Imagine this. You’re staring at a price chart, trying to figure out what happens next. The market has been moving fast, and now it’s taking a break. But is this just a pause before another big move, or is it the start of a reversal?

This is where flags and pennants come in. These patterns are like a secret language in trading. They tell you when a trend is likely to continue. If you understand them well, you can use them to find great entry and exit points.

So, let’s break it down step by step. No complicated jargon. Just simple, practical knowledge that you can start using today.

Flags and pennants are continuation patterns. This means they form in the middle of a strong price move, and they signal that the trend is likely to continue once the pattern is complete.

They are common in all types of markets—stocks, forex, crypto, commodities. Wherever there’s price action, you’ll see these patterns appear.

Here’s a simple way to think about them:

Now, let’s break each one down in detail.

A flag pattern has two main parts:

A flag can be either bullish or bearish.

Example: Imagine a stock price surges from $50 to $65 in a few days. Then, it pulls back slightly to $62, moving sideways in a tight range. If the stock breaks above $65 again, that confirms the bullish flag pattern.

Example: A cryptocurrency falls from $30,000 to $25,000 rapidly. Then, it moves up slightly to $26,000 but stays within a narrow range. If it drops below $25,000, that confirms the bearish flag.

Set a profit target – A common rule is to measure the height of the flagpole and project it from the breakout point.

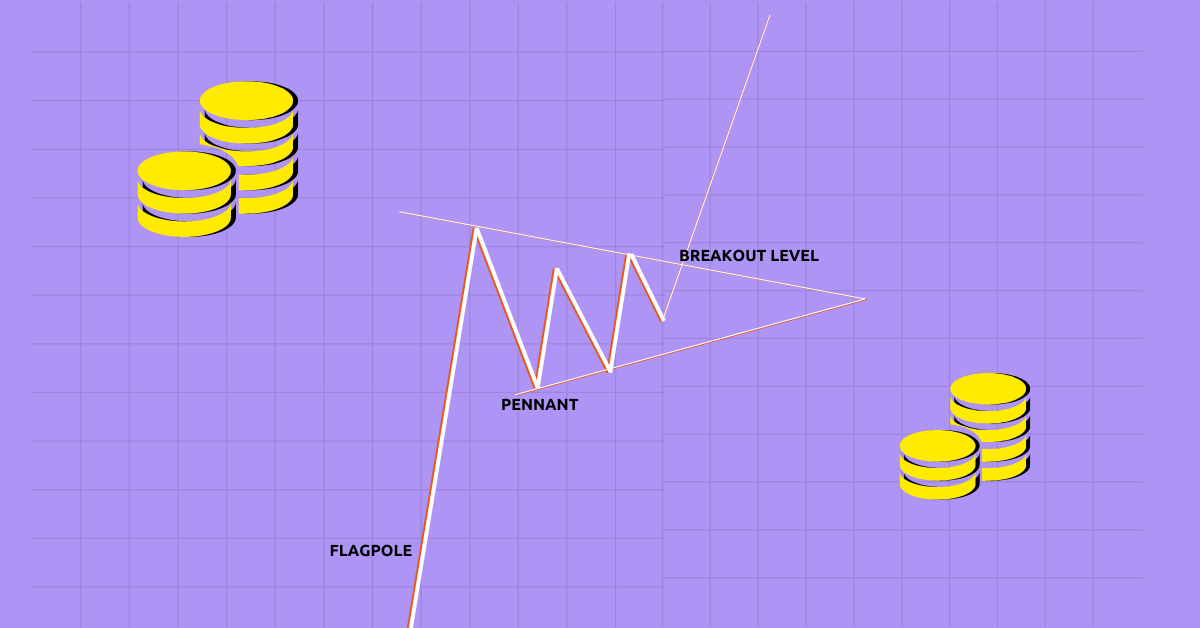

Pennants are similar to flags, but instead of a rectangular pullback, they form a small triangle. The price action tightens before breaking out.

A pennant has three main parts:

Example: Let’s say gold prices jump from $1,800 to $1,950. Then, the price moves within a small range, forming a triangle. If it breaks above $1,950, the bullish pennant is confirmed.

Example: A stock drops from $200 to $180. Then, the price moves in a tightening range, forming a triangle. If it breaks below $180, the bearish pennant is confirmed.

Not using stop-losses – Always protect your capital with stop-loss orders.

Flags and pennants are powerful tools in a trader’s arsenal. They help you catch strong moves while keeping risk in check. The key is to wait for the right setup and manage your risk properly.

Next time you look at a price chart, see if you can spot a flag or a pennant. Practice recognizing them, and soon you’ll be using them like a pro.

Trading is all about stacking the odds in your favor. And knowing these patterns gives you an edge.

Also read: Beyond Basics: Price Action and Support/Resistance for Proficient Crypto Trading

Yes! Indicators like the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) can help confirm breakouts. For example, if an RSI is above 50 during a bullish flag breakout, it strengthens the trade setup.

Ideally, volume should decrease as the pattern forms (during consolidation) and then spike when the breakout happens. A breakout with low volume may be weaker and prone to failure.

Yes, false breakouts are common. That’s why waiting for confirmation (like a strong candle close outside the pattern) and using stop-losses are crucial.

No pattern is 100% reliable. While they indicate high-probability moves, external factors like news or sudden market shifts can change the direction.

Yes! While many traders use leverage to maximize profits, you can trade flags and pennants with a spot position and still make decent gains if the move is strong.

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

The crypto market is looking weak as major coins struggle to move higher. Bitcoin and…

Bitcoin’s rally has paused at a critical level, with price action compressing into a narrow…

Bitcoin price has been struggling to break above the key $71K resistance level and has…

Story Highlights The live price of CAKE token is . Price predictions for 2026 range…

Tokenized real-world assets (RWAs) are entering a new phase. Unlike earlier hype-driven interest, today’s demand…

Bitcoin’s bounce from below $60,000 was sharp enough to shift sentiment in the short term,…