El Salvador’s bold Bitcoin experiment is taking another leap forward. The country’s official Bitcoin Office announced on X that “Bitcoin Banks” are on the way, marking what could be the first banking system in the world fully built around Bitcoin. While the announcement was brief, it signals a major step in embedding BTC into the nation’s core financial services.

The idea appears to align with Bukele’s Bank for Private Investment (BPI) proposal from last year. Under that model, banks would operate with minimal regulations compared to traditional institutions, enjoy greater freedom in partnering with international banks, and have flexibility in lending.

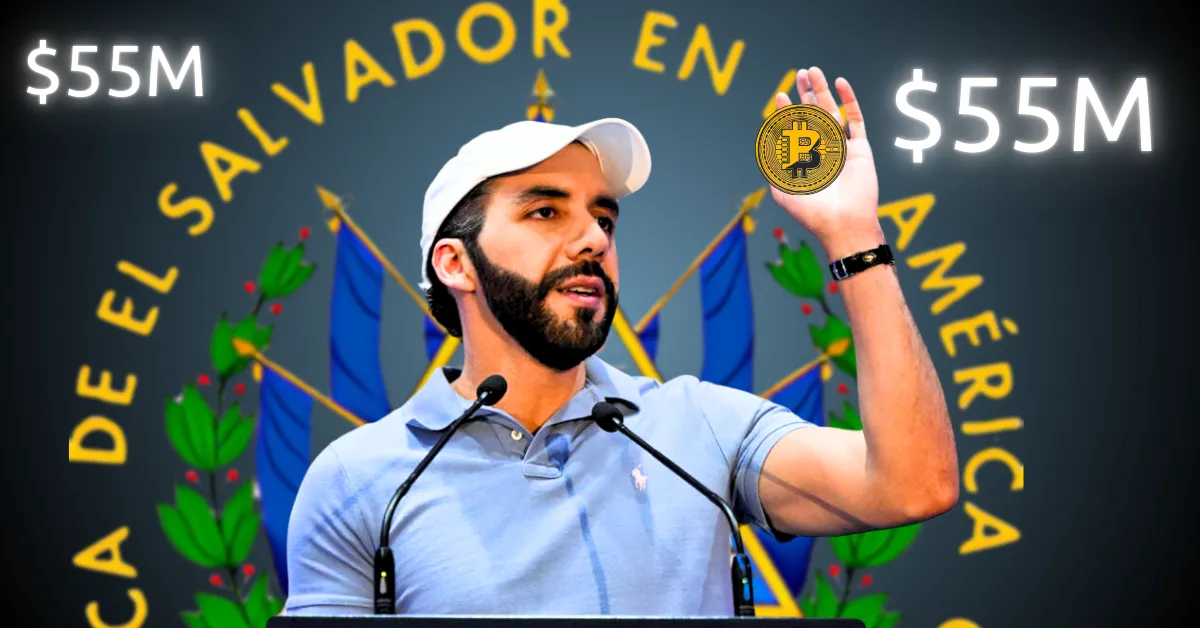

BPI requirements outlined by Bukele include at least $50 million in share capital and a minimum of two shareholders, with the option to register as digital asset managers and Bitcoin service providers. The proposal is still under review by the Technology, Tourism, and Investment Commission.

Although exact details remain under wraps, speculation suggests these Bitcoin Banks may operate with services fully denominated in BTC, potentially under a new legal framework. This could mean savings accounts, loans, and payments handled entirely in Bitcoin, a move that would set El Salvador apart from every other nation in terms of crypto integration.

Max Keiser, President Bukele’s top Bitcoin adviser, called the plan part of an “unstoppable” push for Bitcoin. He says Bitcoin is taking over the world’s wealth and could make traditional central banks irrelevant. Keiser and his wife, Stacy Herbert, who runs El Salvador’s Bitcoin Office, have been driving the country’s pro-Bitcoin policies since it became legal tender in 2021.

If Bitcoin Banks become a reality, they could put El Salvador at the heart of global Bitcoin innovation, drawing in crypto investors, builders, and businesses looking for a Bitcoin-friendly base. For now, the world is watching to see if this bold idea comes to life.

El Salvador’s proposal to launch Bitcoin banks has generated global buzz, but several hurdles could slow or complicate its success. Here’s a breakdown of the main challenges the plan might face:

El Salvador plans world’s first Bitcoin-native banking system, offering BTC-denominated accounts, loans, and payments under a new financial framework announced by the Bitcoin Office.

Modeled after Bukele’s BPI proposal, these banks require $50M capital, allow digital asset management, and operate with minimal regulations compared to traditional banking systems.

While announced, the proposal remains under review by El Salvador’s Technology Commission with no confirmed launch date yet for the groundbreaking banking system.

The Trump-backed Bitcoin miner, American Bitcoin Corp. (NASDAQ: ABTC), has today revealed a 159% year-on-year…

A fresh discussion is taking place in the XRP community: Is the Canton Network quietly…

Trading activity around XRP has picked up sharply, with new data from Bitrue showing a…

Aave, the DeFi lending platform founded by Stani Kulechov in 2020, has surpassed $1 trillion…

Story Highlights The live price of the Avalanche is . Price predictions for 2026 range…

The XRP price isn’t exactly inspiring confidence right now. After a powerful 2025 rally that…