Bitcoin experienced a significant price drop from its recent high of $99,500 to around $94,427.

While the price has decreased, trading volume has increased, suggesting continued market interest.

The market sentiment has cooled down, but the potential for further price movement, both upwards and downwards, remains uncertain.

Bitcoin has dropped below $95,000, catching the market off guard after hovering above $98,000 just a day ago. It briefly peaked near $99,500 before tumbling to $94,427, leaving traders wondering: is this the start of something more concerning?

This sudden drop comes amid heightened trading activity, stirring up speculation about Bitcoin’s next move. The stakes are high, and the market’s next steps could set the tone for the weeks ahead.

Let’s break down the factors driving this volatility and what could come next.

Bitcoin Price Drop Analysis

In just 24 hours, Bitcoin’s price fell by about 5%, sliding from its peak of $99,500 to its current level. Interestingly, trading volume jumped by 60.55% during this drop, indicating that buyers and sellers are still very active.

Some see this as a necessary price correction, possibly setting the stage for Bitcoin to make another attempt at climbing higher.

Key Levels to Watch

Bitcoin is now testing a critical resistance level at $95,750. Breaking past this point could push the price toward $96,000 or $97,350, with the potential to climb back to $98,880 or even aim for $100,000.

However, if Bitcoin fails to overcome $95,750, it could face further declines. Key support levels are at $93,000, $92,500, and $90,000. A fall below these thresholds might open the door to a deeper drop, possibly hitting $88,000.

Whales Are Betting Big

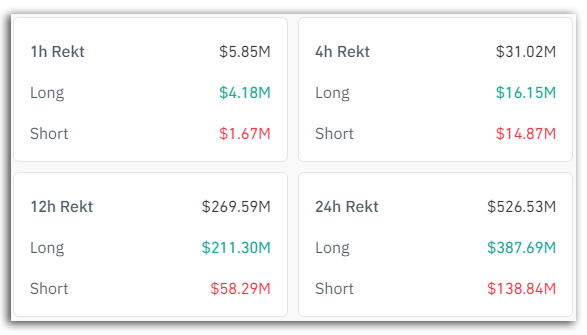

Bitcoin’s large investors, known as “whales,” are still making moves despite a total of $526 million in liquidations, including $300 million from long trades. Their ongoing activity suggests confidence in an imminent price shift, potentially driven by insights that the broader market hasn’t yet grasped.

Market sentiment has noticeably cooled. The Fear & Greed Index, which hit a high of 94 last week when Bitcoin approached $99,000, has now fallen to 79. Similarly, the Relative Strength Index (RSI) is at 41.70, signaling that Bitcoin is no longer in an overbought zone.

This could indicate that the market is pausing before its next big move.

Options Expiry Adds to Market Pressure

The market is also bracing for the expiry of $9.4 billion in Bitcoin options on Friday. These large-scale expirations often lead to increased volatility as traders reposition themselves. The psychological and technical impact of this event could play a significant role in shaping Bitcoin’s next steps.

What’s Next for Bitcoin?

The coming days are critical for Bitcoin. If it can break above the $95,750 resistance, it could regain bullish momentum, potentially heading toward $100,000. However, failure to do so might result in further declines toward lower support levels.

With increased whale activity, cooling sentiment, and the options expiry on the horizon, traders are closely watching for any signs of Bitcoin’s next move.

Whether it rebounds or continues to slide, the market is in for a decisive period.