By Jonatan Randin, Market Analyst at PrimeXBT

Back in the wild crypto bull market of 2017,conversations were filled with dreams of Bitcoin’s vast potential. Many speculated about how, one day, institutional investors would flood in and nations might even adopt Bitcoin, turning it into a truly mainstream asset.

Back then, these ideas felt distant, perhaps even unrealistic. Fast forward to today, and many of those early dreams have started to unfold. We’ve seen countries like El Salvador embrace Bitcoin, and in the US, fresh legislative moves are actively shaping the crypto landscape. What once felt like a far-off vision during the 2017 bull market is now part of our present reality. In parallel, leading multi-asset brokers like PrimeXBT, which offer Crypto Futures and Crypto CFDs, have evolved to give traders the tools to participate in this new era of digital assets.

So the question now is: as Bitcoin matures, will it continue climbing endlessly, or are we approaching a phase where it begins to stabilise and trade more like a traditional market asset?

Global Shifts in Bitcoin Adoption

In the years since those early speculations, the evolution has been remarkable. El Salvador took the lead by adopting Bitcoin as legal tender, and other nations have shown varying degrees of interest. The United States has even begun discussions about establishing a Strategic Bitcoin Reserve, while countries like Bhutan and Iran have integrated Bitcoin into their economic strategies in unique ways.

At the same time, the regulatory landscape has been maturing. The European Union’s MiCA regulation now offers a clear framework for crypto assets, while in the US, the approval of spot Bitcoin ETFs in early 2024 has made it easier than ever for mainstream investors to gain exposure.

Despite challenges in user experience and the fact that Bitcoin isn’t yet a daily payment method for the average person, institutional and state-level involvement is steadily growing. This suggests that ‘mainstream adoption’ might ultimately mean Bitcoin becomes a widely recognised, regulated asset rather than just a speculative instrument.

Bitcoin as a Global Standard

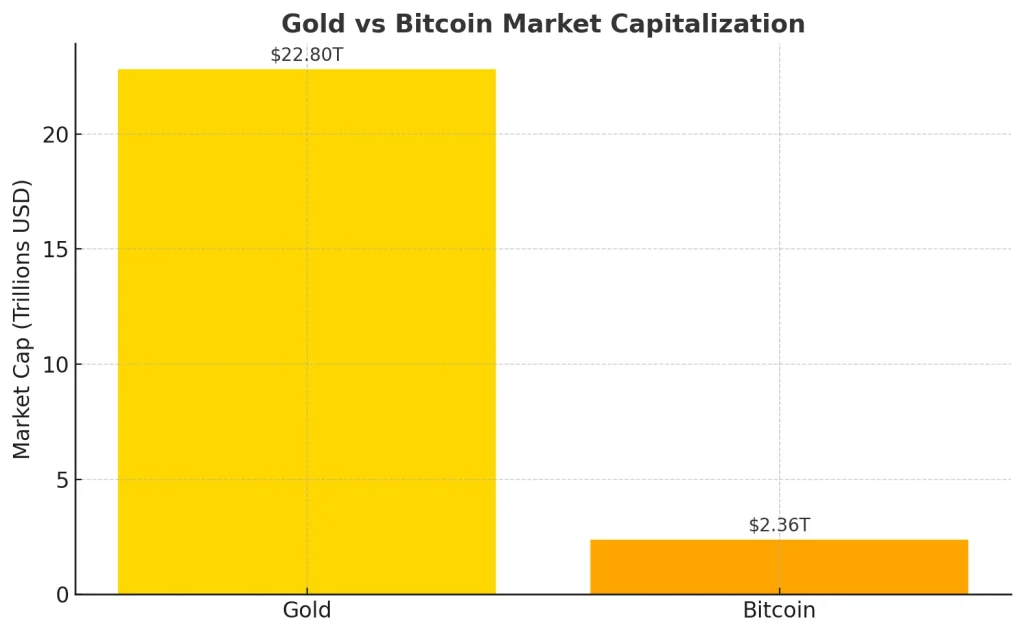

When thinking about Bitcoin’s future, analysts often compare it to gold. Many of them see Bitcoin as a digital equivalent, a modern, decentralised asset that could serve as a store of value just as gold has for centuries.

But it’s not just about market caps and price comparisons, it’s about what each asset represents. Gold has long been valued for its beauty, industrial uses, and ability to store value across centuries. Bitcoin, on the other hand, is entirely digital and decentralised, which gives it unique advantages in our interconnected world.

In a time when geopolitical risks and monetary policy changes can spark uncertainty, Bitcoin and gold both share the advantage of not being issued by any single government. What sets Bitcoin apart, however, is its ability to serve as a digital settlement layer that can be transferred globally in minutes without intermediaries. Unlike a US dollar-pegged stablecoin, which still requires trust in a central authority, Bitcoin operates on a borderless, peer-to-peer network.

For advocates of Bitcoin, this is the real case, not replacing gold’s physical utility, but creating a new type of global reserve asset that underpins cross-border transactions in a decentralised, trustless way.

The Rise of Institutional and Governmental Adoption

Institutional and government interest is no longer theoretical, it’s happening right now. El Salvador has set the example, and other countries are exploring similar paths. Major institutions, from hedge funds to publicly traded companies, are adding Bitcoin to their balance sheets, signalling a genuine shift toward mainstream financial acceptance.

Every time a government introduces a Bitcoin-friendly regulation or an institution adds it to their holdings, the foundation for a larger and more stable Bitcoin ecosystem strengthens. This convergence of technical potential, regulatory clarity, and institutional confidence could be what eventually drives Bitcoin to market caps we once thought were out of reach.

Charting the Path to Gold’s Market Cap

The chart used here overlays Bitcoin’s price history with a logarithmic regression model, highlighting key halving events and a hypothetical price target if Bitcoin were to reach a market cap similar to gold’s.

Since 2012, Bitcoin has followed a gradually tightening growth curve, with each halving marking the start of a new expansion phase. The upper projection band in this model points toward potential price ranges well above $300,000 in a mature adoption phase.

This visual supports the broader narrative being outlined, Bitcoin’s progression from a niche speculative asset to a regulated, institutionally integrated store of value. If current adoption trends continue, Bitcoin could eventually move into a more stable but still upward-trending phase, standing alongside gold as a global standard for value preservation.

Trading Bitcoin with PrimeXBT

For traders looking to participate in Bitcoin’s evolving market, PrimeXBT offers a crypto trading environment built for precision, flexibility, and control. With leverage of up to 1:500 on Bitcoin and up to 1:400 on Ethereum, and competitive conditions across a wide range of altcoins, the broker caters to diverse strategies. Available on both PXTrader and MT5, these features are backed by advanced risk management tools, institutional-grade execution, and a client-first approach. As part of its empowering traders philosophy, PrimeXBT combines deep liquidity, fair trading conditions, and a transparent fee structure, giving traders the tools they need to navigate and act on the next chapter of Bitcoin’s story.

Start trading with PrimeXBT

Disclaimer: The content provided here is for informational purposes only and is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results. The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money. The Company does not accept clients from the Restricted Jurisdictions as indicated on its website / T&Cs. Some products and services, including MT5, may not be available in your jurisdiction. The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.