Imagine this: You’re watching a crypto or stock chart, and it looks dead—no major moves, no big news. Prices move up a little, then down, and repeat this cycle for weeks or months. But suddenly, out of nowhere, the price shoots up like a rocket. By the time most traders realize what’s happening, they’re already too late.

What just happened?

This is Wyckoff Accumulation in action. The smart money—big institutions, hedge funds, and whales—have been silently buying up assets while everyone else was distracted. And if you can spot it early, you can ride the wave before the big breakout.

In this guide, I’ll break down Wyckoff Accumulation in a simple, easy-to-follow way. No confusing jargon—just practical insights you can use right away. Let’s dive in.

Before we jump into the strategy, let’s quickly talk about the man behind it. Richard Wyckoff was a legendary trader in the early 1900s. He studied the market’s biggest players—people like J.P. Morgan—and figured out how they operated.

His goal? To teach regular traders how to think like smart money.

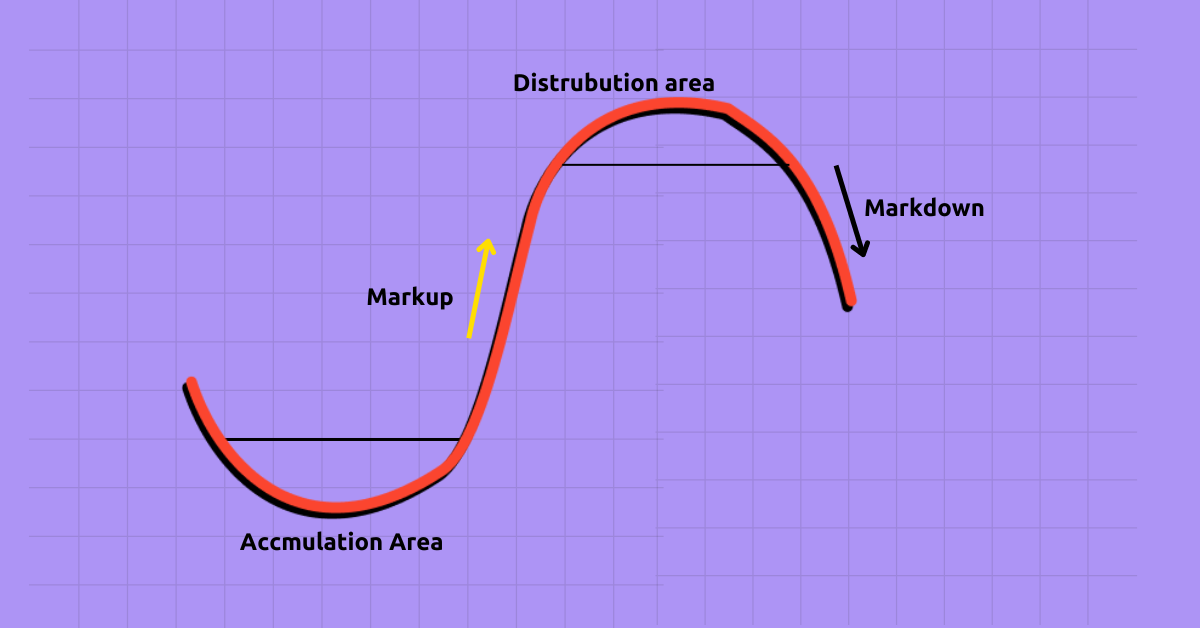

Wyckoff developed a method to identify when big investors are accumulating (buying) assets at low prices before a major uptrend. That’s what we call Wyckoff Accumulation.

Wyckoff Accumulation is a phase in the market where big players buy assets slowly and quietly to avoid causing a sudden price jump.

If they just bought everything at once, prices would shoot up, and everyone would notice. Instead, they manipulate the market—shaking out weak hands, creating fear, and then scooping up assets at low prices.

Once they’ve built their positions, they let the price rise, and retail traders (people like us) rush in. That’s when they start selling for big profits.

Wyckoff Accumulation happens in five main phases. Let’s go step by step.

✅ Key Sign: Big volume on the drop (SC), then a sudden bounce (AR).

✅ Key Sign: Price stays in a sideways range, with fake breakdowns.

✅ Key Sign: A sharp dip below support, followed by a fast recovery.

✅ Key Sign: Higher highs and higher lows, strong green volume.

✅ Key Sign: Rapid price increase, media hype, and FOMO traders rushing in.

Let’s say Bitcoin was at $60,000, then dropped to $30,000 over several months. It then moves sideways between $28,000 and $34,000 for a long time.

This exact pattern happened in previous bull runs—Wyckoff Accumulation played out before massive breakouts.

Now that you know how it works, let’s talk about how to trade it.

Wyckoff Accumulation is one of the most powerful trading strategies. It helps you spot where the smart money is buying before the big pump. Instead of chasing FOMO, you can get in early and ride the wave.

It takes patience. Most people give up because accumulation phases last a long time. But if you can recognize the signs, you’ll put yourself ahead of 90% of traders.

So next time you see a market going sideways, don’t get bored—start paying attention. It might just be the perfect opportunity.

Also read: Wedge Patterns Unveiled: Dominate the Crypto Market Like Never Before

Look for a market that has been in a downtrend and then moves sideways for an extended period. Key signs include:

A Selling Climax (SC) followed by an Automatic Rally (AR)

Price bouncing within a range with no clear trend

Fake breakdowns (Spring) below support, followed by quick recoveries

Increasing volume on dips, signaling smart money is buying

There’s no fixed timeframe—it can last weeks, months, or even years. The length depends on market conditions, liquidity, and how long smart money needs to accumulate assets without attracting too much attention.

The Spring (Phase C) is the best entry point. This is when the price briefly drops below support, causing panic selling, but quickly bounces back. Buying here offers the best risk-reward ratio. If you miss it, the next entry is on the breakout (Phase D) when the price clears resistance with strong volume.

Yes, no trading strategy is foolproof. If the market conditions change (e.g., macroeconomic shifts, negative news, or lack of buying pressure), the accumulation phase can turn into distribution or further downtrends. That’s why it’s crucial to confirm breakouts with volume and set stop-losses below key levels.

Absolutely! Wyckoff’s principles work across all markets, including stocks, forex, and crypto. In fact, many Bitcoin and altcoin price cycles follow Wyckoff Accumulation patterns before major bull runs. Traders who understand this strategy can spot potential long-term buying opportunities early.

As Bitcoin mining gets more expensive around the world, one country stands out for the…

Brazil’s central bank is moving forward with a new regulatory framework for institutional virtual asset…

GottaGamble, in collaboration with game provider BGaming, has announced the launch of a month-long Aviamasters…

Cameron and Tyler Winklevoss spent over a decade building Gemini into one of crypto's most…

Solana (SOL) has slipped below the crucial $80 level, marking a 6% decline over the…

Between late March and early July 2026, five major regulatory and macro events hit back…