Grayscale Investments, the largest crypto asset manager in the world, has introduced a new investment product: the Grayscale MakerDAO Trust. This trust gives investors an easy way to invest in MKR, the token behind MakerDAO, a major player in the decentralized finance (DeFi) space.

Grayscale shared the news on X with a link to their detailed press release about the MKR Trust.

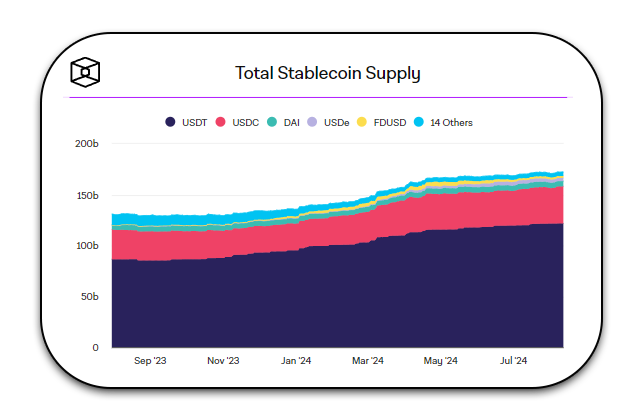

MakerDAO is a significant force in the DeFi world, known for issuing DAI, the third-largest stablecoin by market value. DAI, with a market value of over $5 billion, ranks just behind Tether (USDT) and Circle’s USDC. MakerDAO’s influence is partly due to its ability to offer loans backed by real-world assets.

MakerDAO is set for a major update called the “Endgame” plan. This will involve creating several smaller “subDAOs” to manage different parts of the ecosystem. These changes are expected to strengthen MakerDAO’s role in DeFi.

Grayscale’s new trust is part of its strategy to offer more options for crypto investors. Rayhaneh Sharif-Askary, Head of Product and Research at Grayscale, mentioned that the trust allows investors to take advantage of MakerDAO’s potential. Despite a tough year for crypto, the MKR token has increased by 17% since January 2024, making it an appealing choice for those interested in DeFi’s future.

How the MakerDAO Trust Works

The Grayscale MakerDAO Trust functions like Grayscale’s other single-asset trusts. It is designed for accredited investors who want to invest in MKR without buying digital assets directly. However, as with other closed-end trusts, the trust’s share price might differ from the actual value of MKR.

The launch of the MakerDAO Trust is part of a larger trend where traditional financial products are incorporating digital assets. Grayscale’s expanding portfolio now includes not just single-asset funds but also thematic funds that focus on areas like DeFi and artificial intelligence.

What’s Next

As the crypto market evolves, Grayscale is likely to keep introducing new products. The MakerDAO Trust is a step in this direction, offering investors an easy way to engage with one of the most influential projects in DeFi. Recently, Grayscale also launched funds for Sui and TAO, showing their ongoing commitment to innovation in the crypto space.

Also Read: Dubai Legalizes Cryptocurrency Salaries: A Game-Changer for Crypto Ecosystem

Want to be part of the next big thing in finance? Consider exploring investment opportunities in MakerDAO.

As market sentiment shifts and fresh momentum builds across digital assets, June 2025 presents a…

When Bitcoin first emerged, its fixed 21 million supply was mocked. Today, that scarcity has…

Singapore’s financial authority announces that unlicensed crypto firms operating overseas after June 30 will be…

On May 27, 2025, US President’s crypto czar, David Sacks, says there is a pathway…

Hackers used Monero to move stolen Bitcoin, pushing XMR up 24 percent to $269. But…

Pakistan has allocated 2,000 megawatts (MW) of electricity to fuel Bitcoin mining and artificial intelligence…