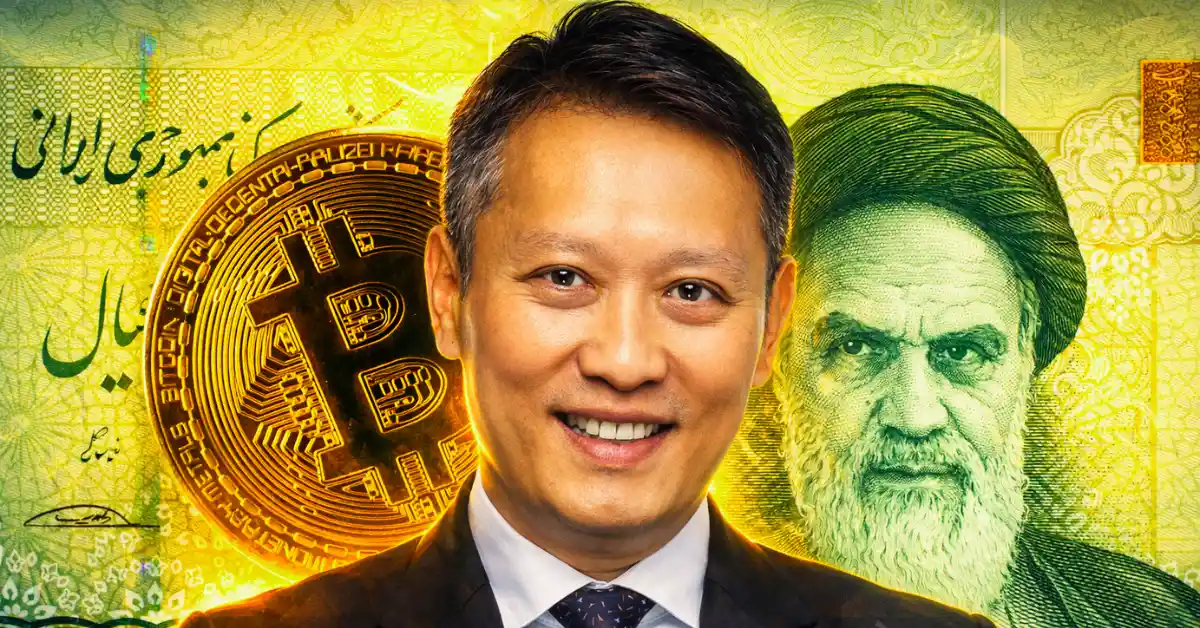

Crypto exchange Binance has denied claims that it processed more than $1 billion in transactions linked to Iranian entities. The company also rejected allegations that it fired employees who raised compliance concerns.

The accusations come from a February 13 investigative report. The report claimed Binance’s internal investigators flagged over $1 billion in transfers between March 2024 and August 2025. Most of the transactions reportedly involved Tether (USDT) on the Tron blockchain.

Report Alleges Internal Compliance Concerns

According to the report, several members of Binance’s compliance investigations team were dismissed after raising concerns internally. Some of these employees reportedly had law enforcement backgrounds.

The report also suggested that more compliance staff left the company in recent months. However, it did not clearly explain the reasons behind those departures.

Binance Responds: No Sanctions Breaches

Binance leadership has strongly denied the allegations.

Co-CEO Richard Teng said the company found no sanctions violations. He also stated that Binance did not fire investigators for raising compliance concerns.

In its official response, Binance said it conducted a detailed internal review with support from external legal counsel. The company said the review found no evidence of sanctions breaches linked to the reported transactions.

Binance added that it follows whistleblower protection laws across multiple jurisdictions. The company rejected claims that employees were punished for reporting compliance issues.

Binance’s $4.3 Billion Settlement

The controversy comes after Binance’s 2023 $4.3 billion settlement with U.S. authorities over anti-money laundering and sanctions violations.

Since that settlement, Binance has operated under tighter regulatory oversight. The company says it has improved its sanctions screening systems, transaction monitoring tools, and internal controls.

Because of this history, any new sanctions-related claims attract strong attention from regulators and investors.

Stablecoins and Regulatory Scrutiny

The case also highlights ongoing regulatory concerns around stablecoins, especially USDT transactions on the Tron network.

In the past, blockchain analytics firms have reported that sanctioned actors used stablecoins to move funds outside traditional financial systems. U.S. authorities, including the Office of Foreign Assets Control (OFAC), have sanctioned other crypto platforms over similar issues.

No New Enforcement Action Yet

So far, no new enforcement action has been announced against Binance. At this stage, the issue remains a dispute between investigative reporting and Binance’s public denial. The situation adds to ongoing discussions about compliance, transparency, and regulation in the global crypto industry.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.