Marathon Digital moved 1,318 Bitcoin worth $87 million to major institutional crypto service platforms recently.

Transfers were sent to Two Prime, BitGo, and Galaxy Digital within a short ten-hour window period.

Marathon still holds 52,850 BTC, keeping its position among the world’s largest corporate Bitcoin holders today.

Bitcoin miner Marathon Digital Holdings has transferred nearly $87 million worth of Bitcoin to major crypto service firms, sparking concerns about fresh selling pressure.

The move comes as Bitcoin trades around $64,800 after a sharp drop, adding to fears that miners may be increasing sell-offs.

Marathon Digital Bitcoin Transfer Signals Possible Selling

On February 6, Marathon Digital Holdings moved a total of 1,318 BTC valued near $87 million to institutional platforms, including Two Prime, BitGo, and Galaxy Digital.

These are well-known institutional platforms that provide custody, trading, and liquidity services. When a mining company sends coins to such firms, it often signals preparation for structured selling, collateral use, or treasury rebalancing.

However, the transfers happened within roughly a 10-hour window while Bitcoin traded around the mid-$60,000 range after a sharp daily drop.

Marathon Current Bitcoin Holdings

Despite the transfer, Marathon still holds about 52,850 BTC worth around 3.42 billion, keeping it among the top corporate Bitcoin holders worldwide. This shows the company is adjusting part of its treasury, not exiting its position.

Still, the timing adds to short-term caution. Bitcoin is already down nearly 10% in 24 hours, and broader sentiment is fragile. When miner flows rise during a falling market, traders tend to expect more volatility.

Miner & Whale Continue to Sell Bitcoin

One major pressure is coming from Bitcoin miners. The average mining cost has risen above $87,000, while Bitcoin trades near $65,402, forcing many miners to sell at a loss. CryptoQuant data shows miner reserves have dropped to 1.806 million BTC, confirming rising sell-offs.

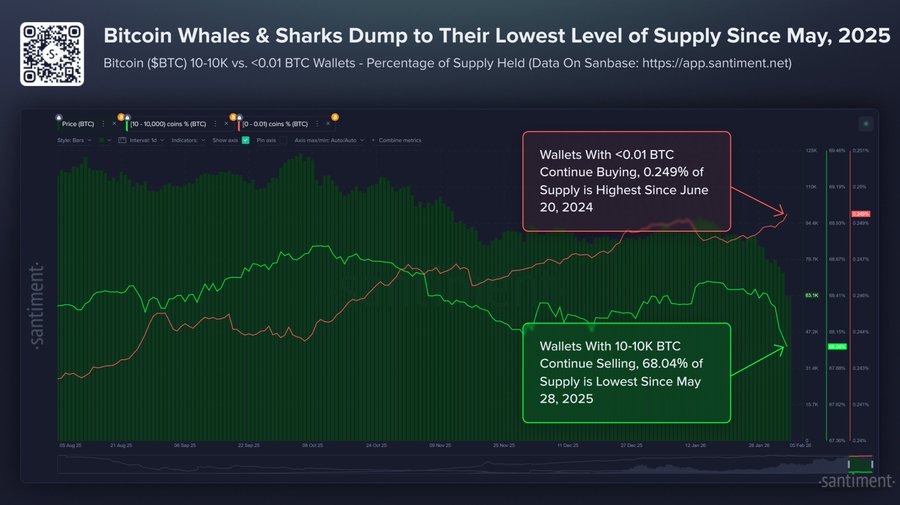

Meanwhile, selling is not limited to miners. Santiment data reveals that Bitcoin whales and large holders are also reducing positions.

Wallets holding between 10 and 10,000 BTC now control just 68.04% of total supply, a nine-month low. These large holders have sold about 81,068 BTC in the last eight days alone.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Marathon transferred $87 million in Bitcoin to institutional service platforms, which often indicates preparing for strategic sales, treasury management, or using holdings as collateral, but it retains over 52,850 BTC.

Many miners are selling because Bitcoin’s price near $65,000 is below the average mining cost of over $87,000, creating financial pressure to cover operational expenses despite potential losses.

After the recent transfer, Marathon Digital holds approximately 52,850 Bitcoin, valued around $3.42 billion, keeping it among the world’s largest corporate Bitcoin treasuries.

Yes, large holders (whales) are reducing positions; wallets holding 10-10,000 BTC now control a 9-month low of 68.04% of supply, selling over 81,000 BTC in just eight days.

Increased miner selling during a market dip can add short-term selling pressure and volatility, as it introduces more coins into the market when investor sentiment is already fragile.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.