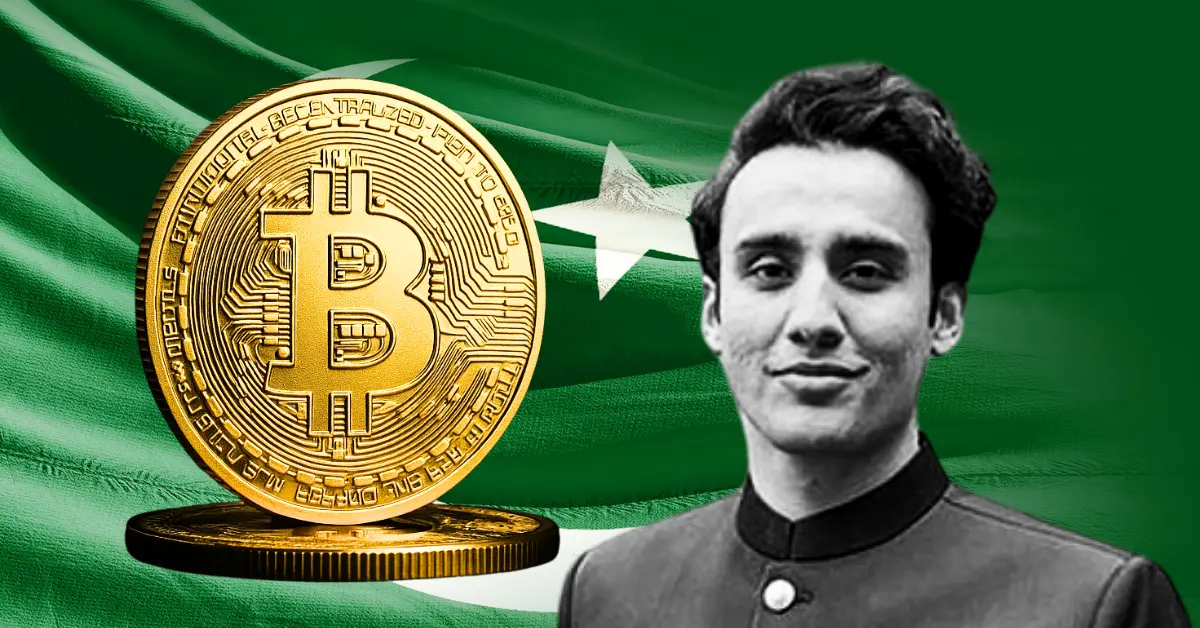

In a high-level meeting aimed at advancing digital asset cooperation, Pakistan’s Minister for Crypto and Blockchain, Bilal Bin Saqib, met with Robert “Bo” Hines, Executive Director of former President Donald Trump’s Council on Digital Assets. The conversation marked a significant move towards cross-border collaboration on crypto innovation and infrastructure development.

During the strategic dialogue, the two leaders explored several critical areas:

Bilal Bin Saqib declared a bold vision during the session:

“It is my mission to position Pakistan as a global leader in digital assets.”

He also announced plans to establish a Strategic Bitcoin Reserve (SBR), highlighting Pakistan’s commitment to digital asset adoption and economic modernization.

Saqib revealed Pakistan’s ambitious plan to allocate 2,000 megawatts of electricity to support crypto mining and AI zones across the country. This initiative marks a major step toward building a digital economy powered by blockchain and artificial intelligence.

Adding to the momentum, on May 21st, Pakistan’s Finance Ministry officially approved the creation of a dedicated crypto regulatory body to oversee and manage all crypto-related activities.

At the meeting, both Hines and Saqib shared a mutual interest in fostering U.S.-Pakistan collaboration on digital assets. The joint approach aims to empower youth, drive innovation, and boost economic inclusion through blockchain ecosystems.

Notably, Pakistan also held separate discussions with the White House Counsel’s Office, underscoring its growing alignment with the U.S. on virtual asset strategies.

The Pakistan-U.S. dialogue follows Pakistan’s recent announcement of its Strategic Bitcoin Reserve (SBR) at the Bitcoin 2025 conference in Las Vegas. With this bold step, Pakistan became the first Asian country to integrate Bitcoin into its sovereign asset strategy.

Pakistan’s crypto leadership vision is no longer just talk. With dedicated energy allocations, regulatory frameworks, and strategic international ties, the country is fast positioning itself as a trailblazer in digital assets. The White House engagement signals the beginning of a new era in U.S.-Pakistan crypto relations—one with the potential to reshape digital finance in Asia and beyond.

The council, led by Bilal bin Saqib, advises the government on blockchain policies, Web3 development, and AI-driven financial innovation.

Pakistan has about 25 million active crypto users and sees an estimated $300 billion in annual transaction volume.

Starting July 1, 2025, profits from selling crypto face a flat 15% Capital Gains Tax (CGT). Crypto earned from mining/staking is taxed as regular income (5-35%).

After breaking above the local consolidation range near $1,950, the Ethereum price has pushed higher…

Bitcoin (BTC) price is up nearly 1.6% over the past 24 hours, trading around $68,213,…

Bitwise Chief Investment Officer Matt Hougan has picked his four must-own crypto assets for this…

The Injective price isn’t moving quietly anymore. It just ripped 20% intraday, and no, this…

Ripple is no longer just a payments company. Through a series of aggressive acquisitions in…

While the broader crypto market has been rotating capital selectively this week, Trump-linked World Liberty…