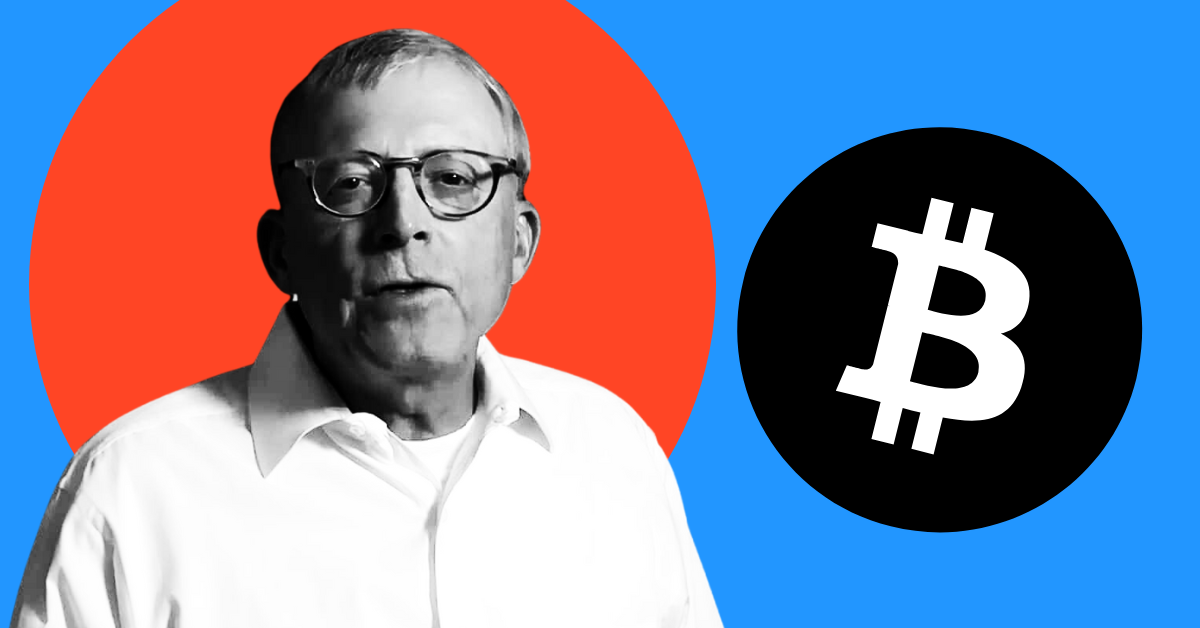

Bitcoin’s surge to $65K today may seem euphoric, but one analyst warns of an imminent correction before hitting a yearly high. Legendary trader Peter Brandt has weighed in on the recent parabolic run of Bitcoin (BTC), sharing insights on the potential for a correction shortly. Peter Brandt believes Bitcoin price drops are actual buying opportunities. He thinks Bitcoin will face a 15–20% correction, regardless of volatility.

Here’s what the expert had to say to back up these projections.

Brandt, renowned for his correct past predictions, acknowledges the possibility of a pullback following Bitcoin’s remarkable 223% surge since September 11, 2023. He points out that in financial markets, a period of consolidation often follows a bullish rally, and Bitcoin may not be an exception to this rule.

Backing his stance through the historical data, Brandt highlights the phenomenon known as the “hump dump” movement observed in Bitcoin’s price behavior. Notably, after reaching its All-Time High (ATH) of $68,789.63 in November 2021, Bitcoin experienced a significant downturn, dropping as much as 422% to $16,291.22 in November 2022.

Notably, the analyst’s analysis further unfolds the layers in the recent price movements, noting Bitcoin’s “hump slump” and “bump dump” patterns since July 2023. Despite the current price of Bitcoin hovering around $64,148.78, up 4.12% in the last 24 hours and comfortably trading above its 50-day and 200-day Moving Averages, Brandt suggests that a correction may still be on the horizon.

However, He views Bitcoin’s latest parabolic run followed by a price drop as an absolute buying opportunity. He anticipates a correction of around 15-20% after the cooloff period, which could see Bitcoin retesting the $55,000 level. Brandt remains optimistic about Bitcoin’s long-term prospects, citing factors such as the spot Bitcoin ETF accumulation trend, halving sentiment, and supply crunch as catalysts that could continue to drive its price higher, despite the anticipated retracement.

In his earlier projections, Brandt has forecasted a top of $200,000 for Bitcoin in the current bull cycle, underscoring his bullish stance on the cryptocurrency’s future trajectory.

As the Bitcoin halving approaches 52 days, some speculate that this surge is just the beginning of a significant bull run. The impending halving, a crucial event in the Bitcoin ecosystem, adds anticipation, potentially propelling the cryptocurrency to new heights.

Peter Brandt’s projections and analyses continue to captivate the attention of investors.

Story Highlights The price of Holo (HOT) today is $0.0009571 HOT price may reach a…

The cryptocurrency market experienced a whirlwind of developments this week. From Bitcoin price volatility and…

Crypto investor Anthony Pompliano recently criticized President Trump's recent threat to fire Fed Chair Jerome…

XRP is currently trading near $2 after bouncing back from $1.61, with many traders viewing…

A popular crypto analyst from the Good Morning Crypto podcast has made a strong prediction…

The XRP price has been displaying magnificent strength as the levels have been held above…