Imagine you’re looking at a price chart, and you notice a pattern forming—something that looks like a mountain or a valley. What if I told you that these shapes could give you a serious trading edge? That’s where double tops and double bottoms come in. These patterns are like road signs telling you what might happen next in the market.

If you’ve ever struggled to figure out when to enter or exit a trade, this guide is for you. We’ll break down these two patterns, explain how to spot them, and, most importantly, show you how to use them to make better trading decisions. Let’s dive in!

Double tops and double bottoms are reversal patterns that signal a potential change in trend. Think of them as the market trying something twice and failing, which hints that the price might head in the opposite direction.

These patterns are common and reliable if identified correctly. But the key is knowing how to confirm them before making your move.

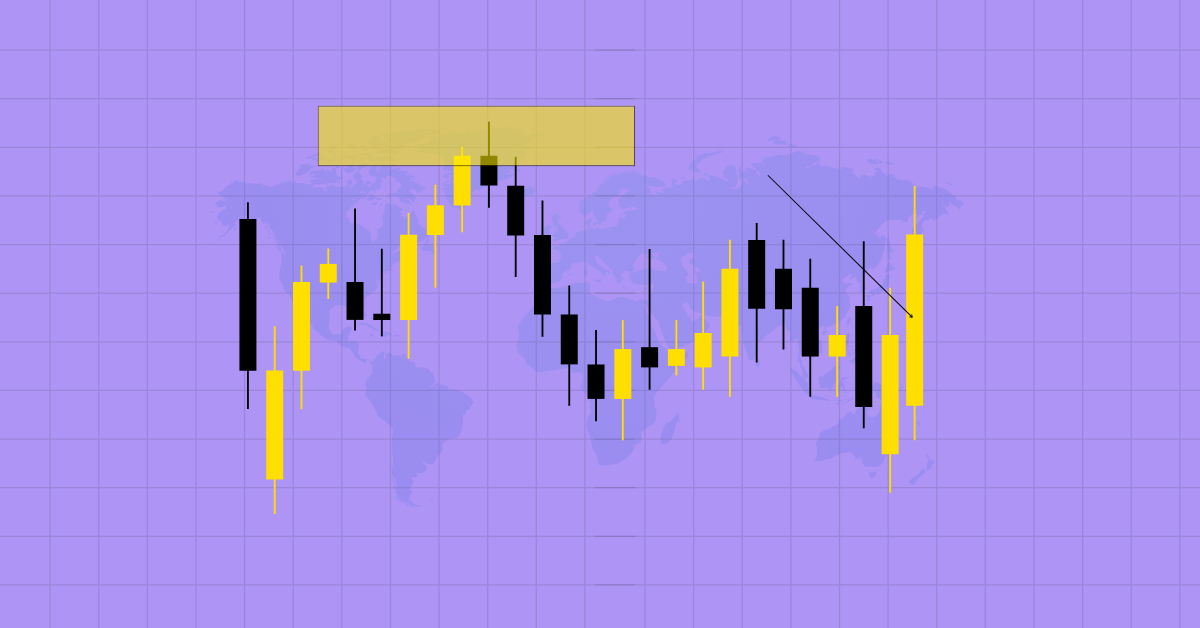

A double top looks like the letter “M” on a chart. Here’s how it forms:

Think of it like someone trying to jump over a wall. They try once and almost make it. They try again but still fail. Eventually, they give up and move in the opposite direction. That’s what’s happening with price action—buyers push the price up, but they can’t sustain it, so sellers take over.

Let’s say Bitcoin is trading at $50,000. It peaks at $55,000, drops to $52,000, then tries to climb back to $55,000 but fails. Once it falls below $52,000, it confirms the double top, and the price might head lower.

A double bottom is the opposite of a double top. It looks like the letter “W” and forms after a downtrend. Here’s how it happens:

Imagine you’re bouncing a basketball. If you drop it and it bounces back twice at the same level before shooting up, that’s exactly how a double bottom works. Sellers push the price down twice, but buyers step in strongly, preventing further decline.

Imagine Ethereum is in a downtrend and falls to $1,500. It bounces to $1,700, drops back to $1,500, but doesn’t go lower. Once it breaks above $1,700, it confirms a double bottom, and the price is likely to rise.

Practice on Demo Accounts – Before using real money, test these patterns on demo trades.

Double tops and double bottoms are powerful patterns that can help you spot trend reversals. But like any strategy, they work best when combined with other tools and proper risk management. The next time you see an “M” or “W” on your chart, you’ll know exactly what to do!

Also read: The Psychology Behind Crypto Trading: A Simple Introduction

Want to practice? Pull up your favorite trading platform and start spotting these patterns in historical charts. The more you train your eye, the better you’ll get at catching high-probability setups.

Also read: Mind Over Market: Conquering Emotional Bias in Crypto Trading

A double top is a bearish reversal pattern where the price forms two peaks at similar levels before declining below a key support level.

A double bottom is a bullish reversal pattern where the price hits a low twice before breaking above resistance, signaling a potential uptrend.

Confirmation happens when the price breaks the neckline with strong volume, supported by other indicators like RSI or MACD.

Yes, false breakouts occur. Always confirm with volume, trend strength, and other technical indicators before entering a trade.

DUBAI, UAE In a rapidly evolving digital asset landscape where transaction velocity has become the…

According to widely circulating reports, Sky News Arabia has reported that Iran's Deputy Foreign Minister…

BC.GAME has announced a $500,000 bounty for credible leads on an Ethereum wallet tied to…

Ethereum price is beginning to show early signs of recovery after weeks of downside pressure.…

A TON blockchain whale accidentally sent 126,000 TON, worth about $220,000, to a scammer’s fake…

Ethereum price has reclaimed the $2,150 level after a strong bounce from the recent lows,…