If you follow crypto, you’ve probably heard about Raydium’s RAY token. Its incredible 665% rise this year has grabbed the spotlight. From dominating Solana’s decentralized exchange (DEX) market to breaking revenue records, Raydium has become a major force in 2024.

RAY’s rise is rooted in solid fundamentals, making it a standout in a crowded market. How did this altcoin achieve such heights and could it climb higher?

Let’s explore the journey of this powerhouse token.

RAY has served its believers with incredible returns of 665.45% this year. With this, it became one of the top performing crypto. As Raydium is not a memecoin, this surge was not some pump and dump. It reRaydium’s RAY token has delivered an impressive 665.45% return this year, making it one of the best-performing cryptocurrencies of 2024.

Unlike memecoins, which often rely on hype for short-lived gains, RAY’s growth reflects genuine trust in the market. As a key part of the Solana ecosystem, Raydium’s success highlights its importance in decentralized finance (DeFi).

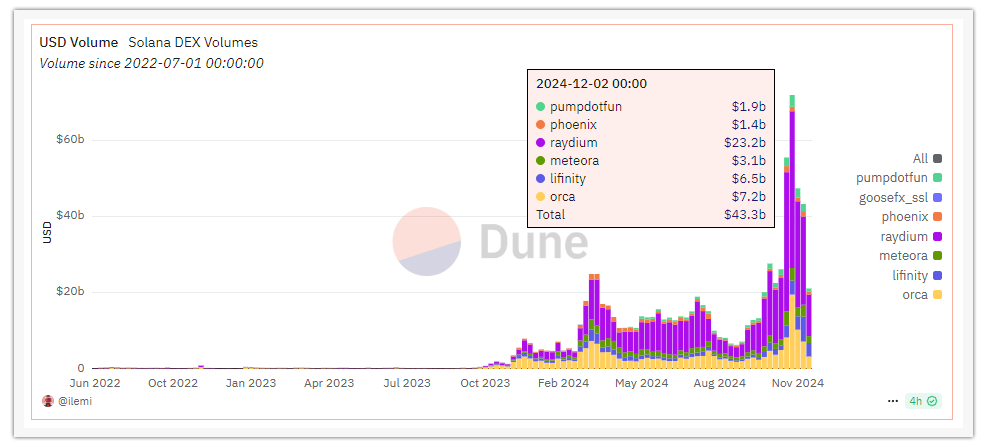

Raydium now controls almost half of all Solana DEX volumes. In a single week, from December 2 to December 9, it processed $23 billion in trades. That’s more than what all its competitors—Orca, Pumpfun, Meteora, and Lifinity—achieved combined. This boost wasn’t random. The sudden spike in meme coin trading brought massive attention and activity to the platform.

Raydium’s dominance extends beyond trading volume. Over the past month, it generated $226 million in fees, surpassing well-known platforms like Uniswap and even Solana itself. Only Ethereum and Tether earned more, underlining Raydium’s profitability and its rising influence in the DeFi space.

But it’s not just about revenue. RAY’s technical indicators reveal strong buying interest. The Relative RAY’s technical metrics reveal significant market interest. The token’s Relative Strength Index (RSI) jumped from 26 to 70 within two days, reflecting strong buying pressure.

While an RSI of 70 hints at a possible price correction, it also confirms the strong upward momentum driving the token’s performance.

The bullish sentiment surrounding Raydium suggests its rally might continue. If the current trend persists, RAY could aim for $6.46, though resistance at $5.85 and $6.46 may slow progress. On the downside, if momentum fades, support between $5.26 and $5.19 could help stabilize the price.

Raydium’s all-time high (ATH) of $16.93 remains a distant target, but the expanding Solana ecosystem and ongoing meme coin hype keep hopes alive. While reaching a new ATH will take time, Raydium’s recent achievements suggest it’s not out of reach.

The future of Raydium’s RAY token is yet to unfold, but one thing is certain: it’s a token worth watching. We’ll keep you updated.

XRP’s spectacular rise from a mere $0.01 to one of the most widely recognized cryptocurrencies…

Bitcoin is trading between $116,000 and $119,210, while Ethereum is hovering around $3,600 to $3,871.…

Alibaba CTO Wang Jian warns that nearly 90% of current AI projects will fail within…

In 2025, Chile is evolving its regulatory framework for fintech, cryptocurrency, and potential Bitcoin reserves.…

The crypto landscape in Vietnam has experienced a significant transition from an unregulated to a…

Millions of cryptocurrencies are estimated to be permanently lost, including over 913,000 Ethereum (about 5%…