BlackRock has named tokenization a key market theme for 2026.

Binance founder CZ says governments are already exploring asset tokenization to unlock early financial value.

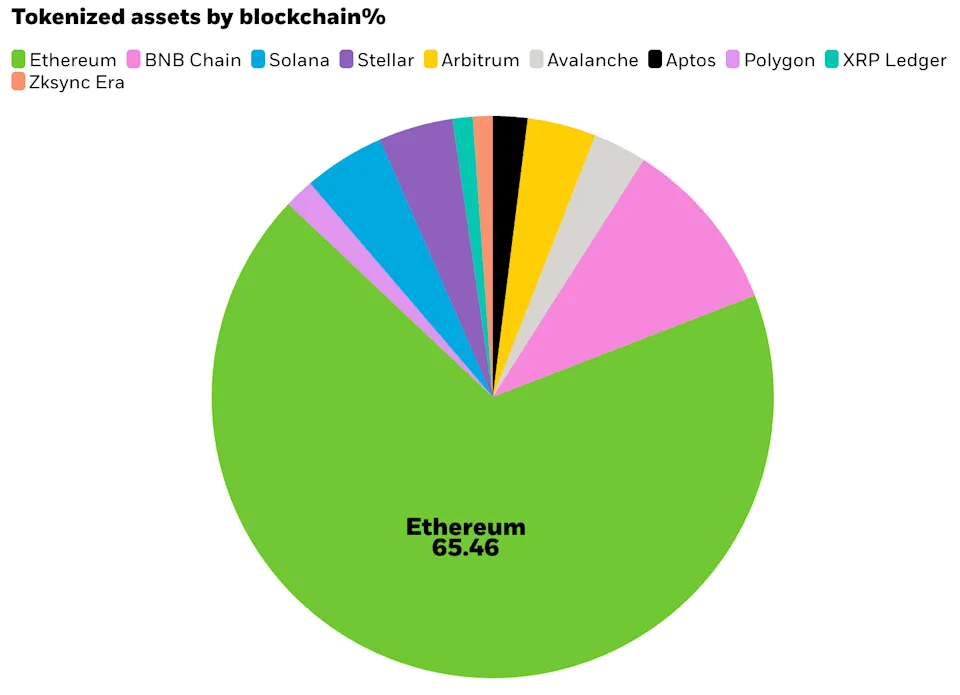

With institutions and governments converging, Ethereum is emerging as the leading platform for tokenized assets.

BlackRock has named cryptocurrency and tokenization among the top investment themes for 2026. At the same time, Binance founder CZ revealed he is talking with around a dozen governments about tokenizing their assets.

The world’s largest asset manager and crypto’s most influential figure are now pointing in the same direction.

BlackRock’s 2026 Thematic Outlook, led by Jay Jacobs, head of U.S. equity ETFs, highlights blockchain as an emerging tool for modernizing access to traditional asset classes. The report shows Ethereum holding over 65% of all tokenized assets, ahead of Solana and other chains.

“As tokenization continues to rise, so will the opportunity to access assets beyond cash and U.S. Treasuries via the blockchain,” the report states.

Stablecoins Hit $8 Trillion in Volume

The iShares Bitcoin Trust (IBIT), BlackRock’s spot Bitcoin ETF, now holds more than $70 billion in net assets. The firm called it the fastest-growing exchange-traded product in history.

Stablecoin volumes also reached $8 trillion last year, topping spot crypto trading. BlackRock pointed to this as proof of real-world blockchain use beyond speculation.

CZ Advises Governments on Tokenization

At the World Economic Forum in Davos, CZ said he is working with multiple governments on asset tokenization strategies.

“I’m talking with probably a dozen governments about tokenizing some of their assets,” he said. “This way the government can actually realize the financial gains first and use that to develop those industries.”

CZ also named three crypto sectors he expects to grow: tokenization, crypto-backed payments, and AI agents. He added that AI systems will likely use crypto as their native currency because “they’re not going to swipe credit cards.”

What This Signals for Ethereum

BlackRock specifically named Ethereum as a potential beneficiary of tokenization growth, citing its use in building decentralized applications and token infrastructure.

With institutional backing and government-level conversations now aligning around the same thesis, Ethereum’s position in the tokenization race looks stronger heading into 2026.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

When large asset managers engage with blockchain, it can accelerate regulatory clarity, infrastructure investment, and mainstream acceptance. This often lowers barriers for other institutions to participate.

Tokenization may increase liquidity by allowing assets to trade continuously and in smaller units. It could also shorten settlement times and reduce reliance on intermediaries.

Legal frameworks, custody standards, and cross-border compliance remain unresolved in many jurisdictions. Market adoption may move unevenly as regulators and institutions adjust.

Investors may look for pilot programs, regulatory approvals, and new tokenized products from established financial firms. Government-backed projects could signal broader adoption timelines.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.