rising since the beginning of September 2024.

This growth in the future open interest suggested increasing investor interest in FET and its upcoming rally. Traders and investors often combine rising open interest with a long/short ratio above 1 when building long positions.

Current FET Price Momentum

At press time, FET is trading near $1.61 and has experienced a price surge of over 7% in the last 24 hours. During the same period, its trading volume declined by 20% indicating lower participation from traders.

Also Check Out: Altcoins on the Verge of a Massive Explosion: TIA, IMX, and ICP Prices Set to Shoot Up