Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go?

Story Highlights

- Bitcoin is currently trading at: $ 90,177.73304091

- Predictions suggest BTC could reach $175K in 2025.

- Long-term forecasts estimate BTC prices could hit $900K by 2030.

The Bitcoin price prediction for 2025 is becoming aggressively bullish as in the year’s second half, July, a new ATH has been marked, smashing previous all-time highs of $112K.

As a wave of bullish momentum sweeps into the market, investors and traders are intrigued by its next stop, as it has entered a price discovery mode.

This optimism has been directly fueled by massive inflows into spot Bitcoin ETFs, skyrocketing institutional adoption, much clearer regulations, and unwavering political support from figures like President Trump.

It’s now seen as “a hedge against inflation” more than ever, and the cryptocurrency is capturing global attention. Major players like MicroStrategy, Metaplanet, Trump Media, and several other entities are boldly adding BTC to their balance sheets, signaling unshakable adoption and confidence in its future.

With the Federal Reserve hinting at future rate cuts and market enthusiasm at a fever pitch, investors are buzzing with questions: “Can Bitcoin sustain its meteoric rise?” and “Will it redefine the financial landscape in the next five years?” This Bitcoin price prediction dives deep into the trends driving this historic rally. Read on for the full scoop.

The BTC price may range between $89,586.98 and $92,099.35 today.

Table of Contents

- Story Highlights

- CoinPedia’s Bitcoin (BTC) Price Prediction

- Bitcoin Price Analysis 2025

- Bitcoin Price Prediction December 2025

- Bitcoin AI Price Prediction For December 2025

- Bitcoin Price Prediction 2025: Onchain Outlook

- Bitcoin Crypto Price Prediction 2026 – 2030

- Bitcoin Prediction: Analysts and Influencers’ BTC Price Target

- FAQs

Bitcoin Price Today

| Cryptocurrency | Bitcoin |

| Token | BTC |

| Price | $90,177.7330 |

| Market Cap | $ 1,800,109,871,415.97 |

| 24h Volume | $ 64,309,434,111.3374 |

| Circulating Supply | 19,961,800.00 |

| Total Supply | 19,961,800.00 |

| All-Time High | $ 126,198.0696 on 06 October 2025 |

| All-Time Low | $ 0.0486 on 14 July 2010 |

CoinPedia’s Bitcoin (BTC) Price Prediction

Firstly, at CoinPedia, we feel optimistic about Bitcoin’s price increase. Hence, we expect the BTC price to create a 2025 high of ~$168,000.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $71,827.81 | $119,713.02 | $167,598.22 |

Bitcoin Price Analysis 2025

The Bitcoin price performance observed since 2024 has demonstrated an upward trend within a defined upward channel. However, the initial swing low was reached in 2023 at around the $16,000 area.

Since then, a bull market began that reached 2021’s high around $70,000 by early 2024, with a decent pullback rally that continued flipping this high and reached $108,000 in early 2025, and Q3 of 2025 marked an ATH of $126,296.

This advancement marked a huge 675% surge in 1008 days when it reached ATH, but this price action of multi-year was happening inside a broadening ascending wedge. And Q4 2025 is seeing a decline from the upper border of this reliable old pattern.

Even the two-year parallel ascending channel has also confirmed a breakdown from the lower border, suggesting a significant decline is forthcoming.

Since the price action doesn’t fall straight, the year is also about to conclude next month. So, bulls are trying to show a little fight, even FOMC news didn’t generate any momentum. It appears that bears are still influencing BTC’s price action. The current zone of $90K is key; losing it here will let BTC slide back to $80K, and if this fails too. Then the $70K to $75K range would be retested next, where a demand could arise that might trigger a rebound, and the rally could extend to new highs as well.

However, if bulls fail to present a proper fight around the $70,000 to $75,000 support area, then the BTC will fall further, as it could trigger a price action that traps long buyers, potentially leading to a decline towards $53,489 in the first half of next year.

Bitcoin Price Prediction December 2025

The Bitcoin price forecast December 2025 suggests that this month will play a pivotal role in determining the future direction of BTC. As we in the final days of fourth quarter, Bitcoin has experienced a decline, dropping below the $100K mark to a low of $80,600, prompting investors to be more cautious. At the start of December, Bitcoin faced resistance at $ 94,000, but a slight uptick has only intensified concerns among investors.

Currently, the price is stabilizing within the $ 89,000 to $ 90,000 support range. Even the FOMC meeting on the 10th failed to spark any significant movement. There’s still a lack of new demand in driving price action, indicating that investors remain wary or are anticipating further price corrections.

It’s possible that the price could dip even lower, presenting an opportunity for investors to buy at more favorable levels. While the recent positive price movement might appear encouraging, but it seems temporary, as the bears may soon take full control of the market.

| Month | Potential Low | Potential Average | Potential High |

| December 2025 | $80,000-$95,000 | $100,000 – $108,000 | $115,000 – $118,000 |

Bitcoin AI Price Prediction For December 2025

| Source / Platform | Low Price (USD) | Average Price (USD) | High Price (USD) |

| Gemini (AI-assisted) | $110,000 – $125,000 | $130,000 – $150,000 | $160,000 – $180,000+ |

| ChatGPT (OpenAI) | $92,000 | $117,000 | $138,000 |

| BlackBox AI | $100,000 | $125,000 | $150,000 |

Bitcoin Price Prediction 2025: Onchain Outlook

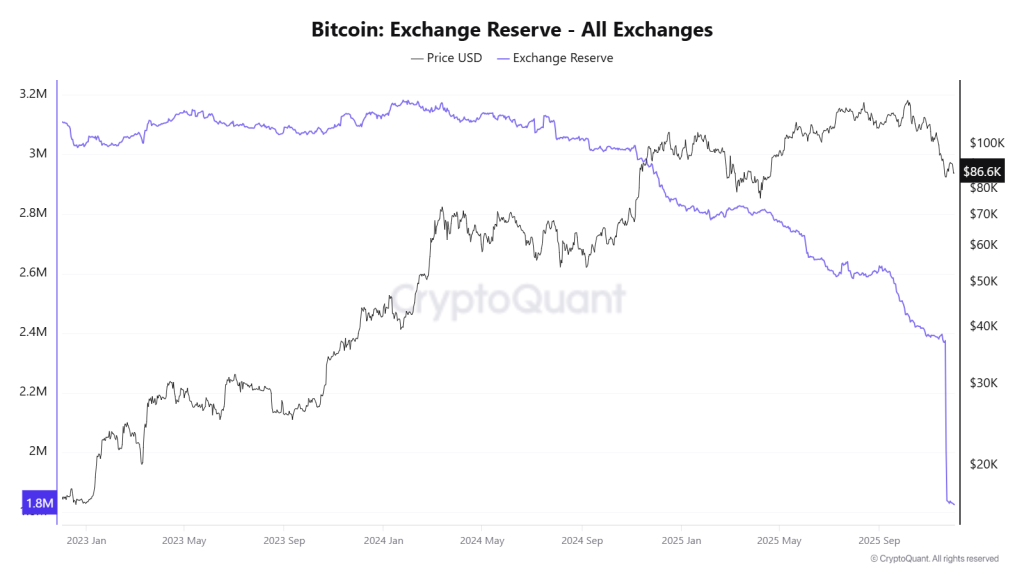

The on-chain data has showed strong accumulation in 2025 and sustained declines in exchange reserves. Crucially, this confirms the elevated institutional commitment, which is evident even in the US Spot ETFs data figures and the corporate adoption also reinforces this trend, with public company holdings nearly doubling since the start of the year.

Ultimately, a Bitcoin price prediction 2025 suggests that the future potential depends strictly on how sustained buying demand remains, as well as geopolitical stability and regulatory clarity.

If the current bullish sentiment persists, the BTC price is expected to reach a cycle high target of $150,000. Conversely, should global uncertainty intensify and sentiment turn negative, the downside risk is projected to find strong support around the $70,000 mark.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $70K | $120K | $175K |

Also Read: What is Bitcoin? An In-Depth Guide To The King Of Digital Currencies

Bitcoin Crypto Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| BTC Price Forecast 2026 | 150K | 200K | 230K |

| BTC Price Prediction 2027 | 170K | 250K | 330K |

| Bitcoin Predictions 2028 | 200K | 350K | 450K |

| BTC Price 2029 | 275K | 500K | 640K |

| Bitcoin Price Prediction 2030 | 380K | 750K | 900K |

BTC Price Forecast 2026

The BTC price range in 2026 is expected to be between $150K and $230K.

BTC Price Prediction 2027

Subsequently, the Bitcoin price range can be between $170K to $330K during the year 2027.

Bitcoin Predictions 2028

With the next Bitcoin halving, the price will see another bullish spark in 2028. Specifically, as per our Bitcoin Price Prediction, the potential BTC price range in 2028 is $200K to $450K.

BTC Price 2029

Thereafter, the BTC price for the year 2029 could range between $275K and $640K.

Bitcoin Price Prediction 2030

Finally, in 2030, the price of Bitcoin is predicted to maintain a positive trend. Indeed, the BTC price is expected to reach a new all-time high, ranging between $380K and $900K.

Bitcoin Price Prediction 2031, 2032, 2033, 2040, 2050

Based on the historic market sentiments and trend analysis of the largest cryptocurrency by market capitalization, here are the possible Bitcoin price targets for the longer time frames.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | $540,830.43 | $901,383.47 | $1,261,936.86 |

| 2032 | $757,162.60 | $1,261,936.86 | $1,766,711.60 |

| 2033 | $1,059,945.80 | $1,766,711.60 | $2,473,477.75 |

| 2040 | $5,799,454.28 | $9,665,757.13 | $13,532,059.98 |

| 2050 | $161,978,188.65 | $269,963,647.74 | $377,949,106.84 |

Bitcoin Prediction: Analysts and Influencers’ BTC Price Target

| Firm Name | 2025 |

| Standard Chartered | $200K |

| VanECk | $180K |

| 10x Reserach | $122K |

| Fundstrat | $250K |

| Blackrock | $700K |

- As per the Bitcoin price forecast by Blockware Solutions, the price of 1 BTC could hit $400,000

- Cathie Wood predicts the price of BTC to achieve the $3.8 million mark by 2030.

- Michael Saylor-led MicroStrategy expects Bitcoin to soar beyond $13 million by 2045.

- ARK Invest has increased its bullish BTC price target to $2.4 million by 2030.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Most forecasts expect Bitcoin to stay bullish in 2025, with potential highs around $175K if strong demand, ETF inflows, and adoption continue.

While some long-term forecasts are extremely bullish, reaching $1 million by 2030 is speculative. Current credible estimates suggest a potential high around $900,000 by 2030.

Yes, Bitcoin is increasingly viewed as a digital inflation hedge. Its fixed supply contrasts with expanding fiat currencies, attracting investors seeking to preserve purchasing power.

Bitcoin could trade significantly higher in 10 years, with some forecasts expecting it to reach several hundred thousand dollars if adoption keeps growing.

Disclaimer and Risk Warning

The price predictions in this article are based on the author's personal analysis and opinions. CoinPedia does not endorse or guarantee these views. Investors should conduct independent research before making any financial decisions.