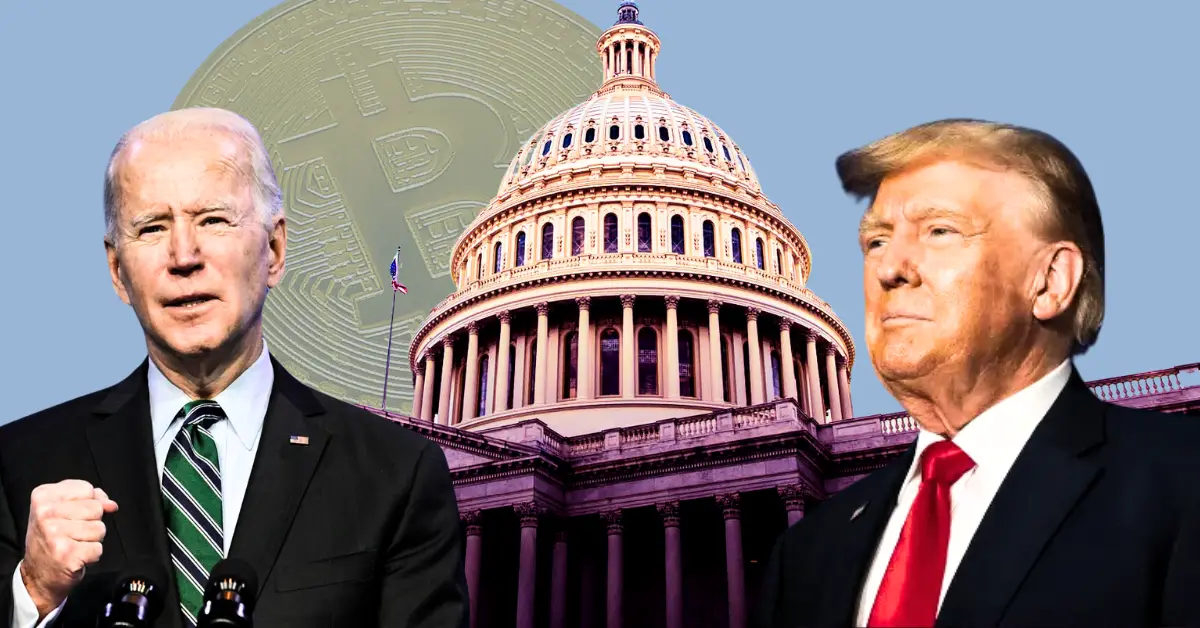

A groundbreaking law has recently granted the U.S. president extensive authority to regulate cryptocurrency usage, stirring up concerns among various observers. This new legislation enables the president to intervene in transactions between U.S. citizens and foreign entities linked to terrorist organizations.

The law requires the Secretary of the Treasury to identify and report any foreign banks or cryptocurrency transaction facilitators that knowingly engage in significant transactions with terrorist groups. This identification process must be completed within 60 days of the law’s enactment and repeated periodically.

Once identified, the president gains the power to either prohibit or impose strict conditions on the opening or maintenance of accounts by these foreign banks within the U.S. Additionally, the president can halt any transactions involving American entities with foreign digital asset transaction facilitators.

However, there are concerns in some quarters that this could be an attempt to assert control over cryptocurrency under the guise of counterterrorism efforts.

Under sections 203 and 205 of the International Emergency Economic Powers Act (IEEPA), the president can enforce these measures, including imposing penalties on individuals or entities found in violation, as outlined in section 206 of the IEEPA.

Transparency and Checks

The law also establishes procedures for judicial review of classified information. If findings or penalties are based on classified data, the Secretary of the Treasury can present this information to the court ex parte and in camera, allowing the judge to privately review it without public disclosure.

Provisions exist for waiving sanctions if it is deemed to be in the national interests of the United States. The Secretary of the Treasury must inform Congress of these waivers, accompanied by a statement explaining the rationale. There is also an exception for intelligence activities, ensuring that these measures do not impede authorized intelligence operations.

Time to Welcome Stronger Regulations?!

Furthermore, the law amends section 5318A of title 31, United States Code, to introduce new prohibitions or conditions on specific fund transfers. If the Secretary of the Treasury determines that certain jurisdictions, institutions, or transactions pose a significant money laundering risk, they are authorized to impose conditions on fund transfers involving these entities.

These amendments empower the Secretary, in collaboration with other pertinent officials, to take action against domestic financial institutions or agencies involved in these “high-risk transactions.”

Ethena has been gearing up for a strong move for the past several months, and…

Solana price catches its breath after a strong rally, Dogecoin howls louder with fresh momentum,…

XRP has reclaimed its spot as the third-largest crypto by market cap after briefly slipping…

JPMorgan has completed its first tokenized U.S. Treasury transaction on a public blockchain, marking a…

Ki Young Ju, CEO of CryptoQuant, recently tweeted that all three major presidential candidates in…

EigenLayer’s native token, EIGEN, has experienced a significant surge, climbing over 91% this week and…