Imagine you’re driving on a highway, and suddenly you see warning signs—”Slippery Road Ahead,” “Sharp Turn Incoming.” You’d slow down, right? The Death Cross is like one of those warning signs, but for traders in the stock and crypto markets. It tells you that a potential market downturn could be on the horizon.

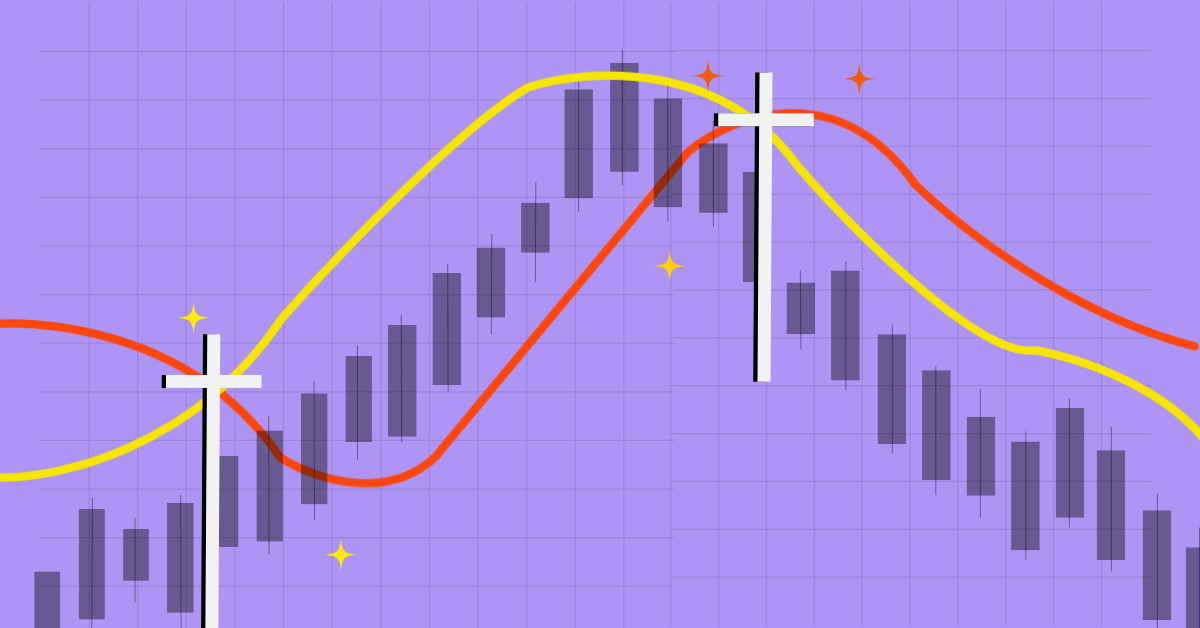

But wait—what exactly is this scary-sounding Death Cross? It’s a technical indicator that happens when the 50-day moving average (MA) crosses below the 200-day moving average on a price chart. Many traders see this as a bearish signal, meaning that the market might head downward.

Now, before you panic, let’s break it down and see how you can use this information to make better trading decisions.

Before we dive deeper, let’s quickly understand moving averages (MA). Think of a moving average as the average price of an asset over a certain period.

When the 50-day MA crosses above the 200-day MA, it’s called a Golden Cross, which is usually seen as bullish (a sign of potential price increases). When the 50-day MA crosses below the 200-day MA, you get the Death Cross—a bearish indicator that suggests a downtrend may be forming.

Markets move in cycles. The Death Cross is one of those signals that traders watch closely because it has historically preceded major market downturns. Here are some notable examples:

But does this mean you should sell everything when you see a Death Cross? Not so fast.

Not necessarily. While it can signal a longer downtrend, it’s not a crystal ball. Sometimes, the market recovers quickly after a Death Cross.

Take Bitcoin’s Death Cross in June 2021 as an example. Many traders panicked, expecting a prolonged bear market. However, Bitcoin bounced back within months and reached new highs later that year.

So, what does this tell us? The Death Cross is just one piece of the puzzle. Smart traders don’t rely on a single indicator—they combine it with other factors before making decisions.

Also Read: Ichimoku Cloud Explained: A Complete Guide to Trend Trading

The Death Cross doesn’t mean “sell everything immediately.” Instead, think of it as a red flag—a sign to be cautious and analyze the market further. If you see a Death Cross forming, check:

For traders who like shorting, the Death Cross can be an entry point. If the trend is strong, some traders open short positions to profit from falling prices.

Example:

Long-term investors use the Death Cross as a signal to protect their portfolios. Instead of panic selling, they may:

Use stop-loss orders: Set automatic sell orders to protect against major losses.

Using It in Isolation – A Death Cross in a bullish market might not have the same impact as one in a weak market.

The Death Cross is a useful tool, but it’s not a one-size-fits-all rule. Here’s what you should do:

At the end of the day, the Death Cross is just one tool in your trading toolbox. Use it wisely, stay informed, and trade smart!

A Death Cross occurs when the 50-day moving average drops below the 200-day moving average, signaling a potential bearish trend.

Traders use it as a warning signal, to identify shorting opportunities, or to hedge risk by reducing exposure and setting stop-loss orders.

Check market sentiment, trading volume, RSI, MACD, and support/resistance levels to confirm if the Death Cross indicates a strong downtrend.

No, the Death Cross signals a possible downtrend, but markets can recover quickly. It’s best used with other indicators for confirmation.

The crypto market is down today. The Bitcoin price marked an intraday low of around…

The crypto market crash intensified today as global markets reacted sharply to fresh macro uncertainty.…

XRP is finding itself at the center of a fresh policy discussion in the United…

Crypto markets turned sharply red over the weekend as investors reacted to fresh macro uncertainty…

XRP price is trading near $1.34 after dropping about 69% from its $3.66 peak. Price…

The crypto market is crashing today as fear spreads quickly among investors. After, the global…