Metaplanet, a Japanese investment firm, has become Asia's second-largest corporate Bitcoin holder.

The company views Bitcoin as a hedge against economic uncertainty in Japan.

Metaplanet is actively seeking to increase its Bitcoin holdings. To fund these purchases, it has recently issued bonds.

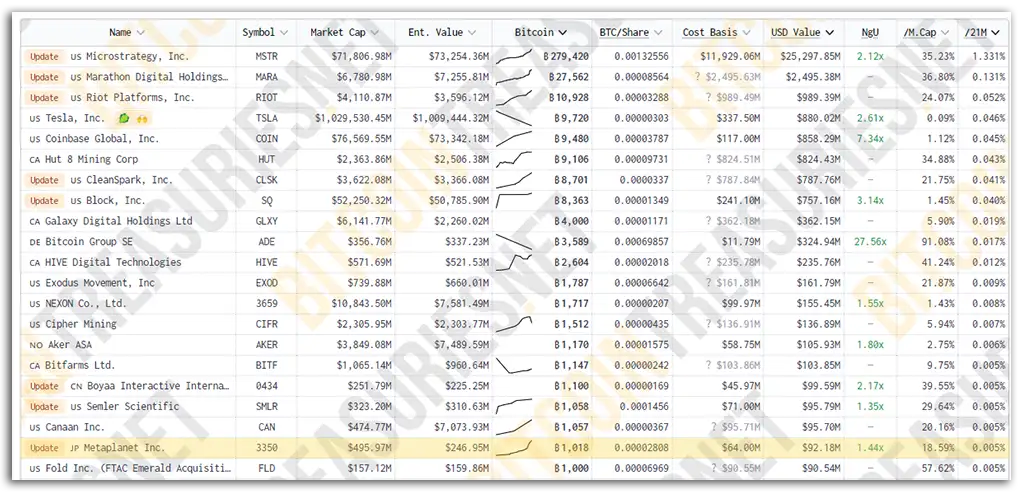

Metaplanet, a bold player in Japan’s investment scene, is making waves with a daring strategy that has caught the attention of both investors and critics. The company now holds 1,018 Bitcoin, valued at $92.18 million. This is a total of 0.005% of the total BTC supply, making it Asia’s second-largest corporate Bitcoin holder!

As the yen weakens, government debt climbs, and interest rates hit rock-bottom, Japanese businesses are being forced to think outside the box. Why choose such a volatile asset? Since April 2024, the company has treated Bitcoin as its main treasury reserve.

Is this more than a financial strategy – a last attempt at surviving in uncertain times?

Read on to discover how Metaplanet is using Bitcoin as a shield against Japan’s economic storm and what it means for the future.

Metaplanet Builds Bitcoin Stash

Metaplanet’s Bitcoin journey didn’t happen overnight. In April 2024, it made its first purchase of 117.7 BTC for $7.19 million. A few months later, it secured a $6.8 million loan from MMXX Ventures to expand its holdings. By October, the company added another 156 BTC for $10 million. Today, Bitcoin makes up nearly 19% of Metaplanet’s total market value—a bold and strategic commitment.

¥1.75 Billion Bonds

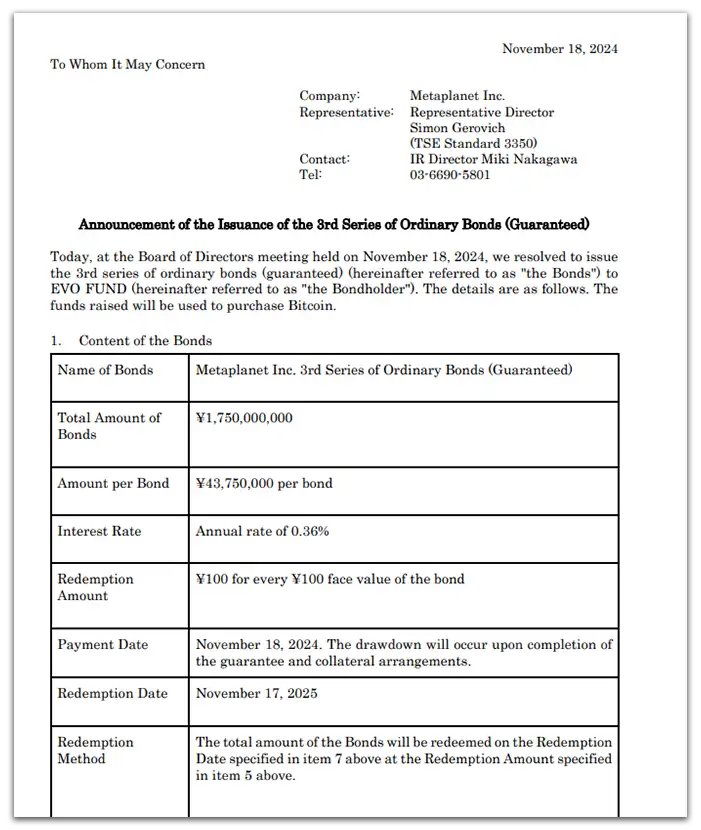

Today, Metaplanet stepped things up. It announced issuing ¥1.75 billion ($11.8 million) in bonds at a super-low 0.36% interest rate. The goal? To buy even more Bitcoin. Every single bond was scooped up by EVO FUND, showing investors are on board with this risky but exciting plan.

Interestingly, Metaplanet’s bonds are not directly collateralized. Instead, the company has offered a first-priority mortgage on the land and building of the Hotel Royal Oak Gotanda, which is owned by its subsidiary, Wen Tokyo Inc. This creative use of assets highlights the company’s determination to sustain its Bitcoin-focused strategy.

Can Metaplanet’s Bitcoin Bet Pay Off?

As Metaplanet doubles down on Bitcoin, the stakes are higher than ever. The company aims to use its growing reserve to navigate Japan’s economic challenges. But with Bitcoin’s notorious volatility, the outcome remains uncertain.

Win or lose, Metaplanet has made its mark! Follow along for more updates.