Breaking: Fed Cuts Key Interest Rate By 25 BPS, QE to Start on Dec 1; What’s the Impact on Crypto Bull Run?

The odds of another 25bps Fed rate in December remain high but have dropped significantly today.

The Fed Chair stated that its much-anticipated Quantitative Easing will start on December 1.

The crypto market has not yet experienced the hallmark of the bull run.

The Federal Reserve has bent its knee to President Donald Trump’s request, amid the ongoing United States Government shutdown, which has lasted nearly 30 days. On Wednesday, October 29, the Fed reduced its federal funds rate by a quarter percentage point to between 3.75% and 4%.

The Fed noted that its Quantitative Easing (QE) will begin on December 1, 2025. Meanwhile, Fed Chair Jerome Powell noted that December’s rate decision will be impacted by the availability of economic data, thus urging a quick resolution to the ongoing government shutdown.

The majority of the Fed’s members voted in favor of monetary action apart from Stephen Miran and Jeffrey Schmid. Notably, Miran, who was voted in by President Trump, advocated a rate cut of 50 bps. On the other hand, Schmidargued in favor of no change for the federal funds rate.

What’s the Impact of the Fed’s Policy Change on the Crypto Bull Market?

Midterm fear and uncertainty unleashed: government shutdowns’ impacts

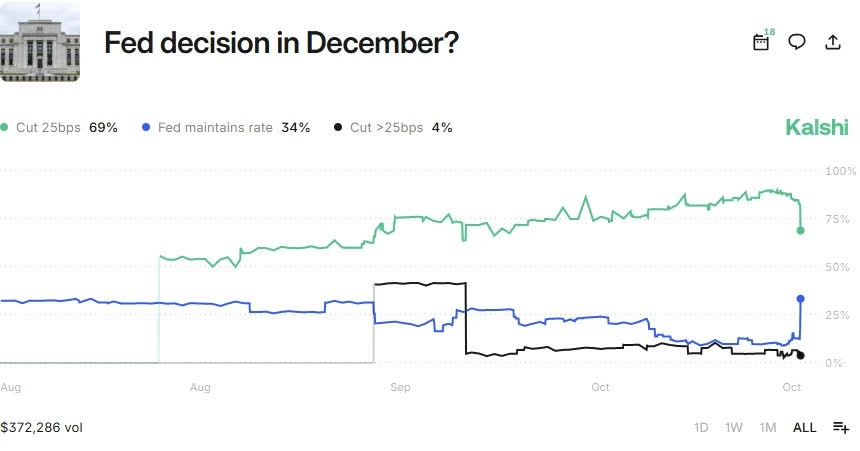

Following the Fed chair Powell’s announcement that the December rate decision will be impacted by data available, the midterm fear and uncertainty surged. Furthermore, Kalshi traders have reduced their conviction of an imminent Fed rate cut in December.

At press time, Kalshi traders were betting a 69% chance that the Fed will initiate a 25 bps rate cut in December. Additionally, Kalshi traders were betting a 34% chance, up from 13% earlier on Wednesday, that the Fed will maintain its rate in December.

As such, the wider crypto bull market may experience a midterm choppy consolidation in the coming few weeks.

Long-term bullish sentiment Solidified

Meanwhile, the long term crypto bull market has been solidified akin to the 2017 crypto summer, which also involved President Trump’s leadership. The now confirmed QE is a major boost to the crypto bull market amid anticipated capital rotation from Gold, which is heavily overbought.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.