In the latest Solana news, CME Group is expanding its crypto lineup by launching options on SOL and XRP futures starting October 13, 2025. This comes on the back of record open interest of $895 million for Solana.

Wondering why it matters?

✔ Attracts more institutional capital into SOL and XRP

✔ Boosts trading volume and market volatility

✔ Signals growing confidence from major players beyond BTC and ETH

Against this backdrop, Solana has been on an impressive run, with its price action, TVL growth, and network upgrades all aligning to strengthen its fundamentals. Join me as I give you more insights on Solana network and SOL price in this analysis.

Drivers of the rally include:

Overall, Solana’s mix of ETF optimism, institutional inflows, and technical improvements creates a supportive backdrop for price growth.

Solana’s TVL has surged to $12.27 billion, up 57% QoQ, marking its strongest growth phase since 2021. Successively, Raydium has grown 32% in monthly TVL, while Jupiter DEX is averaging over $500 million in daily trading volume.

This signals rising developer traction and user adoption. With SOL functioning as both a gas token and a staking asset, this growth directly fuels network demand. Institutional inflows, paired with ecosystem activity, underline why Solana continues to stand out in the DeFi space.

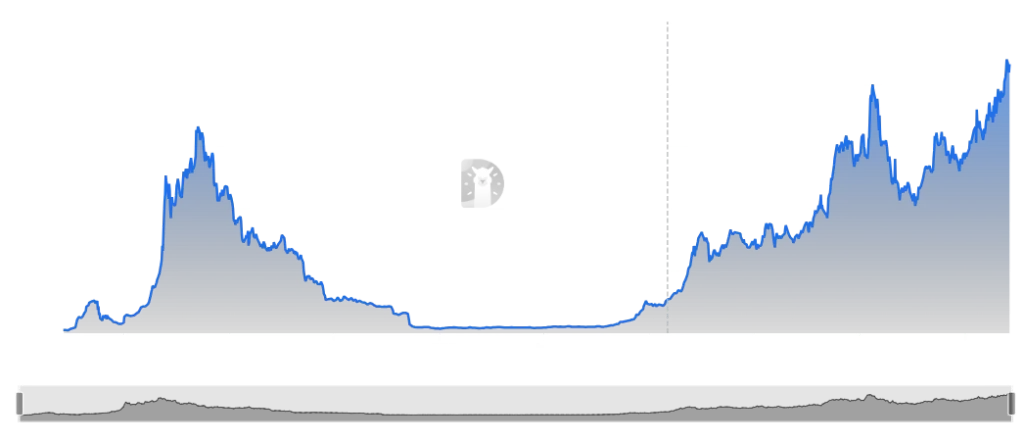

As of now, SOL price trades at $244.46, up 3.08% in the past day and 9.12% in the past week. Its market cap stands at $132.4 billion, with 24-hour trading volume surging 42.23% to $10.89 billion. The daily range has been between $232.77 and $247.47, while the all-time high remains at $294.33.

From the charts, SOL is hovering below resistance at $252.01. A breakout above this could open the path to $300, while strong support sits at $231.87. RSI is around 61.98, suggesting bullish momentum without being overbought.

ETF approval optimism, network upgrades, and institutional inflows are key drivers.

If SOL clears $252 and sustains momentum, a push toward $294–$300 is possible.

Rising TVL reflects stronger ecosystem adoption, which increases SOL’s demand as gas and staking token.

Over the past month, the Bitcoin price has dropped 26%, falling from its January high…

Coinbase has rolled out a new lending facility that allows U.S. customers to borrow up…

Researchers linked to the Federal Reserve say prediction market data from Kalshi could help policymakers…

The White House will host its third stablecoin yields meeting at 9 a.m. ET on…

World Liberty Financial is launching a tokenized investment tied to the Trump International Hotel &…

Senator Elizabeth Warren has strongly opposed any bailout for Bitcoin. In a letter to Treasury…