Retail traders are buying aggressively while institutions quietly exit, a classic warning before dumps.

S&P 500 and VIX rising together historically signal incoming corrections across stocks and crypto.

Analyst TED warns Bitcoin risks 2–3% drop while altcoins could plunge nearly 10%.

As the crypto market is enjoying its recent surge towards $4.14 trillion value, and Bitcoin is crossing $120,000 mark. But behind the hype, clear signs suggest a potential major correction is looming.

Prominent crypto analyst TED warns that retail traders are buying in late, while institutional investors are selling. This usually leads to a sharp drop, with Bitcoin at risk of a 2–3% drop and altcoins facing up to 10% losses soon.

Retail Buys, Institutions Sell

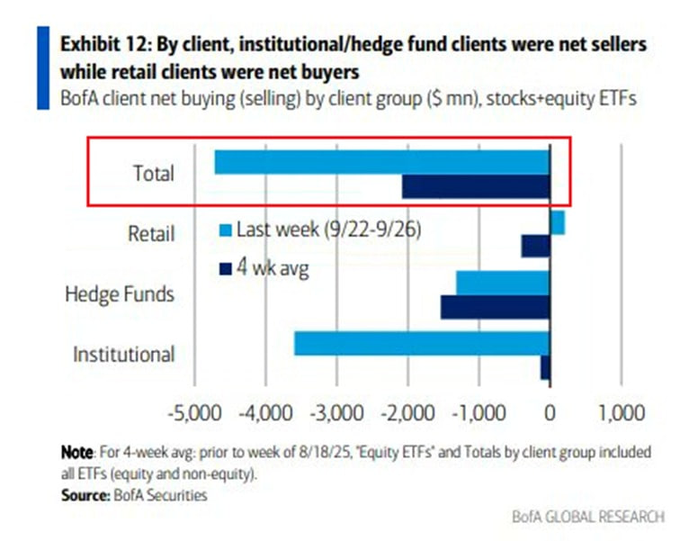

According to the TED, Global research data show that small investors are aggressively buying, and institutional investors are cautious, leaning towards a bearish stance.

Last week alone, institutions sold around $3.6 billion worth of stocks, and hedge funds offloaded another $1.3 billion. In sharp contrast, retail investors poured in about $200 million, thus, this divergence raises concerns that retail traders, driven by FOMO.

Therefore, TED warns this is “big money selling to small money,” a classic setup before market dump.

Markets Trading Without Data

The situation has been further complicated by the ongoing U.S. government shutdown that has created a “data blackout.” Key reports like jobless claims, payrolls, CPI, and retail sales are all on hold.

This means traders have no fresh data to rely on and are instead trading purely on positioning and narrative. Even the Fed, known for being “data-driven,” is left flying blind.

Warning Signs From Stocks and Crypto

Another unusual signal comes from the S&P 500 and VIX rising together for four straight days, a rare occurrence that historically ends in a market correction.

If it repeats, the S&P could dip by up to 1.5%, which historically translates into a 2–3% pullback for Bitcoin and a 5–10% hit for altcoins.

Bitcoin Strong, But Risks Rising

Despite the TED’s bearish prediction, Bitcoin has shown resilience, bouncing 12% from its $107K September low to trade above $120K. ETFs are also supporting demand, with $2.25 billion in inflows this week.

Altcoins are rallying too, with BNB hitting $1,108 and XRP climbing to $3.06, sparking renewed “altseason” talk.

Yet TED remains cautious as he holds 70% in stablecoins, betting that retail enthusiasm is rising, the smart money may already be exiting, and that could set the stage for a sharp correction.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Analysts warn a correction is possible as data shows institutions are selling while retail investors buy, a classic sign of a potential market top before a drop.

A U.S. government shutdown has halted key economic reports, forcing the Fed and traders to operate without fresh data, increasing market volatility and uncertainty.

While prices are high, some analysts are cautious. Current retail enthusiasm may be a “FOMO” signal, suggesting a wait for a potential correction could be prudent.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.