Crypto trading is risky, and success relies on the right tools. Chart patterns are crucial for traders. There exist numerous powerful chart patterns capable of giving accurate insights. Among the most popular are Three White Soldiers and Three Black Crows. Definitely, these patterns hold significant power in analysing market trends. Let’s delve into understanding these patterns deeply for successful trading.

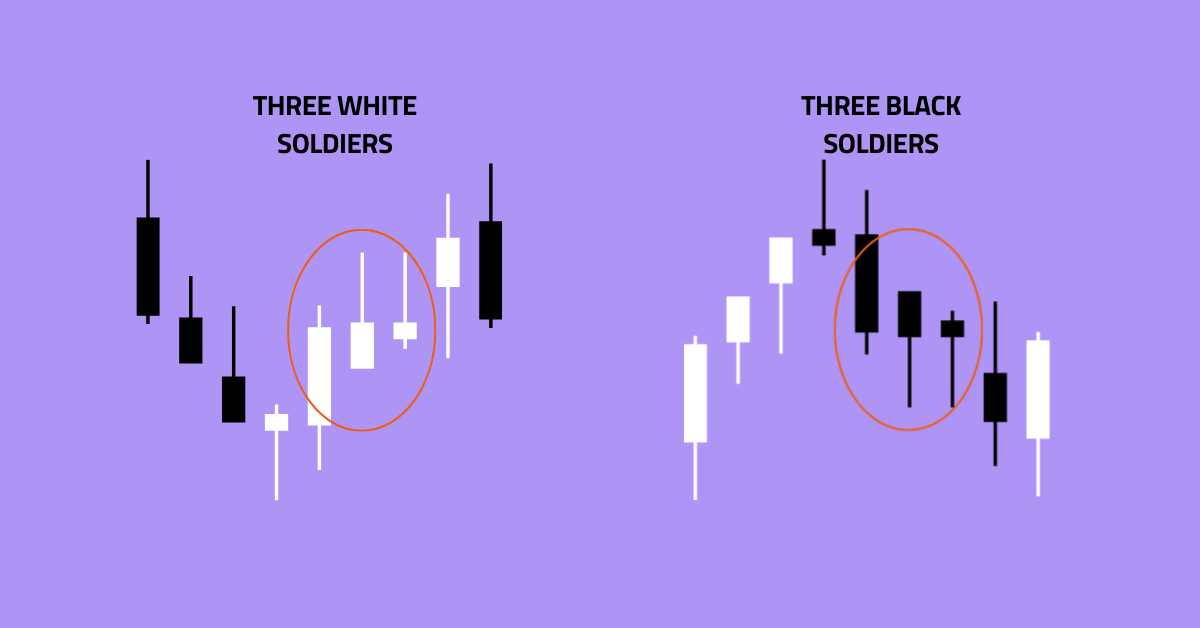

Let’s explain three white soldiers pattern in a simple way. The Three White Soldiers pattern is a bullish candlestick formation that indicates a likely trend reversal. It emerges near the end of a downtrend. This pattern suggests an upcoming shift to a bull market, making it a key indicator for traders looking for potential upward price movements.

Identifying the Three White Soldiers pattern involves:

In order to develop an effective three white soldiers pattern crypto strategy, it is important to identify the pattern accurately.

Time to explain three black crows pattern in an in depth way. The Three Black Crows pattern is a bearish chart pattern indicating a shift in market sentiment. It emerges when bears dominate for three consecutive trading sessions, overpowering bullish momentum. Each session features a black candlestick, signifying lower closing prices. This pattern suggests a potential downtrend, warning traders of substantial bearish pressure.

Identifying the Three Black Crows pattern is very simple.

If you want to create an efficient three black crows pattern crypto strategy, it is crucial to identify the pattern without any scope of confusion.

Also Read: How to Trade Cryptocurrencies? A Step-by-Step Guide to Buying and Selling Crypto

Here is the comparison between the Three White Soldiers pattern and Three Black Crows pattern. The comparison is made based on six important aspects: pattern type, candle colour, candle size, wick size, price relationships, volume confirmation and visual representation.

| Aspects | Three White Soldiers | Three Black Crows |

| Pattern Type | Bullish reversal | Bearish reversal |

| Candle Colour | Three white or green candles | Three black or red candles |

| Candle Size | Above the same size, often vast | Long and descending |

| Wick Size | Small wicks or shadows | May have small wicks |

| Price Relationships | Bottoms above the previous mid-price | Opens within the previous candle’s body, close lower |

| Volume Confirmation | Significantly increasing volume | Typically associated with increased volume |

| Visual Representation | Visually appears as three consecutive, long green candles | Visually appears as three consecutive, long red candles |

Unlocking crypto trading potential with these patterns involves considering key conditions and following specific rules.

To apply Three White Soldiers and Three Black Crows successfully in crypto trading,

Also Read: Crypto Trading Insights: Journeying through Pin Bar Patterns

While Three White Soldiers and Three Black Crows offers valuable insights, relying solely on these candlestick patterns can be risky.

Here are the three prime limitations:

False signals may lead to significant losses if not considered in the broader market context.

Be cautious of large distance between patterns, as implementing a feasible Stop Loss may be challenging.

Always consider the possibility of temporary reversals, preventing unexpected losses.

Trending Topic These Days: Bitcoin Halving 2024: Why It Matters & What To Expect

In the dynamic realm of crypto trading, mastering patterns like Three White Soldiers and Three Black Crows is essential. These candlestick formations, with their bullish and bearish implications, provide valuable insights for crypto traders. However, caution is paramount. While these patterns offer powerful signals, the complexities of the market demand a holistic approach. Always supplement pattern analysis with broader market fundamentals, use additional indicators for confirmation, and be mindful of potential limitations like false signals. By combining pattern recognition with a comprehensive strategy, traders can navigate the crypto market with increased precision and resilience.

On March 4, US President Donald Trump officially nominated Kevin Warsh as Chairman of the…

The cryptocurrency market staged a strong rally today, with Bitcoin climbing past $73,000 and lifting…

The crypto market is showing renewed strength after Bitcoin broke above its recent consolidation range.…

Bitcoin just outperformed the S&P 500, Nasdaq, and gold during a full scale geopolitical crisis,…

After a few unsuccessful attempts, the Solana price hits the $90 threshold, raising bullish possibilities…

Why is Bitcoin up today? Because the same whales who watched retail traders panic sell…