$390M Liquidated Amid Iran-Israel-US Tensions: Will Bitcoin, XRP Survive a 24-Hour Crash Threat?

Trump pushes emergency peace talks with Iran amid rising tensions; crypto market reacts with price swings and heavy liquidations.

Bitcoin and XRP spike, then pull back as $394M in crypto liquidations hit; investors brace for volatility tied to geopolitical risks.

The cryptocurrency market is on edge again as global tensions keep rising. US President Donald Trump has announced a last-ditch effort to prevent an all-out war between Israel and Iran, which could impact global markets, including crypto.

According to reports, Trump is pushing for an emergency meeting with Iranian officials this week. He believes the decision to use powerful “bunker buster” bombs on Iran’s nuclear sites would be a turning point. Trump also cut his trip to the G7 Summit short to head back to Washington and focus on the crisis. In a bold statement, he even called for “everyone” to evacuate Tehran, Iran’s capital, though it’s unclear whether he meant US citizens or the city’s 14 million residents.

The crypto market, which saw a brief rally a few hours ago, has already started reacting. XRP led the jump with a 7% gain, while Bitcoin soared to $108,950 before pulling back. Bitcoin is now hovering slightly above the $107,000 mark.

- Also Read :

- Ripple vs SEC Lawsuit News: Deadline Ends, Appeals Suspended; Next Update on August 15

- ,

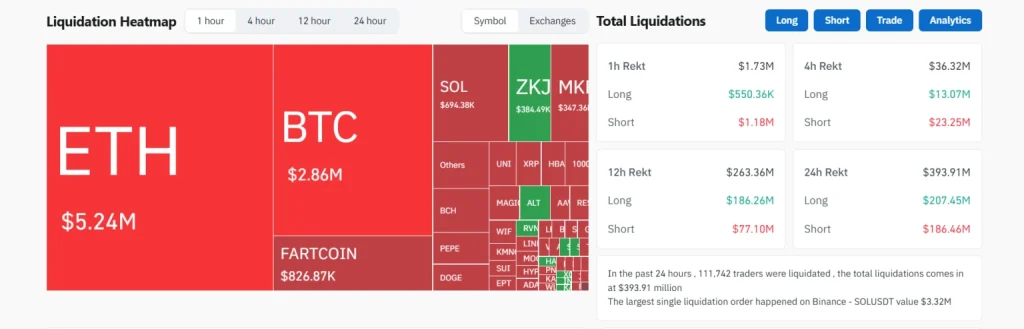

With the latest developments, it’s uncertain which way the market will move next. Experts are closely watching the news, as any escalation could trigger another major sell-off. Adding to the pressure, liquidations have begun across the market. In the past 24 hours alone, total liquidations reached a staggering $394.16 million, wiping out leveraged positions.

Last week, on Friday morning, crypto prices tumbled after Israel launched airstrikes against Iran, sending Bitcoin down to $103,000. For now, the crypto world waits to see if peace talks will ease tensions — or if another crash is coming in the next 24 hours.

The Kobeissi Letter wrote on X (formerly Twitter), “We continue to believe that a peace deal is on the horizon for this conflict. Markets are clearly pricing-in a short-lived conflict ahead. We are hopeful that an agreement can be reached as soon as this week.”

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Crypto is down today due to rising global tensions between Israel and Iran, triggering market uncertainty, liquidations, and a general risk-off sentiment.

Bitcoin briefly soared to $108,950 before pulling back to $107,000, while XRP saw an initial 7% jump. Both show market sensitivity to the news.

Experts are closely watching for peace talks to ease tensions, as continued escalation could trigger further major sell-offs and crashes in the crypto market. Sources

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.