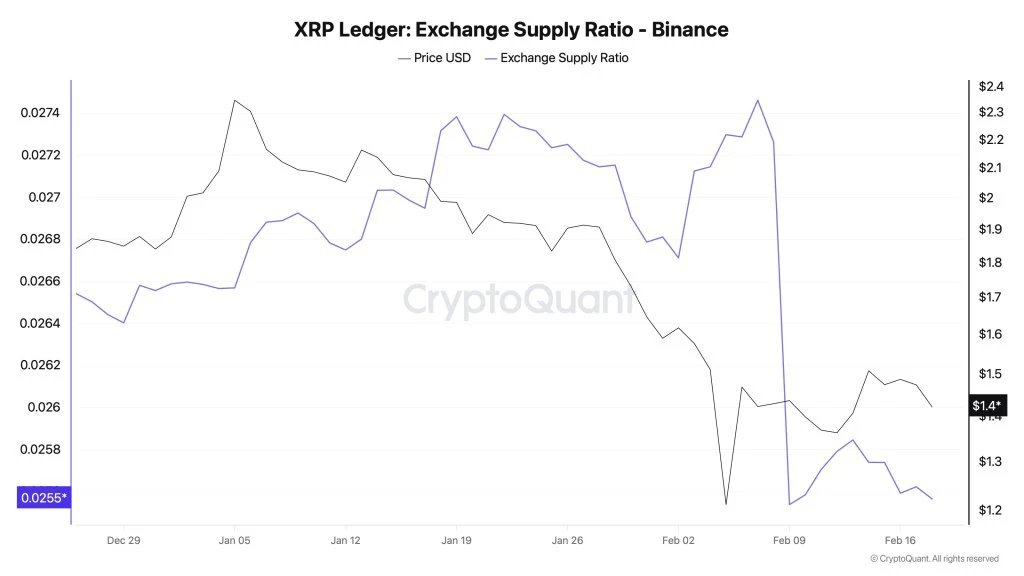

200M XRP left Binance, exchange supply ratio drops to 0.025, signaling accumulation. Price support at $1.19–$1.36 key for next move.

XRP sees rising sentiment and lower sell pressure as tokens leave exchanges; bulls eye $1.67 for breakout, support holds near $1.19–$1.36.

XRP is flashing an interesting signal. Over the past 10 days, around 200 million XRP have left Binance. At the same time, the exchange supply ratio has fallen from 0.027 to 0.025, according to market data. In simple terms, a smaller share of the total XRP supply is now sitting on Binance.

That usually means one thing: fewer tokens are immediately available to sell.

What the Chart Is Showing

Looking at the chart, the exchange supply ratio (purple line) trends downward sharply in early February. This drop happens after XRP went through a heavy 40 percent year-to-date correction.

At the same time, price (black line) also pulled back from recent highs. The combination of falling exchange supply and a corrected price often suggests that some investors are moving coins off exchanges into private wallets. That behavior is commonly linked to accumulation rather than short-term trading.

It does not guarantee a rally, but historically, declining exchange balances can reduce immediate sell pressure.

Market Sentiment Is Split

The broader crypto market has struggled to regain momentum. Social data shows that bullish comments around Bitcoin and Ethereum have dropped compared to last week.

Interestingly, XRP stands out. Sentiment around XRP has climbed to a five-week high. This shift appears to be driven by recent partnership expansion announcements and growing optimism within the XRP community. While Bitcoin and Ethereum sentiment cools, XRP discussions are heating up.

That contrast is worth watching.

XRP Price Update: Key Levels to Watch

From a technical point of view, XRP recently bounced strongly from its February 6 low, climbing roughly 30 to 35 percent. However, the rebound lacked strong continuation.

Price failed to break above a resistance zone formed earlier in February and is now drifting back toward its main support area between $1.19 and $1.36.

Here is what matters now:

- XRP is holding above this support zone for the moment.

- If the price drops below $1.19 to $1.20, the risk of a deeper move increases, potentially opening the door to sub-$1 levels.

- For bulls to regain control, XRP needs a strong upward reaction from this support and eventually a break above $1.67, which marks the recent swing high.

The recent rallies have mostly formed three-wave structures, which are typically weaker and more corrective in nature. A stronger five-wave style breakout would be needed to confirm a more durable trend shift.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Large amounts of XRP moving off Binance usually signals investors are transferring tokens to private wallets for long-term holding, which reduces the supply available for immediate selling.

Yes, a falling exchange supply ratio is often seen as bullish because it suggests there are fewer coins available to trade, which can potentially reduce selling pressure if demand remains steady.

For bulls to regain control and confirm a trend reversal, XRP needs to break above the recent swing high of $1.67 after holding its current support zone.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.