Gemini’s $425M Nasdaq IPO makes it one of the biggest U.S.-listed crypto exchanges.

IPO priced at $28, but shares opened $37, giving Gemini $4.4B valuation.

Winklevoss twins retain 94.5% voting control, ensuring full leadership despite going public.

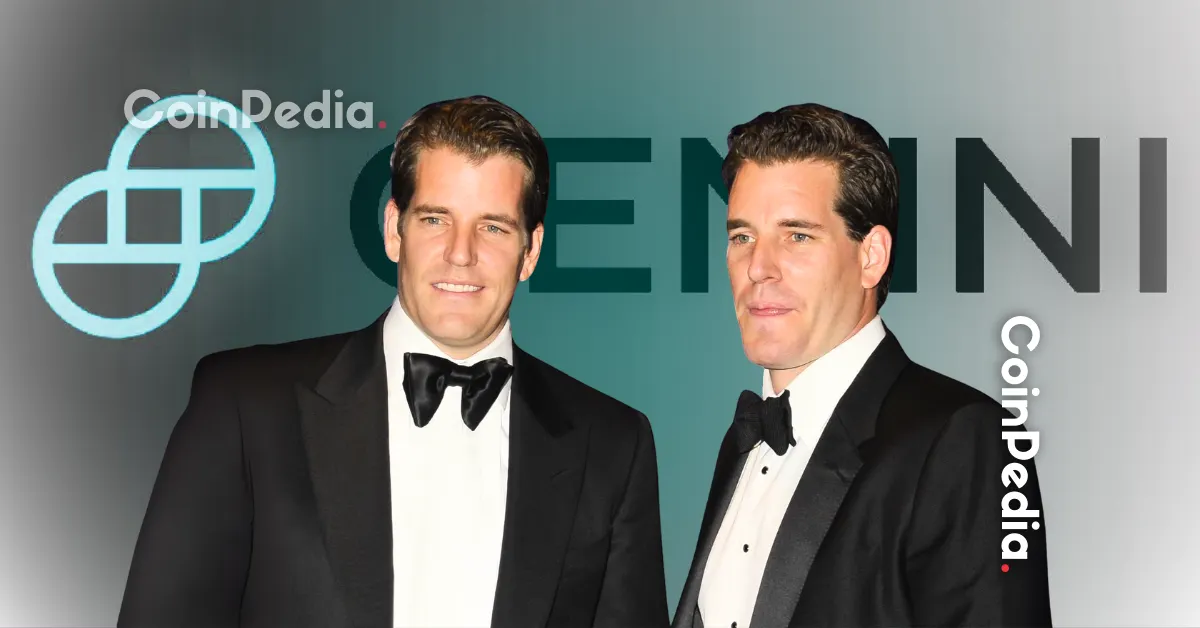

The world of cryptocurrency just welcomed another big moment as Gemini, the exchange led by Cameron and Tyler Winklevoss, made its debut on Nasdaq. The listing, under the ticker GEMI, raised $425 million and instantly positioned Gemini among the most prominent public crypto firms.

Gemini’s Strong Debut on Nasdaq

On its debut, Gemini priced its IPO at $28 per share, selling around 15.2 million shares. The stock, however, opened much higher at $37.01, giving the firm a valuation of nearly $4.4 billion.

Interestingly, Nasdaq itself became part of the story by investing $50 million in Gemini’s stock through a private placement. The move not only showed confidence in Gemini but also signaled a deeper partnership between traditional finance and the crypto sector.

Additionally, the company and its stockholders gave underwriters a 30-day option to buy 750,000 extra shares. Gemini clarified it won’t earn from shares sold by stockholders.

Winklevoss Twins Keep Control

Despite going public, the Winklevoss brothers are not losing their grip on the company. According to filings, they will retain about 94.5% of Gemini’s voting power, ensuring they remain firmly in control of the exchange’s direction.

The IPO also included 10% allocations for insiders and long-time & up to 30% for retail traders through platforms like Robinhood, SoFi, and Webull, a rare move that gave everyday investors a chance to participate early.

Joining the Club of Public Crypto Firms

Gemini now joins Coinbase and Bullish as one of the few U.S.-listed crypto exchanges. It also follows recent public debuts by Circle, Figure Technologies, and eToro, highlighting a wave of crypto-native firms tapping into U.S. capital markets this year.

The timing looks favorable. With friendlier regulatory signals and growing interest in digital assets, more crypto companies are seizing the opportunity to raise funds and expand.

Gemini Faces Losses Despite IPO Success

While the IPO was a financial success, Gemini still faces challenges. The exchange posted a net loss of $283 million in the first half of 2025, following a $159 million loss in 2024.

Despite these numbers, investors seem optimistic that Gemini’s brand, partnerships, and position in the U.S. market will drive long-term growth.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.