Binance reportedly buying millions in Bitcoin, sparking debates over manipulation or internal liquidity moves.

Tom Lee fear a potential 50% Bitcoin correction despite strong ETF inflows and bullish sentiment.

Bitcoin faces key resistance at $112,000, with rejection possibly triggering a fall toward $108,000.

Bitcoin is once again sitting on a knife-edge. Despite reports of Binance buying millions worth of BTC, top crypto analysts are starting to raise red flags that a sharp 50% correction might be closer than most expect.

The price of BTC briefly crossed $111,000, but many traders fear this surge might be a trap, a setup before a major correction hits.

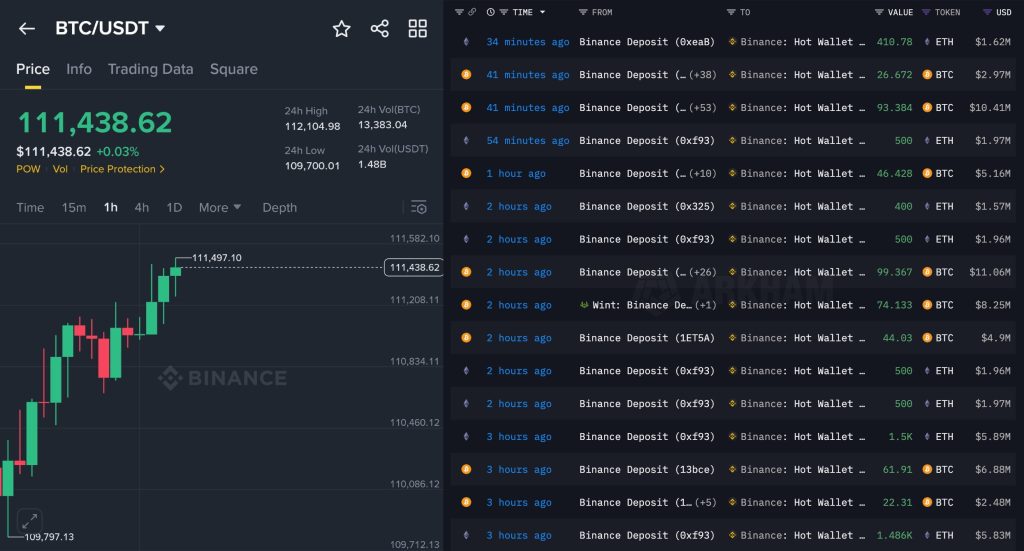

Binance Short Squeeze or Smart Accumulation?

Crypto trader CryptoNobler recently spotted unusual activity on Binance, the world’s largest exchange. He noted that Binance has been buying millions of dollars’ worth of Bitcoin, with some transactions exceeding 400 BTC.

Although on-chain data shows the same wallets repeatedly moving funds, a pattern often observed when exchanges manage internal liquidity or attempt to influence market moves.

Tom Lee Sees 50% Correction For BTC

Adding to the concern is long-time Bitcoin bull Tom Lee, co-founder of Fundstrat Global Advisors, who has cautioned investors about short-term risks.

In his latest interview, Lee said Bitcoin remains vulnerable to face the possibility of 50% price corrections, especially with its strong correlation to global stock market volatility.

Despite over $20 billion flowing into Bitcoin ETFs since early 2025, Lee believes such drawdowns are part of Bitcoin’s nature.

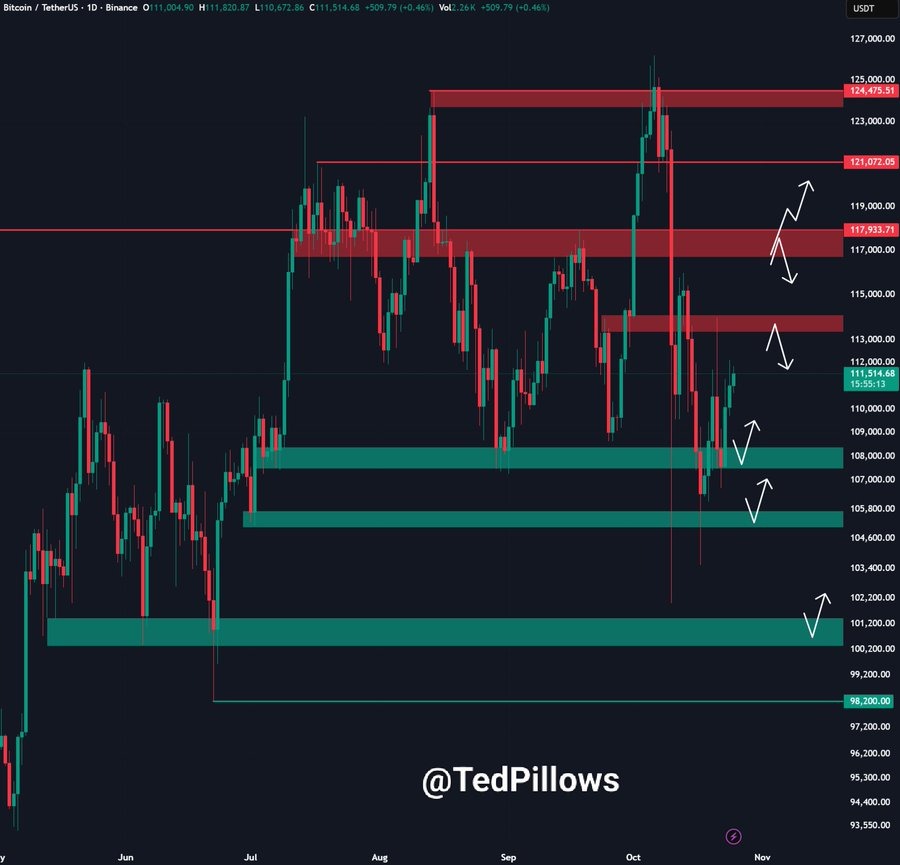

Bitcoin’s Key Level To Watch

Social media quickly filled with speculation. Well-known crypto analyst Ted pointed out that Bitcoin might have recently bounced from its $110,000 support level, but the next key test lies at $112,000.

“If Bitcoin gets rejected again, expect a sharp correction toward the $108,000–$110,000 range.”

A rejection from $112K could open the door for deeper downside, especially if Binance’s aggressive wallet movements turn out to be strategic liquidity plays rather than organic accumulation.

As of now, Bitcoin price is trading around $111,590, reflecting a slight jump seen in the last 24 hours.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.