The XRP Lawsuit is finally approaching the finish line. Ripple has already dropped its cross-appeal, and now everyone’s waiting to see if the SEC will officially withdraw theirs. If that happens, the years-long legal battle could wrap up in a matter of days or weeks. Regulatory clarity is finally within reach, and the future for XRP is starting to look a lot clearer.

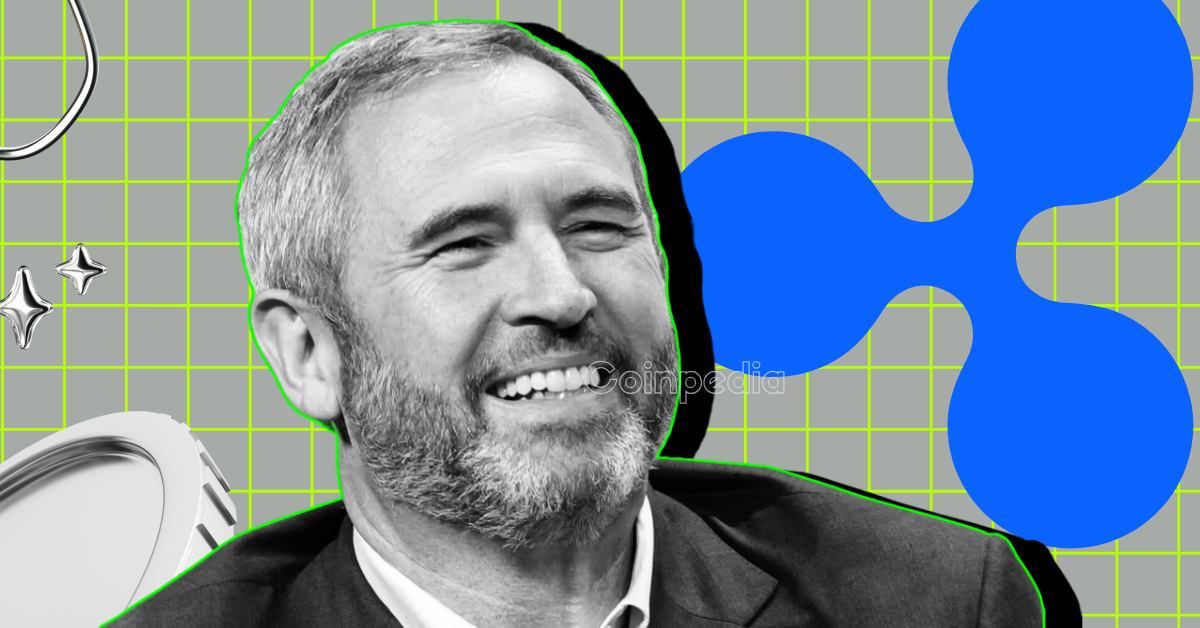

Ripple CEO Brad Garlinghouse is all set to testify before the Senate today with a sharp focus on XRP and regulatory clarity in the U.S. He has shared his full testimony ahead of the hearing.

In the testimony, Brad highlights Ripple’s decade-long mission to build an “Internet of Value,” where money moves seamlessly like information. He also stressed Ripple’s compliance-first approach, highlighting over 60 licenses and ongoing work with regulators.

As per the Ripple CEO, smart crypto regulation should protect consumers, keep bad actors in check, make sure markets are well overseen, and still leave room for innovation. He also pointed out the damage that was caused due to years of regulatory uncertainty, which drove innovation and jobs offshore. He notes that Ripple was the first major U.S. crypto company that was sued by the SEC in 2020.

After a four-year legal battle, Ripple won a landmark ruling: the court determined that XRP is not a security. He underscored that the win was not just a victory for Ripple but for the entire U.S. crypto industry.

Despite these challenges, Ripple continues to engage with lawmakers and regulators, stressing the need for smart and clearer crypto rules. He has outlined three key priorities for Congress: Firstly, clearly define the roles of financial regulators, secondly, create safe pathways for companies to innovate in the U.S., and finally, a real plan to ensure that the U.S. can be a global crypto leader.

Brad says that the U.S. has everything it needs to lead in the blockchain. With over 55 million Americans involved in crypto and a $3.4 trillion market cap, a clear regulatory framework is long overdue.

He also called on the Senate to prioritize passing the crypto market structure bill (The CLARITY Act) for digital assets. This would spark a new wave of innovation and bring major benefits to both consumers and businesses. Ripple, he added, is ready to work with lawmakers to help make that future a reality.

Tomorrow, on July 10th, the SEC will hold a closed-door meeting. There are growing speculations that it could be related to Ripple, and a final resolution could be near.

The SEC vs. Ripple case is effectively concluding. Ripple has already dropped its cross-appeal, and the crypto community is now awaiting the SEC’s official withdrawal of its appeal, which could happen as early as today, July 10, 2025, during a closed-door meeting focused on “enforcement matters.” A settlement agreement has been reached.

Brad Garlinghouse specifically urged the Senate to prioritize passing the CLARITY Act. This proposed market structure bill for digital assets aims to bring much-needed regulatory certainty by clearly defining which digital assets are securities and which are commodities, thereby ending the jurisdictional confusion that has plagued the industry.

After a four-year legal battle, Ripple secured a landmark ruling in August 2024: the court determined that XRP itself is not a security for programmatic (retail) sales on exchanges. This was a significant victory for Ripple and the broader U.S. crypto industry, providing crucial clarity on XRP’s status, though institutional sales were deemed unregistered securities.

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Polymarket, the blockchain platform where users bet on everything from politics to sports, is making…

Crypto markets have always faced cycles of hype and correction, but a new kind of…

Dogecoin (DOGE) price is once again at a critical juncture, testing its key support level…

WazirX, once India’s largest cryptocurrency exchange by volume, is preparing to reopen on October 24,…

Berachain has proposed a new Preconfirmation System aimed at enhancing transaction confirmation speeds by over…

WazirX is set to resume trading on October 24, marking the final step in its…