Bitcoin forms fifth Golden Cross, a signal that triggered strong rallies during uncertain markets

Trader Merlijn says Golden Cross could drive 45% to 50% Bitcoin price rally ahead

Bitcoin price has been moving sideways around $86K, keeping the crypto market nervous. However, bullish hope has returned as Bitcoin formed a fresh Golden Cross, a signal that often comes before major price rallies.”

According to popular trader Merlijn The Trader, this setup could fuel a 45%–50% move, potentially pushing Bitcoin toward $130K in the coming months.

Bitcoin Golden Cross Appears Again

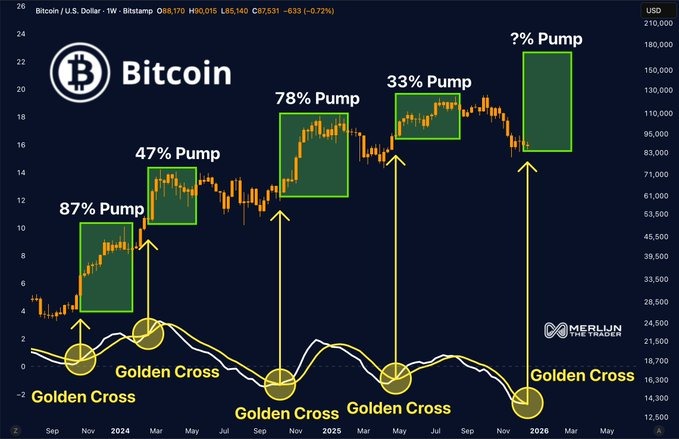

According to charts shared by crypto trader Merlijn The Trader, Bitcoin has formed its fifth Golden Cross since 2020. In past cycles, this signal appeared early, when confidence was low, and many investors were unsure about the market’s next move.

This is why the signal matters. History shows that Bitcoin often moves higher after similar Golden Cross patterns. In earlier cycles, Bitcoin rose by:

- 87% in early 2020

- 47% in the next phase

- 78% during the 2021 rally

- 33% in a later cycle

These gains did not happen right away. Bitcoin usually stayed flat for weeks or even months before starting its move. This suggests the Golden Cross often marks the start of a build-up phase, not the top.

How High Can Bitcoin Price Go This Time?

The same situation is visible now. Bitcoin is struggling to move above $90,000, and the overall market mood remains cautious. Merlijn points out that Golden Cross signals usually show up when sentiment is weak, not when excitement is high.

At present, Bitcoin is trading near $86,600. Even the smallest gain of 33% would push the price close to $115,000.

If momentum improves and Bitcoin sees a mid-range rally of around 45%, the price could move toward $130,000. Meanwhile, a similar move this time could lift prices into the $145,000 to $155,000 range.

Bitcoin Price Struggles Short Term

Despite the bullish setup, Bitcoin is still facing short-term pressure. Data from Glassnode shows nearly 6.7 million BTC are currently held at a loss, creating strong selling pressure near the $90,000–$95,000 zone.

At the same time, holiday trading has reduced liquidity, which often leads to sharp but temporary price swings. Recent buying activity has also come mostly from derivatives traders, not long-term spot buyers.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

A Golden Cross happens when a short-term moving average crosses above a long-term one, often signaling growing momentum and potential price rallies.

Bitcoin often recovers weeks or months after a Golden Cross, once selling pressure fades and spot buying returns, signaling stronger market confidence.

Bitcoin could retest nearby support zones if selling continues, but strong long-term demand and historical patterns suggest deep drops are less likely.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.