Bitwise's ETF will invest in companies with significant Bitcoin reserves, prioritizing the value of their holdings over market cap.

The ETF aims to provide investors with exposure to companies adopting a "Bitcoin standard" .

Companies with strong Bitcoin holdings have seen significant stock price increases, and the ETF seeks to capitalize on this trend.

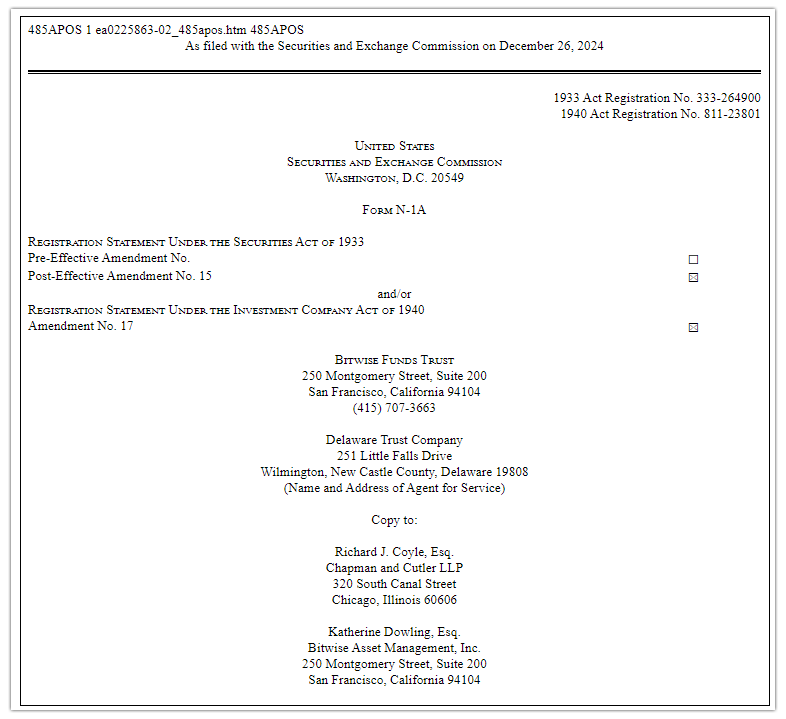

Bitwise has proposed an Exchange-Traded Fund (ETF) that shines a spotlight on companies holding massive Bitcoin reserves. However, this is more than it might seem.

It’s a bold attempt to offer investors a way to capitalize on the “Bitcoin standard”—a concept that’s gaining traction among some of the world’s most forward-thinking firms.

What sets this ETF apart? And why are companies betting big on Bitcoin? Let’s break it all down.

How This ETF Stands Out

The proposed fund, called the Bitwise Bitcoin Standard Corporations ETF, isn’t your typical ETF. Companies must meet strict requirements to be included:

- Hold at least 1,000 Bitcoin in reserves.

- Have a market capitalization of at least $100 million.

- Ensure daily liquidity of $1 million.

- Keep less than 10% of their stock privately held.

Unlike most ETFs that weigh companies by their market size, this fund focuses on the value of their Bitcoin holdings. For example, MicroStrategy, which owns 444,262 BTC, would dominate the fund, even though Tesla, with its 9,720 BTC, has a much larger market cap. To ensure balance, no single holding can exceed 25% of the ETF.

Why Are Companies Buying Bitcoin?

For many companies, investing in Bitcoin has proven to be a winning strategy. Take KULR Technology Group, for instance. The company recently purchased 217.18 BTC for $21 million. This move caused its stock price to rise by 40%, showing how Bitcoin adoption can drive investor interest.

Bitcoin itself has had a stellar year, climbing 117% and reaching an all-time high of $108,000 in December. It’s currently trading around $95,800, highlighting its resilience and growing appeal.

- Also Read :

- Top 10 Public Companies Holding Over 1,000 Bitcoins

- ,

What’s at Stake for Investors?

Bitwise isn’t alone in this race. Strive Asset Management, founded by Vivek Ramaswamy, has filed for an ETF focused on Bitcoin bonds. The competition between these ETFs could shape how investors engage with the growing crypto market.

For those betting on Bitcoin’s adoption, these ETFs offer a fresh way to invest in the cryptocurrency’s future. However, as with any crypto-related investment, the potential comes with a level of uncertainty.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

With ETFs like these, Bitcoin’s influence is seeping further into traditional finance. What a move!