Enthusiasts would agree that Bitcoin has had a wild ride in Q2 of 2024.

After a strong start to the year, the world’s most famous cryptocurrency took a nosedive. This report delves into the quarterly and monthly returns, comparing them to previous years and analysing the data for a clearer understanding of performance.

Read on and stay in the know.

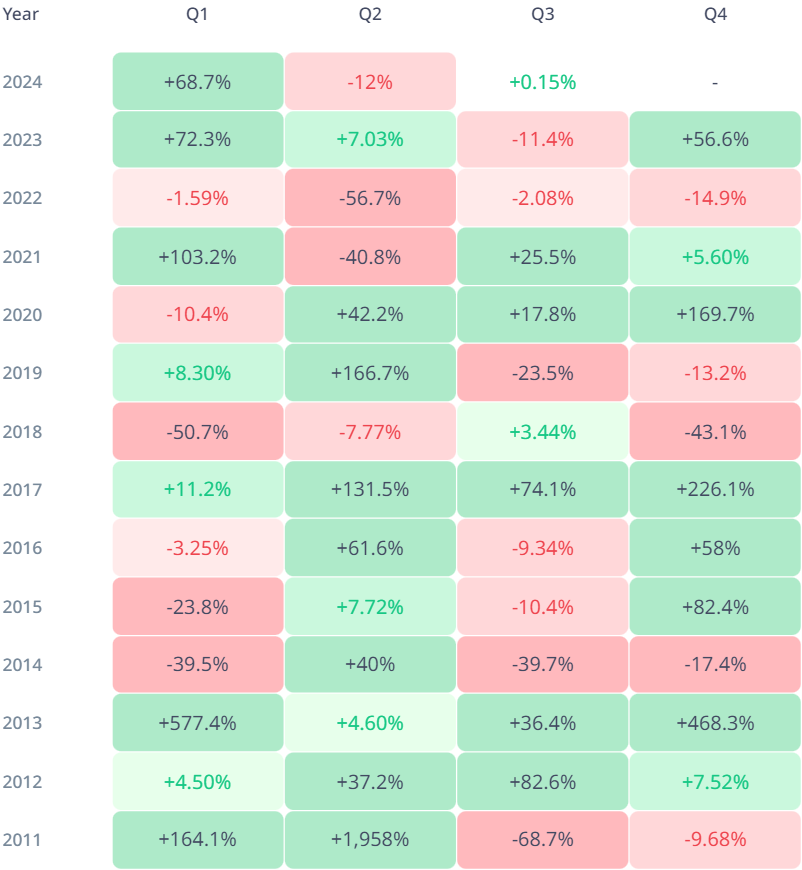

Bitcoin’s quarterly returns for Q2 2024 show a 12% decline, meaning the price at the end of June 2024 was 12% lower than at the beginning of April 2024. The closing price of Q2 2024 was $62,743, down from $71,262 in Q1 2024. This sharp decline contrasts with the same quarter in 2023, where Bitcoin saw a positive return of 7.03%.

Breaking down the monthly performance in 2024, Bitcoin’s price fell by 7% in June, following an 11.1% increase in May and a 14.7% drop in April. Earlier in the year, Bitcoin enjoyed a significant rise, with returns of +16.3% in March, +44% in February, and a modest +0.87% in January.

Comparing year-on-year performance, Bitcoin’s Q2 2024 decline stands out against its q2 2023 return of +7.03%. Despite the recent dip, Bitcoin’s six-month price change remains positive at +42.4%, highlighting its strong performance in the first half of the year. The three-month price change, however, shows a -9.92% decline as of July 1, 2024.

Looking at historical data from 2011 to 2024, Bitcoin’s average monthly returns reveal intriguing patterns. June typically sees an average return of +7.91%, while May averages +20%, and April stands out with a robust +34.7%. March and February also display positive averages at +11.8% and +16.6%, respectively, with January averaging +9.78%.

Bitcoin’s performance in Q2 2024 reveals the cryptocurrency’s inherent volatility. Despite the recent decline, historical and early 2024 data reveal periods of significant growth, highlighting Bitcoin’s enduring potential amidst its fluctuating trends.

Read Also: Sony Steps Into Crypto Arena with Amber Japan Acquisition

Did you adjust your investment strategy based on Q2 results? Share your experiences!

This is the story of how Mantra secured a lucrative RWA tokenization deal – and…

Solana (SOL) has been quite bullish in the past few days and some analysts have…

Bitcoin may be on the brink of a remarkable rise. Recent market rebounds suggest a…

The past week turned out to be one of the most profitable weeks for the…

With the crypto market showing signs of stability, memecoins and emerging altcoins have been stealing…

In today’s rapidly shifting crypto landscape, meme coins are no longer just jokes; they are…