Nearly $3 billion in Bitcoin and Ethereum options expire today, raising short term volatility risks.

Bitcoin options expiry covers 38,000 contracts worth $2.5 billion with $74,000 max pain level.

Ethereum options expiry totals 215,000 contracts worth $410 million with downside hedging still visible.

The crypto market today is going to see strong volatility as bitcoin options expiry and ethereum options expiry bring nearly $3 billion worth of contracts to an end on the Deribit exchange.

This major crypto options expiry represents close to 9% of total open interest, making it a key event for short-term price action.

Bitcoin Options Expiry To Sees $2.5 Billion

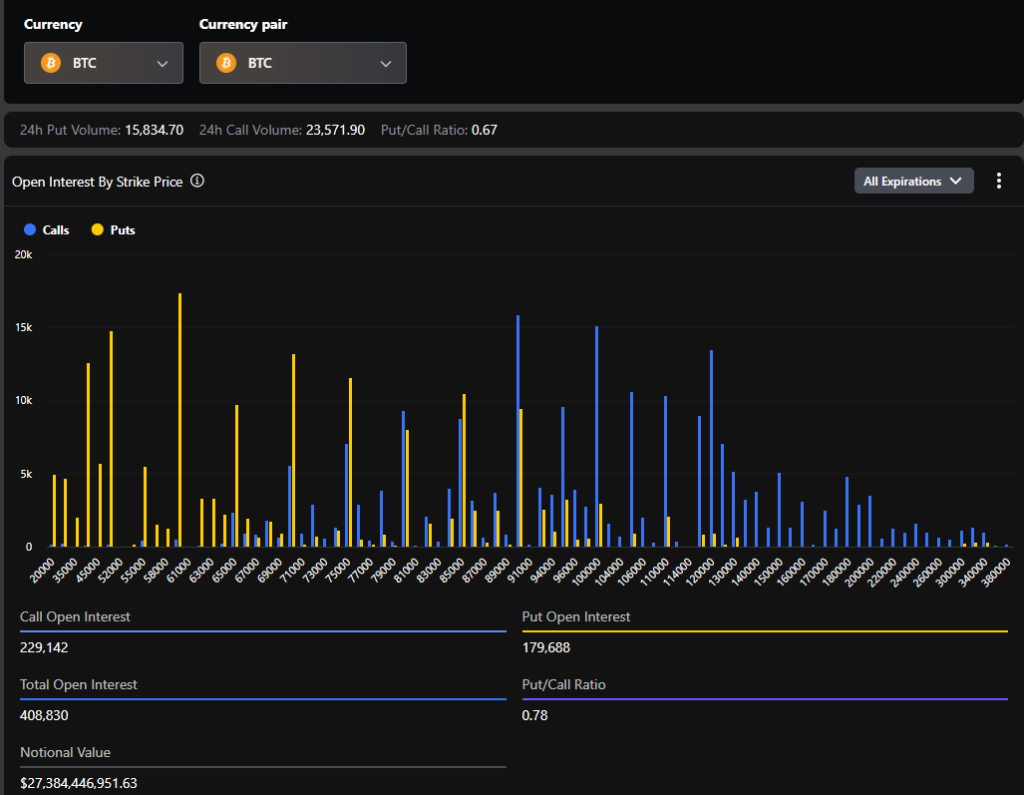

According to Deribit’s latest data, the bitcoin options expiry included around 38,000 contracts with a total value of nearly $2.5 billion.

The put-call ratio stands at 0.71, showing that traders are taking a balanced view rather than betting heavily in one direction. The BTC max pain level is at $74,000, while Bitcoin traded near $66,872.

The Bitcoin option expiry chart shows rising caution in the market, especially as Bitcoin continues to struggle to move back above the $70,000 level.

Ethereum Options Expiry Adds Pressure With $410 Million

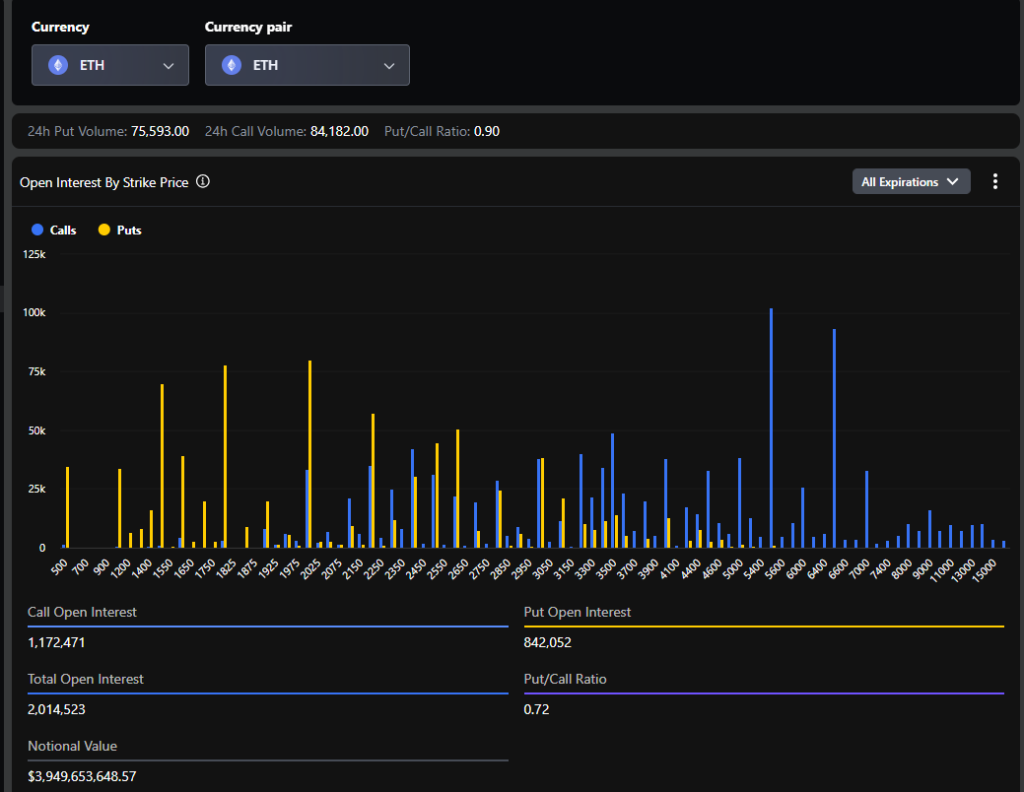

Alongside Bitcoin, the ethereum options expiry covered about 215,000 contracts worth roughly $410 million. However, the ETH “max pain” level sits around $2,100, while the current price is near $1,950.

The put-call ratio is close to 0.82, which shows many traders are still protecting against further downside.

How the Crypto Market will React

This week’s expiry is larger than last week’s event, when a notable bitcoin options expiry saw about $2.1 billion worth of BTC contracts settle. During that expiry, Bitcoin’s price moved by around 2%, showing only a limited short-term impact.

Historically, expiries of this size can slightly influence short-term price moves, but markets often stabilize once positions are settled.

Now, with Bitcoin trading near $66,891 and Ethereum around $1,985, the market could see short bursts of volatility again as open interest unwinds.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Options expiry is when crypto contracts settle. Traders close or roll positions, which can briefly increase volatility.

No. Expiry can trigger volatility, but historical data shows price moves are often limited and short-lived.

Expect volatility, manage risk, avoid overleveraging, and watch key levels like max pain and open interest.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.