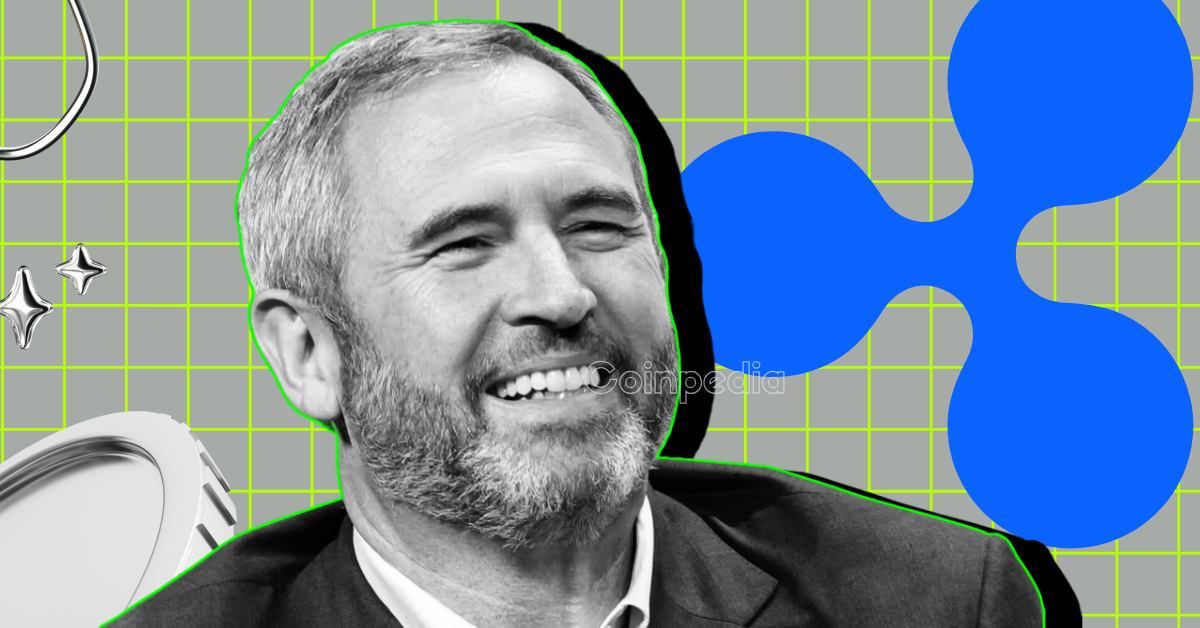

The US Congress has scheduled a hearing on crypto market structure next week with industry leaders set to testify, including Ripple CEO Brad Garlinghouse. The initiative is expected to influence future crypto legislation in the United States. Attorney John E Deaton shared a post on X (formerly Twitter), detailing the lack of clarity.

The committee session, which will take place on Wednesday at 10:00 AM ET, will focus on enhancing crypto market structure, a long-awaited legislative proposal that can shape the landscape of cryptocurrency in the US.

Eleanor Terret, host of Crypto in America, reported the hearing on X, which aims to define how digital assets are classified and regulated. According to her report via X, confirmed witnesses in the hearing include:

With unique perspectives from industry leaders, republican lawmakers will push for greater legal certainty, especially in defining the decentralized protocol and how open-source developers should be treated under federal law.

Ripple had been in a legal battle with the SEC, which resulted in providing some clarity regarding the sales of XRP. However, the crypto exchange still lacks complete legal clarity for XRP. Deaton, an XRP attorney, shed light on Ripple’s legal struggle for legal clarity.

He stated “I’ll be there in spirit, Brad.”

The CLARITY and GENIUS Acts are two of the key focuses in the upcoming hearing. The legislation seeks to create a regulatory framework for the CLARITY Bill that separates digital commodities from securities, an issue that has long divided the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Moving in parallel, the GENIUS Act continued its own trajectory towards a potential vote in the House. If passed, the GENIUS Act would proceed to the President’s desk for signing, while the CLARITY bill to move to Senate consideration.

The US is currently in a wave of embracing innovation by regulating cryptocurrency and other digital assets. It has also set a ‘crypto week’ in July to further welcome the new legal structure for crypto.

The CLARITY Act aims to resolve the long-standing confusion over whether crypto assets should be classified as securities or commodities. Its goal is to establish a clear regulatory framework that separates digital commodities from securities, impacting how various digital assets are overseen by the SEC and CFTC.

The GENIUS Act, which recently cleared the Senate and is expected to pass in the House, is poised to bring stablecoins into the traditional financial system. If signed into law, it’s viewed as a cornerstone of President Trump’s vision to boost the dollar’s dominance through regulated stablecoins, potentially leading to increased institutional adoption and market growth.

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

While XRP now trades around $2.97 USD, traders are weighing Ripple’s legal timeline as closely…

The long-running debate over XRP’s decentralization has resurfaced, but this time, lawyer and well-known XRP…

Bitcoin has a way of moving in rhythms, and many traders are paying close attention…

I’ve been watching PancakeSwap closely since yesterday, and the CAKE price movements have been nothing…

When a whale moved 312,233 SOL into Coinbase Institutional, traders sat up straight. That is…

The SEC missed its Thursday deadline to decide on Canary Capital’s spot Litecoin ETF, with…