Learn the difference between centralized, decentralized, and hybrid exchanges, each offering unique features for different traders.

Protect your funds with secure storage options like cold wallets and always use strong passwords and 2FA.

Avoid common beginner mistakes like FOMO, overtrading, and ignoring fees to make smarter, more profitable moves in the crypto market.

Say you’re sitting at a coffee shop, sipping your latte, and you overhear someone talking about Bitcoin.

They mention something about “buying it on an exchange.” Suddenly, your curiosity kicks in.

What’s a cryptocurrency exchange? Is it like a stock market? Or more like a currency exchange at the airport?

Don’t worry—by the end of this guide, you’ll not only know the answer but also feel confident navigating the world of crypto exchanges.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is like an online marketplace. Here, people buy, sell, and trade cryptocurrencies, just like you’d trade baseball cards or buy a used bike on eBay. These exchanges connect buyers and sellers, allowing you to exchange one digital asset (like Bitcoin) for another (like Ethereum) or even for traditional money (like dollars or euros).

Some exchanges cater to beginners, making it easy to get started. Others are designed for advanced traders, packed with charts and tools that can feel overwhelming. So, where do you start?

Types of Cryptocurrency Exchanges

There are three main types of crypto exchanges:

- Centralized Exchanges (CEXs)

- Think of these like traditional banks. They’re run by companies that oversee the platform and its transactions.

- Examples: Coinbase, Binance, Kraken.

- Pros: User-friendly, high liquidity, customer support.

- Cons: You’re trusting a company with your funds, and they’re targets for hackers.

- Decentralized Exchanges (DEXs)

- These run without a central authority, relying on blockchain technology to process transactions.

- Examples: Uniswap, PancakeSwap, SushiSwap.

- Pros: More privacy, you’re in full control of your funds.

- Cons: Can be tricky for beginners, lower liquidity.

- Hybrid Exchanges

How to Choose the Right Exchange for You?

When picking an exchange, ask yourself:

What’s My Goal?

Are you just starting and need something simple? Or are you ready to trade like a pro?

Is It Safe?

Look for exchanges with strong security features like two-factor authentication (2FA) and cold storage.

What Are the Fees?

Fees can sneak up on you. Some exchanges charge for deposits, withdrawals, and every trade you make.

Does It Support My Country and Currency?

Not all exchanges work in every country or support your local currency.

What Coins Are Available?

If you want to buy a specific cryptocurrency, make sure the exchange offers it.

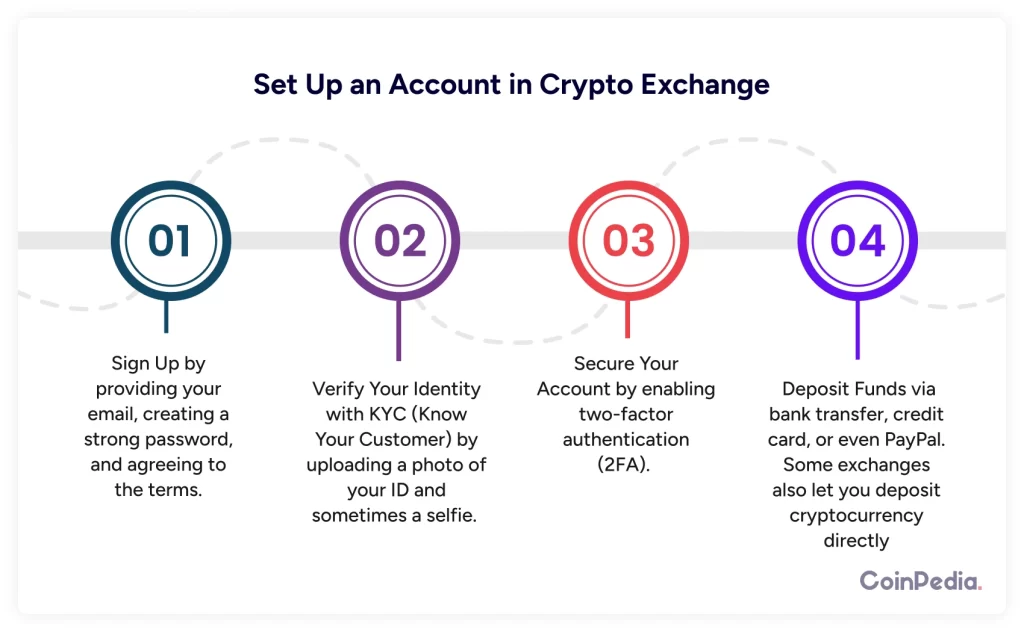

Setting Up Your Account

Once you’ve chosen an exchange, it’s time to set up your account. Here’s how:

- Sign Up

- Provide your email, create a strong password, and agree to the terms.

- Verify Your Identity

- Most centralized exchanges require KYC (Know Your Customer) verification. This means uploading a photo of your ID and sometimes a selfie. It might feel intrusive, but it’s for security.

- Secure Your Account

- Enable two-factor authentication (2FA). This adds an extra layer of protection by requiring a code from your phone whenever you log in.

- Deposit Funds

- You can usually deposit traditional money via bank transfer, credit card, or even PayPal. Some exchanges also let you deposit cryptocurrency directly.

Understanding Fees

Fees can feel like hidden traps if you’re not careful. Here’s what to watch for:

- Trading Fees

- Every time you buy or sell, the exchange takes a small percentage. This can range from 0.1% to 1% per trade.

- Deposit and Withdrawal Fees

- Depositing money is often free, but withdrawing it might cost you. Crypto withdrawals also come with network fees.

- Hidden Fees

- Some exchanges charge higher fees if you’re using a credit card. Always read the fine print.

Making Your First Trade

Trading on an exchange might seem intimidating, but it’s simpler than it looks. Here’s a quick walkthrough:

- Decide What to Buy

- Research the coin you want. Is it Bitcoin, Ethereum, or something else?

- Place an Order

- Exchanges offer two main types of orders:

- Market Order: Buys or sells immediately at the current price.

- Limit Order: Sets a specific price at which you want to buy or sell.

- Exchanges offer two main types of orders:

- Review and Confirm

- Double-check everything. Once you hit confirm, the trade is done.

Storing Your Cryptocurrency

Here’s a pro tip:

Exchanges aren’t the safest place to store your crypto long-term. Why?

Because if the exchange gets hacked, you could lose your funds. Instead, consider:

- Hot Wallets

- Connected to the internet, these are great for quick access but less secure.

- Examples: Mobile wallets, desktop wallets.

- Cold Wallets

- Offline storage, like USB drives or hardware wallets. These are super secure but less convenient.

- Examples: Ledger, Trezor.

- Paper Wallets

- A printed version of your private keys. Just don’t lose it or spill coffee on it!

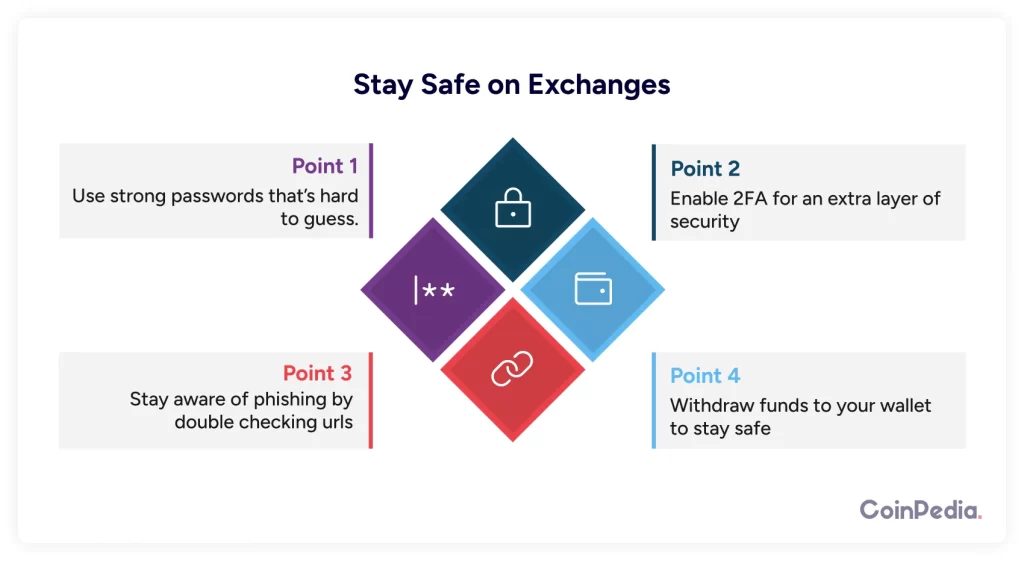

Staying Safe on Exchanges

The crypto world can be risky if you’re not careful. Here are some tips:

- Use Strong Passwords

- Make it unique and hard to guess. Avoid using the same password for multiple accounts.

- Enable 2FA

- Always. No excuses.

- Beware of Phishing

- Double-check URLs and avoid clicking on suspicious links. Scammers are everywhere.

- Withdraw Funds to Your Wallet

- Don’t leave large amounts of crypto sitting on an exchange.

Common Beginner Mistakes

- FOMO (Fear of Missing Out)

- Don’t buy a coin just because everyone else is. Do your research.

- Ignoring Fees

- Those small fees add up over time.

- Sending Crypto to the Wrong Address

- Double-check addresses before hitting send. Crypto transactions are irreversible.

- Overtrading

- Trading too often can eat into your profits. Sometimes, patience pays.

The Future of Crypto Exchanges

The world of crypto is evolving fast. New exchanges, features, and technologies pop up all the time.

Keep an eye out for:

- Better Security

- As exchanges get smarter, so do hackers. Expect more innovations to protect your funds.

- More Accessibility

- Exchanges are becoming easier to use, with better mobile apps and simpler interfaces.

- Integration with Traditional Finance

- The line between traditional finance and crypto is blurring. You might soon see crypto accounts linked directly to your bank.

So, what next?

Starting your journey into cryptocurrency exchanges can feel overwhelming. But with the right knowledge and tools, it’s manageable. Remember, take your time, do your research, and don’t rush into anything.

So, are you ready to take your first step into the crypto world? Choose an exchange, set up your account, and start exploring. The future of finance is at your fingertips.

FAQs

A crypto exchange is an online platform where you can buy, sell, and trade cryptocurrencies like Bitcoin and Ethereum.

There are three types: centralized (CEX), decentralized (DEX), and hybrid exchanges, each with unique features and benefits.

Consider factors like fees, security, supported coins, ease of use, and whether it works with your local currency.

We'd Love to Hear Your Thoughts on This Article!

Was this writing helpful?

Yes

Yes  No

No

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.