Cardano's (ADA) open interest (OI) has been rising aggressively, jumping by 5.9% in the past four hours.

ADA’s long/short ratio currently stands at 1.056, indicating a strong bullish sentiment among traders.

ADA could soar by 30%, reaching $0.98 or $1, if it closes a daily candle above the $0.78 level.

Cardano (ADA), with 125% of the rally in the past two weeks, is poised to continue its upward momentum in the coming days. With its strong bullish price action, and if the overall market sentiment supports it, there is a strong possibility of notable gains for ADA holders.

Cardano (ADA) Technical Analysis and Upcoming Level

Based on the daily chart, ADA appears to be consolidating near a crucial resistance level of $0.77 over the past four trading days. Historically, whenever the ADA price consolidates near a key level, it tends to rally significantly. This time, traders and investors similarly anticipate strong momentum in the coming days.

Recent data and price action highlight that if ADA breaks out of its ongoing consolidation and closes a daily candle above the $0.78 level, it could surge by 30%, potentially reaching $0.98 or even $1 in the coming days.

Currently, ADA is trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating an uptrend. However, its Relative Strength Index (RSI) signals a potential price correction or decline, as its value of 80.15 is in overbought territory.

Despite this, the sentiment around ADA remains strongly bullish, suggesting the asset could breach this level quickly.

Bullish On-Chain Metrics

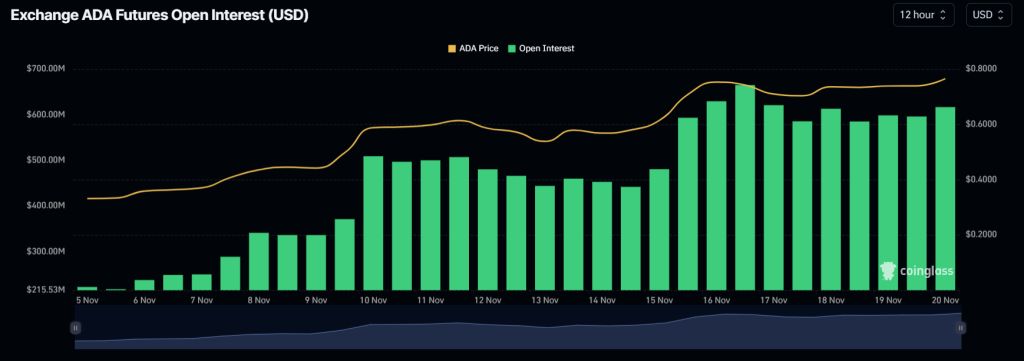

Besides technical analysis, on-chain metrics further support the asset’s bullish outlook. According to on-chain analytics firm Coinglass, ADA’s open interest (OI) has increased by 5.90% in the past four hours and 3.80% in the past hour. This notable rise in OI indicates heightened trader activity, signaling aggressive participation amid a bullish sentiment.

Additionally, ADA’s long/short ratio currently stands at 1.056, reflecting a strong bullish sentiment among traders.

At press time, ADA is trading near $0.76 and has gained over 4.12% in the past 24 hours. However, during the same period, its trading volume dropped by 27%, indicating lower participation from traders and investors.