Bitcoin is showing signs of bearish momentum, even as market sentiment reflects high levels of greed. Over the past 24 hours, the global cryptocurrency market cap has dropped by 5.44%, shrinking to $3.43 trillion. To add to the chaos, historic liquidations have swept through the market, particularly in the past 12 hours.

But why is Bitcoin falling when the mood is so optimistic? Is the market headed for trouble again?

Let’s explore the key factors behind this downturn and uncover what might lie ahead for the world’s largest cryptocurrency.

If you’ve been in crypto long enough to experience a market cycle, this pattern might feel familiar. Long periods of high greed often lead to market pullbacks. When traders get too comfortable during a bull run, the market tends to correct itself. Experienced investors often warn against complacency, advising caution when greed dominates.

These moments are when the market typically takes back profits from traders caught off guard.

After hitting a new all-time high (ATH), Bitcoin faced rejection and dropped by 13.6%. Although this drop didn’t hold as a closing price and appeared as a chart shadow, it marked the start of a downturn. Bitcoin initially found support on the 20-day moving average (MA) but fell below it on December 9, sparking market panic. It then dropped below the 50-day and 100-day MAs, deepening bearish sentiment.

Currently, Bitcoin is trading at $96,607, down 2.90% in the past 24 hours. Trading volume has surged by 118% as more traders short the asset. Could Bitcoin drop further? While it’s hard to predict an exact bottom, the next strong support zone is around $92,600, which aligns with the 200-day moving average, adding extra support.

A Look at the Technicals

Market indicators are signaling trouble for Bitcoin bulls. The Relative Strength Index (RSI) has fallen sharply to 38.08, favoring short traders. The Average Directional Index (ADX) is at 16.44, indicating bears are firmly in control.

With Eric Trum predicting Bitcoin could hit $1 million soon, read ‘Bitcoin Price Prediction‘ to stay ahead of the curve!

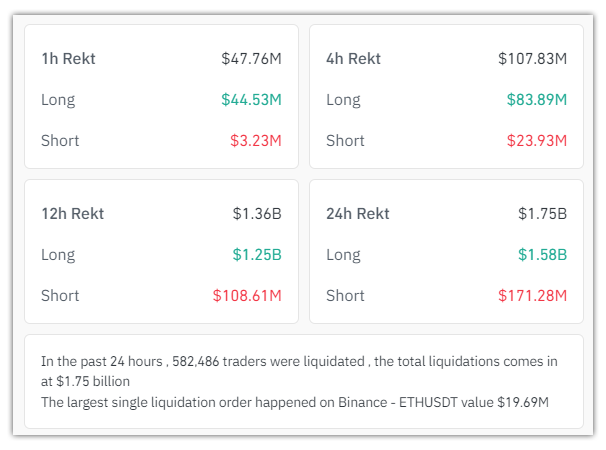

Data from Coinglass reveals that $1.75 billion worth of liquidations occurred in the past 24 hours, with most losses affecting long traders. Bitcoin’s price drop triggered these liquidations, leaving over half a million traders with losses.

Whale activity provides more clues. While market sentiment suggests greed, long traders are acting cautiously. Whale data shows very few long orders around current price levels, with most large players shorting Bitcoin. Strong buy orders are clustered between $92,000 and $94,000, which could mean Bitcoin might fall further if buyers don’t step in soon.

Bitcoin’s decline during a bull market highlights the unpredictable nature of emotional trading. The Fear and Greed Index shows high greed, yet technical indicators suggest bearish momentum. Markets often move against the crowd, so a sudden reversal is always a possibility. As short positions increase, Bitcoin could see a sharp bounce back.

The current market conditions call for caution. High greed often leads to unexpected market moves, and traders should remain vigilant to protect their funds.

Always trade with care and stay prepared for sudden changes.

If the bullish sentiment sustains, the star crypto may continue gaining value tomorrow.

With a potential surge, the Bitcoin (BTC) price may close the month with a high of $110,000.

As per Coinpedia’s BTC price prediction, 1 BTC could peak at $169,046.

At the time of writing, 1 Bitcoin value was $97,700.43.

The demand for top-tier altcoins - led by Ethereum (ETH), BNB, and Sui (SUI) -…

Solana (SOL) price has entered a crucial sell wall between $170 and $203, which has…

Ethereum (ETH) showed signs of cooling volatility after failing to break above the $4,000 resistance…

As Bitcoin and Ethereum fuel the resurgence of Altcoin Season 2025, investors are scanning the…

Dogecoin millionaire who turned four figures into millions returns with new meme coin prediction. Which…

XRP is holding on to recent gains after a decent move over the weekend. The…