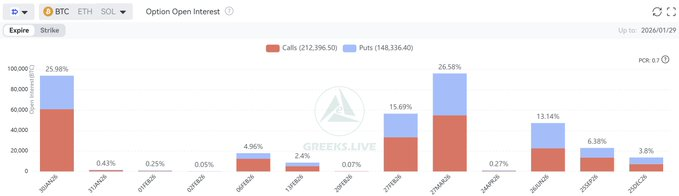

Bitcoin is trading in a tight range as the crypto market heads into the first monthly options expiry of 2026, according to data shared by GreeksLive.

More than 25% of all open options positions are set to expire tomorrow, but so far, price action has remained relatively calm. Analysts say this is largely because there are no major market-moving events on the horizon and the U.S. Federal Reserve has left interest rates unchanged.

Bitcoin Stuck Between Key Levels

Bitcoin has slipped back into a consolidation phase after recent volatility. At the moment, $90,000 is acting as strong resistance, while $86,000 is providing firm support. As long as price stays between these levels, analysts expect sideways movement to continue.

At the same time, implied volatility (IV), a measure of expected price swings, has been trending lower, showing traders are not betting on a sharp breakout in the near term.

Institutional Flows Add Pressure

GreeksLive said that a large number of institutional-held coins have recently moved onto exchanges, increasing liquidity and adding short-term pressure to the market. Crypto-related U.S. stocks have also been underperforming.

As a result, market mood has started to turn more pessimistic, with traders becoming more sensitive to negative headlines and uncertainty.

What’s Next For Bitcoin Price?

Technical analysts say Bitcoin’s rejection near the $90,000–$95,000 zone confirms that resistance remains strong. There is also a warning that if selling pressure increases, Bitcoin could revisit lower levels before finding a more stable base.

However, markets can move in either direction. A clear break above resistance would be needed to shift sentiment bullish again, while a loss of support near $86,000 could open the door to deeper downside.

For now, Bitcoin appears to be doing what markets often do ahead of major expiries — move sideways, shake out traders, and wait for a new catalyst.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.