Bitcoin crashed to $60,000 after a sharp 15% drop erased post-election rally gains completely.

Miner selling pressure increased as average Bitcoin production cost rose above $87,000, forcing forced liquidations.

More than $2.6 billion leveraged positions liquidated, with long traders taking majority losses during sudden crash.

On February 6, the crypto market saw a sharp crash as Bitcoin plunged nearly 15%, wiping out around $350 billion in total market value in a single day. Bitcoin’s price fell to $60,030, erasing gains made since its October peak near $126,000.

This drop also wiped out the entire “Trump bump” rally from November 2024, as selling pressure increased from miners, profit-taking, deleveraging, and global market fears.

Bitcoin Price Drop Linked to Miner Selling Pressure

One of the biggest pressures is coming from Bitcoin miners. Data shows that the average cost to mine one Bitcoin has now risen above $87,000. With Bitcoin currently trading near $65,000, many miners are operating at a loss. To cover expenses, they are being forced to sell their holdings.

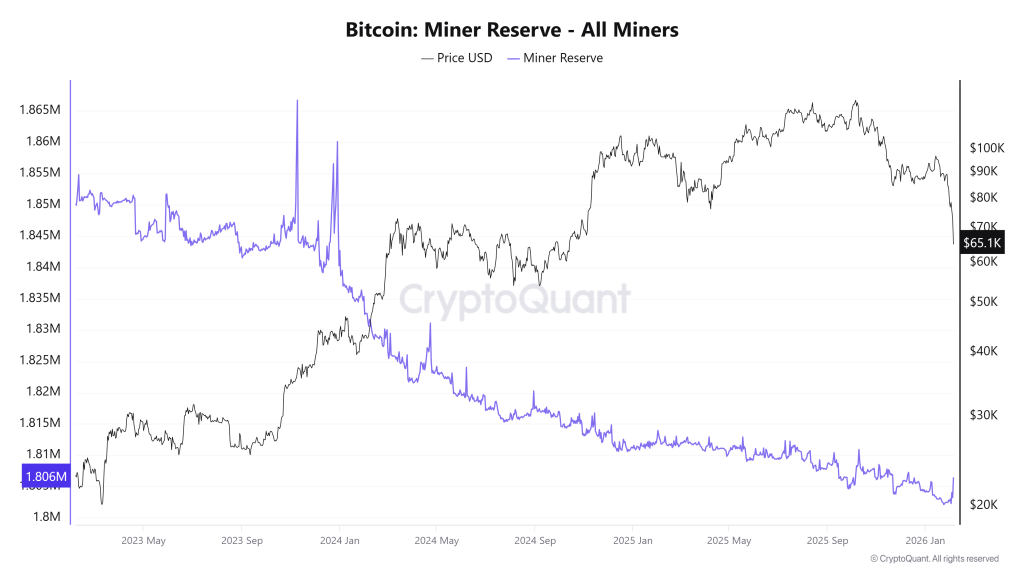

Bitcoin miner Reserves have fallen consistently over the past months and now stand near 1.806 million BTC. This indicates that miners are selling more coins than they are keeping, adding to market supply.

Bitcoin ETFs Record Heavy Outflows

At the same time, institutional demand has weakened sharply. Bitcoin exchange-traded funds (ETFs) saw heavy outflows again. On February 5, spot Bitcoin ETFs recorded $258.8 million in net withdrawals.

Although this was lower than the $544.9 million outflow seen a day earlier, the total outflows for the week have already crossed $1.07 billion.

Liquidations Add More Pressure on BTC Price

Liquidations also played a major role in pushing prices lower. In just 24 hours, more than $2.65 billion worth of leveraged crypto positions were wiped out. Around 82% of these liquidations came from long traders who were betting on higher prices.

The single largest liquidation happened on Binance, where a BTCUSDT position worth $12 million was forcibly closed.

Michael Saylor’s Strategy In Big Losses

Even major corporate Bitcoin holders felt the pain. Michael Saylor’s Strategy reported an unrealized loss of about $9 billion, equal to 16% of its massive Bitcoin holdings. Despite this, Saylor urged investors to stay calm and “HODL.”

Yet some leaders, including Ripple CEO Brad Garlinghouse, reminded traders of Warren Buffett’s famous advice: be fearful when others are greedy and greedy when others are fearful.

Bitcoin Price Outlook

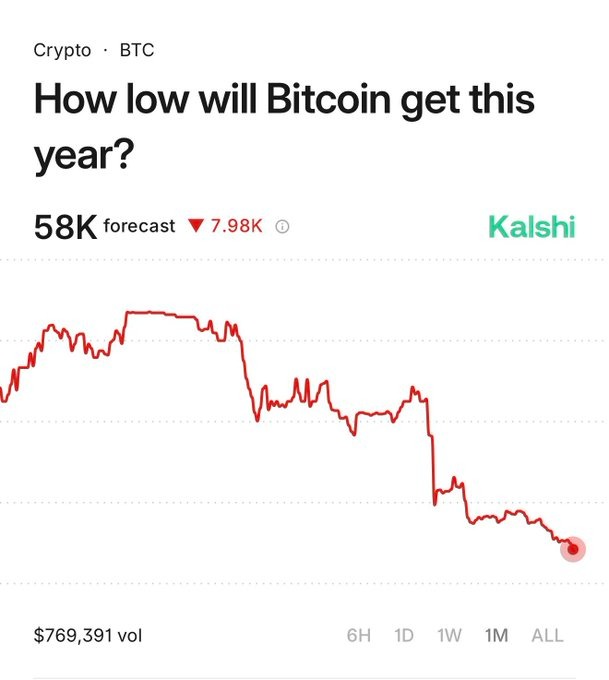

Bitcoin is now testing one of its most important support levels in years. If the price fails to hold above $60,000, analysts warn that more downside could follow.

Even traders on the prediction market Kalshi expect Bitcoin to touch $58,000 in 2026.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin crashed nearly 15% due to miners selling at a loss, over $1 billion in ETF outflows, and $2.65 billion in leveraged positions being liquidated in a single day.

A recovery typically needs reduced selling pressure, stabilizing miner activity, slowing ETF outflows, and renewed spot buying at key support levels.

Institutions often re-enter gradually once volatility settles and price levels appear attractive relative to long-term fundamentals.

Key signs include declining liquidations, stable miner reserves, ETF inflows, and higher trading volume near support levels.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.