Bitcoin drops to $86K as monthly algorithm resets trigger mass liquidations. Key support at $86K decides if price rebounds toward $93K or dips to $83–85K.

Low liquidity and cleared stop-losses drive Bitcoin’s sharp fall, but broader trend holds. December targets: defend $86K or test $83–85K before aiming for $100K.

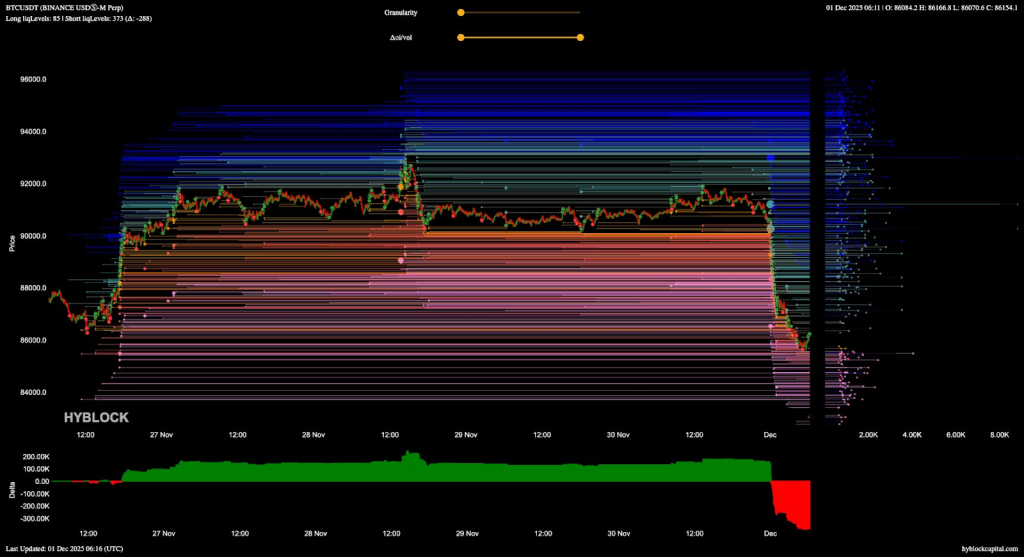

Bitcoin price today fell sharply at the start of the new month, dropping from over $90,000 to around $86,000. There was no major news behind the move; it happened because trading activity was low and many long positions were cleared out as algorithms reset for the new month, causing temporary liquidity issues.

A large wave of liquidations cleared out stop-loss orders between $90,000 and $86,000, allowing the price to fall quickly. With that block now gone, traders are watching how Bitcoin behaves around current levels.

Despite the drop, Bitcoin’s broader trend remains unchanged. The rejection at resistance was expected, and the market is still in a wider phase of consolidation and accumulation. According to analyst Michaël van de Poppe, a retest of the upper range in the next one to two weeks, which could set the stage for another attempt at breaking toward $100,000.

Analysts are watching the $86,000 level carefully because it sits at the top of Bitcoin’s recent support zone. If Bitcoin cannot move back above this level and hold, it suggests the drop was real and that the price may continue to move lower in the short term.

Below $86,000 is the next important area between $83,000 and $85,000. This zone contains a large group of stop-loss orders from traders who are still holding long positions.

Right now, the market has low liquidity, so if Bitcoin does not recover above $86,000 soon, the price may gradually move down toward the $83,000–$85,000 area. Any small bounce from current levels may just be a brief pause before the market tests that lower zone.

The positive sign for bulls is that clearing this liquidation zone could trigger a major reset in the market. Funding rates may drop to zero or even turn negative, which often helps price bounce back. If that happens, Bitcoin could quickly move toward the short-term liquidity targets around $91,500–$93,000.

Bitcoin Price Forecast For December

In the short term, Bitcoin will likely move down to test the support area between $83,000 and $85,000. The $86,000 level is still the key level to watch. If BTC price can stay above it, the price could rebound toward $91,000–$93,000. If it cannot hold this level, the price may drop into the lower zone before any real recovery happens.

Even with the recent volatility, the broader market setup still supports the possibility of Bitcoin moving toward $100,000 once this period of consolidation and cleanup is over.

For December, the important levels to follow are $86,000 and the $83,000–$85,000 zone, as these will decide Bitcoin’s short-term direction and help shape the next major rally.

| Metric | Bitcoin Price (December 2025 Projection) |

| Expected Low | $80,000 – $85,000 |

| Expected High | $94,000 – $96,000 |

| Expected Average Price | $89,000 – $92,000 |

| Potential Peak (if breakout occurs) | Up to $110,000 |

FAQs

BTC is down because low liquidity and automated long liquidations triggered a fast drop, not due to major news or changes in fundamentals.

Future BTC price depends on liquidity, macro trends, investor sentiment, and how price reacts around key support and resistance levels.

Bitcoin’s roadmap focuses on stronger scaling tools, improved security, and broader institutional adoption, which can support long-term growth.

Bitcoin may range between $80,000 and $96,000, with a possible breakout toward $110,000 if momentum returns after testing key support zones.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.