Ripple’s XRP is making waves in the crypto world with the launch of a brand new feature: Automated Market Makers (AMMs). This is a big deal for the platform, but is it all smooth sailing? Experts are urging caution alongside the excitement.

Dive deeper to learn what AMMs mean for XRP and how to navigate potential risks.

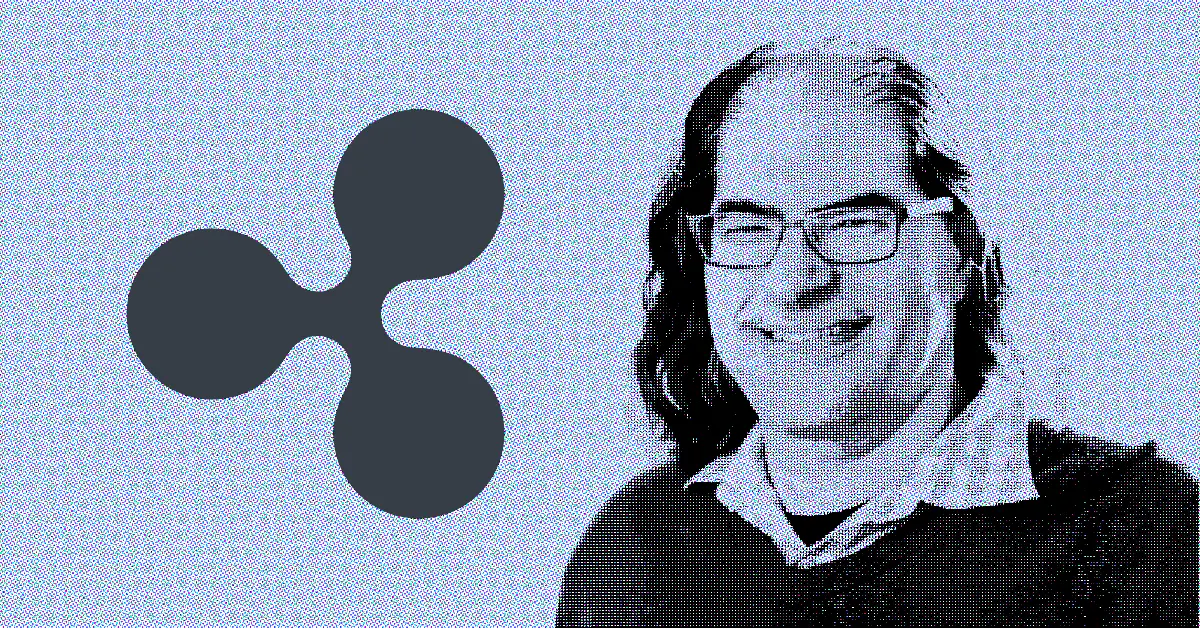

In the midst of this milestone, David Schwartz, Ripple’s Chief Technical Officer (CTO), has taken to various platforms to caution cryptocurrency enthusiasts about potential risks associated with AMMs.

In a recent tweet, Schwartz highlighted the dangers of single-sided deposits in AMMs, especially when the deposited funds are smaller than the actual investment size.

He explained that such deposits could lead to losses of stored cash within the system, often indicated by a phenomenon called “slippage,” as shown by the storage tool.

Furthermore, Schwartz emphasized the risks of investing in heavily involved pre-investment AMMs, suggesting that such incidents should not be taken lightly as they represent missed opportunities for all parties involved.

He also pointed out a potential solution for users in such situations, where they can possibly recover their investment by unilaterally placing an asset that lacks a pool.

Also Read: Ripple vs. SEC: Sealed Brief Set for Public Release, Timelines Revealed

Schwartz strongly advised users to prioritize safety and explore alternative storage methods if they encounter significant downturns. He recommended that in the realm of AMM trading, equal amounts should be invested in both assets to mitigate risks.

However, he clarified that single-sided deposits in reasonably liquid AMMs should generally be safe. As AMM pools expand and trading activity continues to surge, Schwartz anticipates a decrease in associated risks. He envisions pools becoming more adept at balancing out, resulting in increased liquidity over time.

Schwartz’s warnings serve as a timely reminder for cryptocurrency users to meticulously assess AMM fees and balances before diving into investments.

Also Check Out The: Ripple CEO Slams SEC, Warns Ethereum Battle Threatens USA Crypto Dominance

Story Highlights Solana Price Today is . Solana coin price could reach a potential high…

The Supreme Court of India has made it clear that cryptocurrency should be regulated, not…

As the crypto markets gain momentum, the AAVE price, which was in the middle of…

Story Highlights Binance Coin Price Today is . The BNB price prediction anticipates a potential…

Story Highlights The Ethereum price today is . ETH price with a potential surge could…

Wall Street faced a sharp pullback on Monday, May 19, as Moody’s downgraded the U.S.…