After two consecutive days of experiencing huge sell-offs, Bitcoin ETFs finally saw an inflow of $241.00 million.

Ethereum ETFs saw a total outflow of $79.36 million, with Fidelity’s FETH leading with $33.26 million.

Bitcoin is trading at $111,766, signalling a 4.6% drop and Ethereum is priced at $4,011.92

On September 24, the US spot Bitcoin ETF saw a combined inflow of $241.00 million, while Ethereum ETFs continued their day 3 streak of outflow. It recorded a total net outflow of $79.36 million, as per the SoSoValue report.

Bitcoin ETF Breakdown

After two consecutive days of experiencing huge sell-offs, Bitcoin ETFs finally managed to record an inflow of $241.00 million. BlackRock IBIT led with $128.90 million, and Ark and 21Shares ARKB followed with $37.72 million.

Additional gains were made by Fidelity FBTC, Bitwise BITB, and Grayscale BTC of $29.70 million, $24.69 million, and $13.56 million, respectively. VanEck HODL also made a smaller addition of $6.42 million in inflows.

Despite the inflows, the total trading value of the Bitcoin ETF dropped to $2.58 billion, with total net assets $149.74 billion. This marks 6.62% of Bitcoin market cap, slightly higher than the previous day.

Ethereum ETF Breakdown

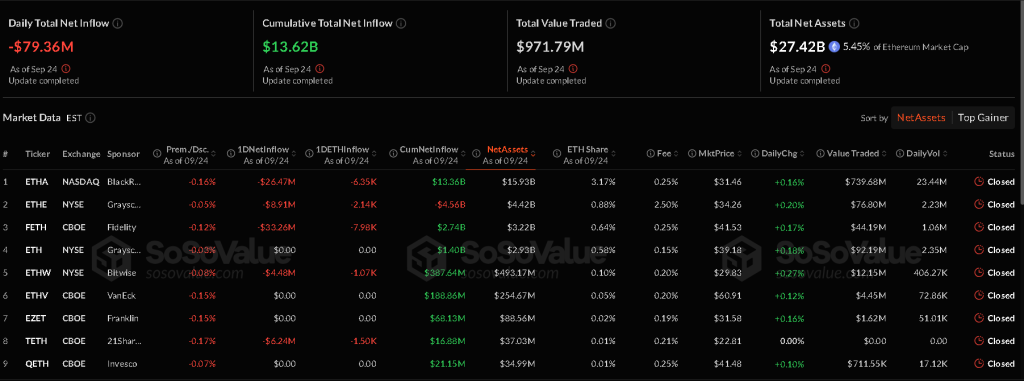

Ethereum ETFs saw a total outflow of $79.36 million, with Fidelity’s FETH leading with $33.26 million. BlackRock ETHA also experienced heavy selling pressure of $26.47 million, followed by Grayscale’s ETHE $8.91 million. 21Shares TETH and Bitwise ETHW also posted smaller withdrawals of $6.24 million and $4.48 million, respectively.

The total trading value of Ethereum ETFs dropped below a billion, reaching $971.79 million. Net assets came in at $27.42 billion, representing 5.45% of the Ethereum market cap.

Market Context

Bitcoin is trading at $111,766, signalling a 4.6% drop compared to a week ago. Its market cap has also dipped to $2.225 trillion. Its daily trading volume has reached $49.837 billion, showing mild progress there.

Ethereum is priced at $4,011.92, with a market cap of $483.822 billion, showing a sharp decline. Its trading volume has also slipped to $37.680 billion, reflecting a slow market.

Due to heavy outflow this week, Bitcoin and Ethereum’s prices are experiencing price swings. Crypto analysts from Bloomberg warn the market to brace for further volatility.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

On September 24, Bitcoin ETFs had a total trading value of $2.58 billion with $241 million in inflows. Ethereum ETFs saw a lower trading value of $971.79 million, with a total net outflow of $79.36 million.

BlackRock’s IBIT led Bitcoin ETF inflows with $128.90 million. For Ethereum ETFs, Fidelity’s FETH was the primary contributor to outflows, recording a $33.26 million withdrawal.

Prices are experiencing swings due to heavy outflows from ETFs this week, which impact market liquidity and investor sentiment, leading to increased volatility.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.