While new ETFs experienced massive inflows, Grayscale's existing ETHE ETF faced significant outflows.

Grayscale's ETHE ETF is losing billions due to high fees and lack of discounts, driving investors to the new, cheaper ETFs.

The massive shift of funds between ETFs has caused selling pressure on Ethereum, contributing to its price drop.

The much-anticipated debut of US spot Ethereum exchange-traded funds (ETFs) has taken an unexpected turn. After the SEC’s approval, eight out of nine ETFs began trading on Tuesday. While one ETF attracted significant inflows, Grayscale’s converted fund, ETHE, experienced substantial outflows.

Let’s delve into why Grayscale, a prominent management firm, is facing such an issue today. After all, what’s driving this dramatic shift?

It’s Been An Unusual Beginning

On July 23, US ETH ETFs began trading, with all eight funds drawing in over $1 billion on the first day. In contrast, Grayscale’s ETHE ticker, which had been trading on the OTC market, saw immediate and heavy outflows. Grayscale’s Ethereum Trust, launched as a private placement in 2017 and publicly traded on OTC markets since 2019, introduced an ETF under the ETHE ticker on the NYSE on July 23.

Despite the new ETFs enjoying substantial inflows, Grayscale’s existing ETF suffered $1.16 billion in outflows over the past three days.

How High Fees Impacts the Game

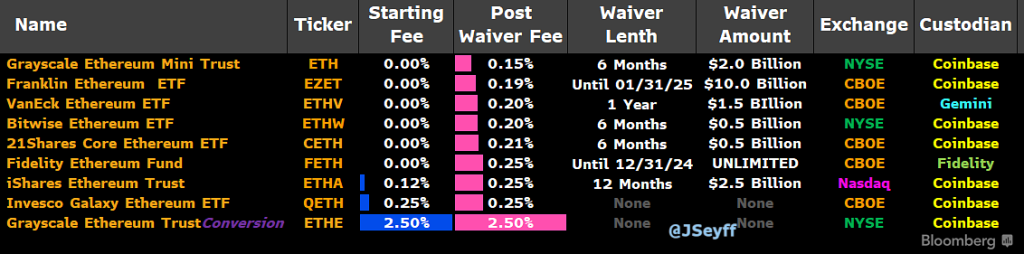

Experts warn that if these outflows continue at the current rate, ETHE could run out of Ethereum in less than a month. A major factor behind this trend is ETHE’s high fee of 2.5%, compared to Grayscale’s new mini trust ETH ETF, which offers the lowest fee among the new ETFs at 0.15%.

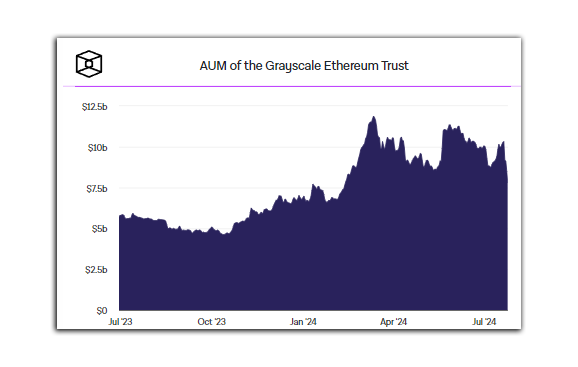

Over the past three days, Grayscale’s new ETF recorded inflows of $119.1 million. Coupled with a 7% drop in Ethereum’s price, the value of assets under Grayscale’s management fell from $10 billion to $7.5 billion in the same period.

What Investors Are Choosing

Currently, Grayscale is seeing a net daily outflow of about $385 million. If this trend continues, ETHE could be emptied of all its Ethereum within a month. Another reason for the outflow is that the older ETF, ETHE, no longer offers discounts and has high fees. As a result, investors are choosing to exit the older ETF in favor of the newer, more cost-effective options.

Alongside Grayscale, five other ETF issuers use Coinbase as their custodian, while VanEck uses Gemini, and Fidelity self-custodies its Ethereum. In the first two days, Coinbase saw an inflow of about 160,930 ETH. However, due to ETHE’s outflows, $811 million worth of funds exited Coinbase. The influx of 113,119 ETH into Coinbase created selling pressure in the market, contributing to the observed drop in Ethereum’s price.

A Classic Case of “Sell the News”

Analyzing these factors, it appears that the Ethereum ETF launch has turned into a classic “sell the news” scenario. Investors are seeking better returns, leading to heavy outflows from Grayscale’s ETHE. Conversely, all the new ETH ETFs, including Grayscale’s mini trust, are seeing significant inflows. The current situation suggests that Grayscale will continue to endure heavy outflows from its older ETF, maintaining selling pressure on Ethereum.

Let’s discuss: Is Grayscale’s high fee structure the main culprit behind the outflows?