Bitcoin underperforms as Gold hits new highs

Peter Schiff warns Bitcoin’s decline against gold suggests BTC is in bear market

Analysts say that the bearish sentiments often signal a market reversal

Bitcoin has seen massive crashes lately, dropping below $112,000 levels. It has slipped over 9% from its all-time high of $124K just a month ago, raising concerns over its next move.

In contrast, gold has been rising to new all-time highs. Although Bitcoin is often compared to “digital gold,” critics are now questioning its role against the proven stability and strength of the gold.

Is Bitcoin In A Bear Market?

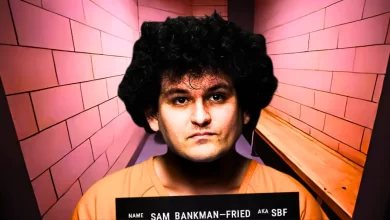

Known Bitcoin critic Peter Schiff took to X to argue that Bitcoin is not living up to its hype.

He notes that when priced in gold, BTC is down 20% from its August peak. That is a steeper decline than the 10% drop in dollar terms.

Since Bitcoin is marketed as digital gold, Schiff argues this comparison matters even more. If Bitcoin is losing ground to gold itself, he says, then the case for it as a safe-haven asset is weaker, and the market is already showing bearish conditions. The argument speaks for itself as BTC is down 4% over the past week.

Signs of Weakness in the Rally?

Cryptoquant analyst Darkfost notes that recent small pullbacks are starting to dent investor sentiment. Historically, markets often hit a low sentiment before reversing, offering opportunities for patient traders who go against the crowd. He notes that this shift is worth watching closely.

Social media sentiment also gives another hint about where Bitcoin might go next.

Santiment shows a wide split between predictions. Bearish calls are placing Bitcoin between $70K-$100K, while bullish forecasts are aiming much higher at $130K-$160K. Interestingly, Santiment notes that extreme bullish predictions come before short-term corrections, clearly suggesting that some turbulence could lie ahead for BTC.

How Low Could Bitcoin Go?

The debate now turns to how low Bitcoin might actually go if bearish momentum builds.

Expert Benjamin Cowen suggests Bitcoin could potentially drop 70% from its next all-time high. Previous cycles saw declines of 94%, 87%, and around 77%. While such a steep correction can never be guaranteed, historical patterns indicate that it remains a possibility worth considering.

Reasons to Stay Optimistic for Q4

Despite the bearish sentiment, BTC is up 4.15% over the last month, with just a week left. Historically when September ends in the green, the following months often continue the trend and Q4 may be gearing up for a strong run.

Michael Saylor recently explained that despite Bitcoin’s recent downward price action, the real driver now is corporate and institutional adoption.

This is putting upward pressure on Bitcoin’s price. As resistance and macro headwinds ease, he expects BTC to climb sharply again toward the end of the year.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin’s price is experiencing a pullback after reaching a new all-time high. This is influenced by factors like a stronger U.S. dollar, profit-taking by traders, and a shift in market sentiment.

Some critics, like Peter Schiff, argue that Bitcoin is showing signs of a bear market, especially when its performance is compared to gold. However, historically, such corrections are common and may not signal a full bear market.

While Bitcoin has pulled back, gold has risen to new all-time highs. Critics point to this to question Bitcoin’s role as a “digital gold,” highlighting gold’s proven stability during market uncertainty.

Despite short-term volatility, some experts remain optimistic. They cite increasing corporate and institutional adoption as a key driver that could push Bitcoin’s price higher toward the end of the year, particularly if market headwinds ease.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.