Ever looked at a price chart and wondered, “Where is this market going next?” You’re not alone. Every trader, whether new or experienced, faces this question daily. The good news? There’s a simple yet powerful tool that can help you make sense of price movements – trend lines and channels.

Mastering these tools can be the difference between making confident trades and feeling lost in a sea of candlesticks. So, let’s break it down step by step in an easy-to-follow, no-nonsense way.

Think of trendlines as your market GPS. They help you see the overall direction of price movements. A trendline is simply a straight line that connects two or more price points and extends into the future. This gives you a rough idea of where the market might be headed.

There are three types of trends:

Let’s break each one down.

An uptrend means the market is moving higher. To draw an uptrend line:

This trendline acts as a support level – meaning prices tend to bounce off it instead of breaking through it.

Imagine Bitcoin is trending up. On your chart, you notice that it keeps bouncing at higher price points, like $30,000, then $32,000, then $35,000. If you draw a line connecting those points, you have an uptrend line. As long as the price respects this trendline, the uptrend is intact.

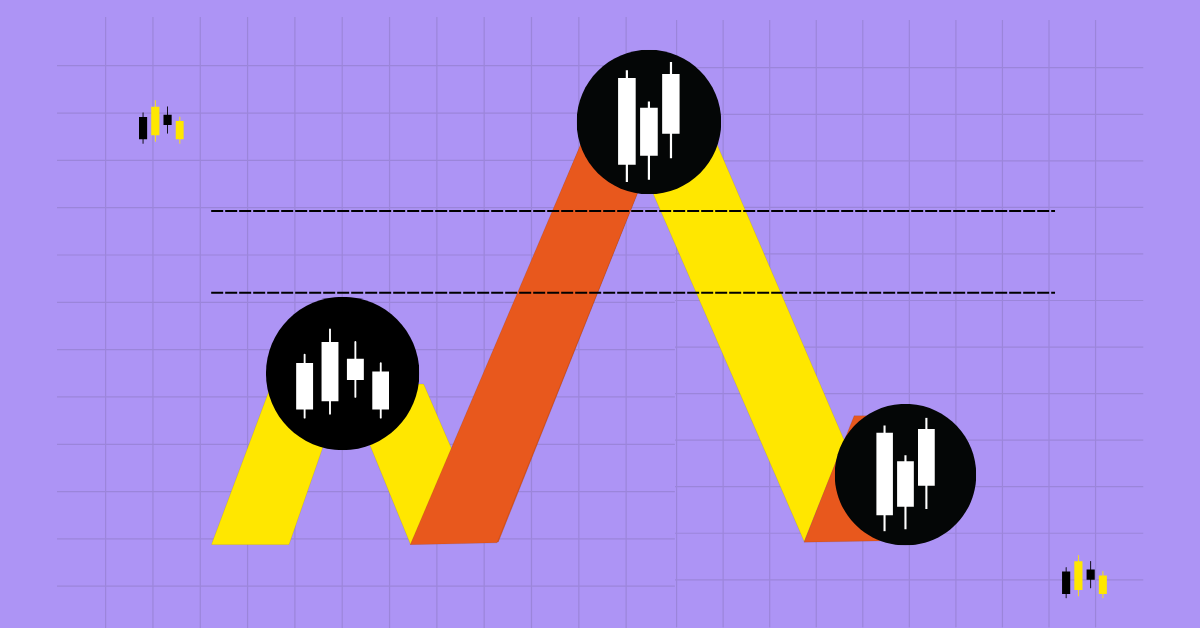

A downtrend is the opposite. Prices are making lower highs and lower lows. To draw a downtrend line:

This trendline acts as a resistance level – meaning prices struggle to break above it.

Let’s say Ethereum is dropping. It falls from $2,500 to $2,200, then bounces to $2,400 but drops again to $2,000. If you connect these lower highs, you’ll have a downtrend line. As long as prices stay below this line, the downtrend remains strong.

Sometimes, prices don’t make higher highs or lower lows. They move in a range, bouncing between support and resistance levels. No clear uptrend or downtrend – just a waiting game until the market picks a direction.

If a stock is fluctuating between $100 and $120, but not breaking out, it’s in a sideways trend. Traders often wait for a breakout before making a move.

Now that you know trendlines, let’s take it a step further – channels. Channels are like trendlines but with an extra line that runs parallel. This helps traders identify both support and resistance in a trending market.

There are three types of channels:

To draw an ascending channel:

Prices will usually bounce between these two lines, giving you trade opportunities.

If Tesla’s stock price keeps moving up but within a defined range, bouncing off two parallel lines, that’s an ascending channel. Traders can buy near the lower trendline (support) and sell near the upper trendline (resistance).

A descending channel works the same way, just flipped.

Prices will bounce between these two lines as long as the trend continues.

If a crypto coin like Solana is in a bearish trend but bouncing off two parallel lines, it’s in a descending channel. Traders can sell near resistance and buy near support if they’re looking for a short-term trade.

A horizontal channel is when prices move sideways but stay within a defined range.

If Apple stock fluctuates between $150 and $170, bouncing off both levels, it’s in a horizontal channel. Traders wait for a breakout before making big trades.

Now that you understand trend lines and channels, let’s discuss how to use them for trading.

Always place a stop-loss slightly beyond the trendline. If the trendline breaks, the trend might be reversing, and you want to cut losses quickly.

If you’re buying Bitcoin near an uptrend line at $40,000, place a stop-loss at $39,500 in case the trend fails.

When price breaks through a trendline, it often signals a trend reversal or a strong continuation.

If Ethereum has been in a downtrend but suddenly breaks above the trendline, it may signal the start of a new uptrend. Smart traders wait for confirmation before jumping in.

Trendlines and channels are like a trader’s best friend. They simplify price movements and give you a clear roadmap of what’s happening in the market. The key is to practice drawing them on real charts. The more you do it, the better you’ll get.

Also read: Engulfing Candlestick Patterns: How to Spot and Trade Market Reversals

Identify two or more highs (for downtrend) or lows (for uptrend), connect them with a straight line, and extend it to project future price movement.

A trendline shows a single support or resistance level, while a channel consists of two parallel trendlines indicating both support and resistance zones.

Trendlines help traders identify market direction, entry and exit points, and potential reversals by acting as dynamic support or resistance levels.

A trendline breakout signals a potential trend reversal or continuation. A break above resistance is bullish, while a break below support is bearish.

Trendlines are effective but work best with confirmation from other indicators. Adjust them as the market evolves and avoid forcing trendlines to fit data.

The crypto market has been bleeding red over the past few weeks, with Bitcoin hovering…

Bitcoin is once again at a critical level, and traders are asking the big question:…

KITE crypto has quietly transitioned from low-volatility consolidation into full-blown on-chain expansion and the data…

Tether's USDT just posted a $1.5 billion supply drop in February, marking the largest monthly…

Ethereum has quietly crossed a major threshold. More than half of its total supply is…

AI agents can now pay for services using XRP and RLUSD on the XRP Ledger,…